Studycafe | Dec 25, 2019 |

SOP for Non filers of GST returns – Understanding CBIC Circular

CBIC has come with circular No. 129/48/2019-GST Standard Operating Procedure to be followed in case of non-filers of returns.

Legal Provisions of the GST Act & Rules:

Section 46 of the CGST Act is given below:

Notice to return defaulters .

Where a registered person fails to furnish a return under section 39 or section 44 or section 45, a notice shall be issued requiring him to furnish such return within fifteen days in such form and manner as may be prescribed.

Section 62 of the CGST Act is given below:

Assessment of non-filers of returns

62. (1) Notwithstanding anything to the contrary contained in section 73 or section 74, where a registered person fails to furnish the return under section 39 or section 45, even after the service of a notice under section 46, the proper officer may proceed to assess the tax liability of the said person to the best of his judgment taking into account all the relevant material which is available or which he has gathered and issue an assessment order within a period of five years from the date specified under section 44 for furnishing of the annual return for the financial year to which the tax not paid relates.

(2) Where the registered person furnishes a valid return within thirty days of the service of the assessment order under sub-section (1), the said assessment order shall be deemed to have been withdrawn but the liability for payment of interest under sub-section (1) of section 50 or for payment of late fee under section 47 shall continue.

Click here to Watch the Video on the Same : https://www.youtube.com/watchv=5NTdCEZ-atE

Rule 68 of CGST Rules is given below:

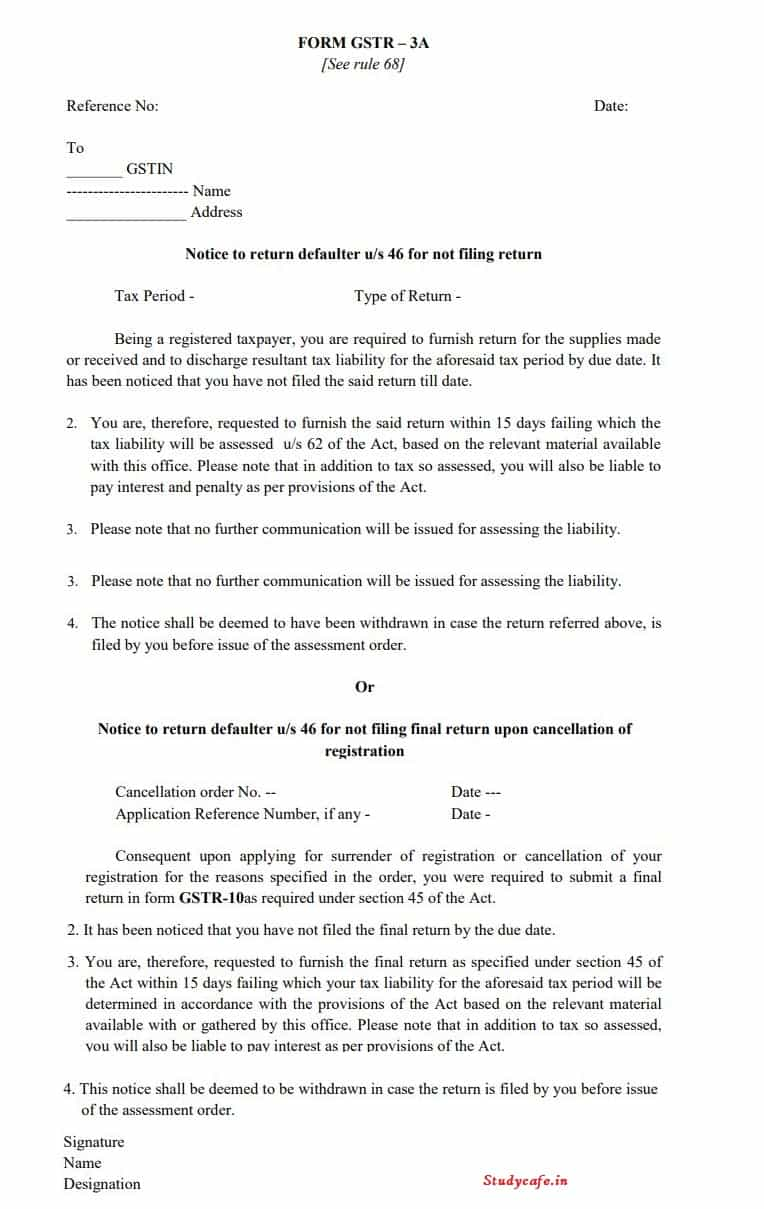

Notice to non-filers of GST returns

A notice in FORM GSTR-3A shall be issued, electronically, to a registered person who fails to furnish return under section 39 or section 44 or section 45 or section 52.

