Special Provisions For Treatment Of Foreign Exchange Fluctuations Gain/Loss -Section 43a

FCS DEEPAK P. SINGH | Mar 3, 2022 |

Special Provisions For Treatment Of Foreign Exchange Fluctuations Gain/Loss -Section 43a

We know that in case of export or import we generally use foreign currencies to settle payments. The fluctuation in rates of foreign currency will pose problem to the importer. The rate of exchange rate of foreign currency at the time of agreement and at the time of payment may differ and in case of increase in exchange rate of foreign currency the importer is required to pay more amount than agreed. It is important to adjust foreign exchange loss due to fluctuation in rate of foreign currencies at the point of payment.

The Income Tax Act,1961 provides that the adjustment of fluctuations in foreign currency rate will be adjusted at the time of payment.

SECTION 43A -INCOME TAX ACT, 1961 provides that “ Notwithstanding anything contained in any other provisions of this Act, 1961 , where an assessee has acquired any asset in any previous year from a country outside India for the purpose of his business or profession and, in consequence of a change in the rate of exchange during any previous year after the acquisition of such asset, there is an increase or reduction in the liability of the assessee as expressed in India Currency ( as compared to liability existing at the time of acquisition of the asset) at the time of making of payment-

Please Note That: the amount by which the liability as aforesaid is so increased or reduced during such previous year and which is taken into account at the time of making the payment, irrespective of the method of accounting adopted by the assessee, shall be added to, as the case may be deducted from –

And the amount arrived after such addition or deduction shall be taken to be the actual cost of the asset or the amount of expenditure of a capital nature or as the case may be, the cost of acquisition of the capital asset as aforesaid.

Treatment of Forex Gain/Loss – Other than Section 43A:

Section 43AA of IT Act deals with taxation of Forex fluctuation. The said section states that subject to the provisions of Section 43A, any gain or loss arising on account of any change in foreign exchange rates shall be treated as income or loss, as the case may be, and such gain or loss shall be computed in accordance with ICDS notified under Section 145(2)[4]

Section 43AA is applicable for all forex transactions including those relating to monetary, non-monetary, translation of Financial Statements of Foreign Operations, Forward Exchange Contracts and Foreign Currency Translation Reserves.

In other words, except for situations stated in Section 43A, for all other situations, the gain/loss arising from forex transactions is to be dealt in accordance with Section 43AA read with relevant ICDS.

Section 145(2) of IT Act has notified 10 ICDS with effective from Assessment Year (AY) 2017-18.

ICDS – 06 deals with Effects of Foreign Exchange Rates. Para 1 of ICDS – 06 states that said standard deals with inter alia, treatment of transactions in foreign currencies. The treatment of foreign exchange fluctuations for monetary items and non-monetary items is different.

Para 2(k) of ICDS-06 defines ‘monetary items’ are money held and assets to be received or liabilities to be paid in fixed or determinable amounts of money. Cash, receivables and payables are examples of monetary items.

Para 2(l) defines ‘non-monetary items’ assets and liabilities other than monetary items. Fixed Assets, inventories and investment in equity shares are examples of non-monetary items.

Further, Para 2(g) defines ‘Foreign Currency Transaction’ is a transaction which is denominated in or requires settlement of foreign currency, including transactions arising when a person:

Para 3(1) states that a foreign currency transaction shall be recorded on initial recognition in the reporting currency, by applying the foreign currency amount the exchange rate between the reporting currency and the foreign currency at the date of transaction.

Para 4(a) states that at last day of previous year foreign currency monetary items shall be converted into reporting currency by applying the closing rate.

Para 4(c) states that, for non-monetary items in a foreign currency, they shall be converted into reporting currency by using the exchange rate at the date of transaction.

Para 5(i) states that in respect of monetary items, exchange differences arising on the settlement thereof or on conversion thereof at last day of previous year shall be recognized as income or expense in that previous year.

Para 5(ii) states that in respect of non-monetary items, exchange differences arising on conversion thereof at the last day of previous year shall not be recognized as income or expense in that previous year.

Para 6 states that notwithstanding anything contained in Para 3, 4 and 5, initial recognition, conversion and recognition of exchange difference shall be subject to the provisions of Section 43A.

Hence, from the above, it is evident that except for the circumstances as described in Section 43A, the gain or loss arising from forex fluctuations on monetary items has to be treated as income or loss in terms of ICDS-06 read with Section 43AA.

PLEASE NOTE THAT:

After section 43A of the Income-tax Act, the following section shall be inserted and shall be deemed to have been inserted with effect from the 1st day of April, 2017, namely:-

Taxation of foreign exchange fluctuation.

“43AA.(1) Subject to the provisions of section 43A, any gain or loss arising on account of any change in foreign exchange rates shall be treated as income or loss, as the case may be, and such gain or loss shall be computed in accordance with the income computation and disclosure standards notified under sub-section (2) of section 145.

(2) For the purposes of sub-section (1), gain or loss arising on account of the effects of change in foreign exchange rates shall be in respect of all foreign currency transactions, including those relating to-

(i) monetary items and non-monetary items;

(ii) translation of financial statements of foreign operations;

(iii) forward exchange contracts;

(iv) foreign currency translation reserves.”.