Let us Understand :

What are the various returns covered by this SOP

Returns covered by this SOP are :

What will happen if I won’t file my GST Return on time

A notice in FORM GSTR-3A shall be issued, electronically, to a registered person who fails to furnish return under section 39 or section 44 or section 45 or section 52.

SOP for Non filers of GST returns – Understanding CBIC Circular

What Action Should be taken by tax payer after receiving notice in FORM GSTR-3A

Taxpayer should file pending GST Return within 15 Days of receipt of notice in FORM GSTR-3A.

What if Return is not filed even after receipt of notice in FORM GSTR-3A

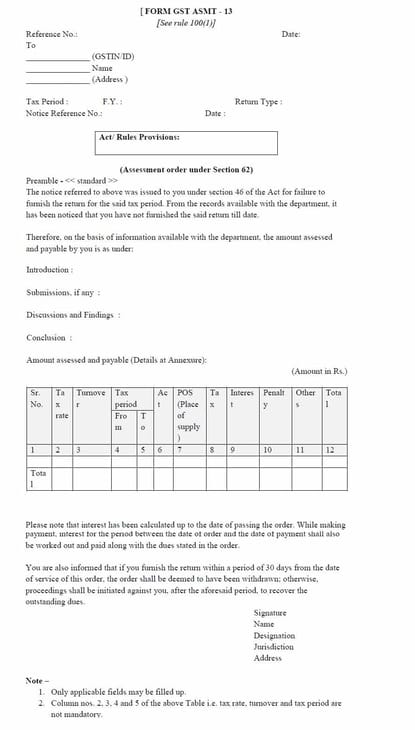

If return is not filed even after receipt of notice in FORM GSTR-3A, After 15 days, best judgement assessment will be done by GST Depatment (in ASMT 13) with the available details.

SOP for Non filers of GST returns – Understanding CBIC Circular

What is best Judgement Assessment in GST

Best Judgement Assessment is made by the AO, based on his reasoning and using the available information.

In GST situation of best judgement arises when:

What will happen if I file return after initiation of best judgment assessment proceedings

The proceedings will be dropped if return is filed within 30 days of notice of best judgment assessment proceedings

What will happen if I don’t file return within 30 days of notice of best judgment assessment proceedings

Recovery proceedings would be initiated against non-filers in case GST Return not filed.

What data can be used by Tax Officer for doing the Best Judgement Assessment

For the purpose of assessment of tax liability, the proper officer may take into account the details of outward supplies available in the statement furnished under FORM GSTR-1, details of supplies auto- populated in FORM GSTR-2A, information available from e-way bills, or any other information available from any other source, including from inspection of books of accounts;

Crux of Circular no.129/48/2019-GST dated 24th Dec 2019

1) Every Registered persons will get a reminder 3 days before due date to file their GST returns

2) once the due date is over, the registered person will get a auto msg stating that he has not filed the said return

3) 5 days after the due date is over, the registered person will get a notice in form GSTR3A requiring him to furnish the said return within 15 days

4) if the person doesn’t file the return within 15 days, the officer will pass a best judgement assessment order in form GST ASMT 13 on thr basis of information like E-way bill, 2A or any other relevant information.

5) Now, the registered person gets a final opportunity to submit his return within 30 days from passing the above order, if he files then the order will stand withdrawn. If he doesn’t, then the officer will start recovery proceedings u/s 79 and 80 for recovery of GST.

Click Here to Buy CA Final Pendrive Classes at Discounted Rate

For Regular Updates Join : https://t.me/Studycafe

Tags : GST, GST Return

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"