ADJUSTMENT IN THE COST MADE EARLIER SHALL BE EXCLUDED: where an addition to or deduction from the actual cost or expenditure or cost of acquisition has been made under this section , as it stood immediately before its submission by the Finance Act, 2002 , on account of an increase or reduction in the liability as aforesaid , the amount to be added to or as the case may be deducted under this section from ,the actual cost or expenditure or cost of acquisition at the time of making the payment shall be so adjusted that the total amount added or reduced from the actual cost or expenditure or cost of acquisition , is equal to the increase or reduction in the aforesaid liability taken into account at the time of making payment.

Where there are exchange fluctuations on revenue account e.g., fluctuations on account of purchases on credit from a country outside India or sale made on credit to a country outside India or any other expenditure incurred on revenue account, such exchange rate fluctuation shall be treated as under-

LET’S CONSIDER SOME JUDGEMENTS:

Please Note That: for determining the nature of receipts, due consideration should be given to source of funds and not to ultimate use of funds. Therefore, the entire gain on fluctuation of currency has to be treated as capital receipts as the source of funds in this case is capital nature.

6.IN THE MATTER OF BESTOBELL (INDIA) – SUPREME COURT:

In the facts of this matter, the assessee has taken loan from parent company for the purposes of execution of works in India. The terms of the contract state that the loan has to be repaid within one year or availability of funds whichever is earlier. On the balance sheet date, the loan was outstanding and the fall in rupee made assesse to account for additional loss for the repayment of loan.

The assessee claimed that such loss is revenue in nature and should be allowed.

However, the Revenue claims that such loss is arising out of capital transaction and hence capital loss. The court held that the loss arising from devaluation of rupee on outstanding loan cannot be considered as extra expenditure to be incurred for meeting the debt like postal expenses or bank charges or as extra expenditure resulting in a business loss of revenue nature.

If there had been a devaluation in favor of the assessee as a result of which the assessee had to pay less to its creditors, the surplus would be arising would have been of capital nature and could not have been assessed in the hands of assessee as a business profit. Conversely, as a result of the exchange rate going against the assessee, the loss which the assessee incurred cannot be held to be revenue loss.

PLEASE NOTE THAT:

Even though, this judgment is post Tata Locomotive and Engineering Co. Limited’s verdict, the SC has not referred the later for arriving at the said conclusion. The SC went to state that since the loss arising was not similar to the expenditure a company would incur on postal expenses or bank charges, the said loss cannot be allowed as revenue in nature. Further, the SC went on to state that the same is also not allowed as revenue in nature since, if there was a gain, the assessee would not have offered it to tax. From the above judgment, it is clear that the SC has not undertaken the analysis as to whether the forex loss was arising out of a capital or revenue nature but simply concluded that the forex loss cannot be allowed as revenue nature despite the said loan is used for the purposes of working capital/business. Hence, to this extent, this judgment needs a re-look.

7. IN THE MATTER OF COOPER CORPORATION (P) LIMITED – PUNE ITAT

The facts in the matter of this case, is that a foreign currency loan was availed by the assessee and utilized the same for acquisition of assets and expansion of project. On the year end, the outstanding foreign currency loan is required to be translated into Indian Rupees by applying the foreign exchange rate as on closing day of reporting period and the net exchange difference resulting in translation is required to be recognized as income or expense for the respective financial period as per the Accounting Standard -11 issued by ICAI.

The assessee has initially availed loans from Indian Banks and the said loans are converted to foreign currency loans in order to take benefit of lower rate of interest on such foreign currency loans vis-à-vis loans in Indian currency, leaving an exposure to changes in foreign exchange. Because of stronger US Dollar, the assessee at year end has incurred a loss on such foreign currency loan.

The said loss was claimed as deduction under Section 37(1) of the Act. The AO has rejected the plea of the assessee on various grounds, one of them being that such loss is on account of loans used for purposes of acquisition of capital assets and accordingly the loss is capital in nature and the same cannot be allowed under the provisions of Section 37(1) of the Act.

The ITAT has held that in absence of applicability of Section 43A and in absence of any provisions of the Income Tax Act dealing with issue, claim of exchange fluctuation loss in revenue account in accordance with generally accepted accounting standards notified by ICAI, conversion of foreign currency loans which led to loans, were dictated by revenue considerations towards saving interest costs etc., the loss can be allowed under Section 37(1) of the Act.

PLEASE NOTE THAT:

The ITAT has held that such loans were initially taken in Indian currency and later converted them to the foreign currency in order to save interest and on assumption that there will be no loss arising on foreign exchange fluctuation.

The ITAT has also stated that there was no dispute the fact that the acquisition of capital assets/expansion of projects etc from the term loans taken are completed and the assets so acquired have been put to use. As a consequence, the loss occasioned from foreign currency loans so converted is post facto subsequent to capital assets having been put to use. The ITAT also has examined the provisions of Section 43A and stated that the same would not be applicable to the facts of the instant case for the reason that the assets are procured within India, whereas Section 43A shall be applicable in case of asset purchase outside India. Then the ITAT has proceeded to examine the issue, whether the loss is on revenue or capital account has to be tested in light of generally accepted accounting principles, pronouncements and guidelines etc.

The ITAT has proceeded thereafter to examine the provisions of Section 43(1) of IT Act which deals with ‘actual cost’. The ITAT has stated that despite there are number of explanations dealing with ‘actual cost’ in various circumstances, there is no explanation which deals with any gain or loss on foreign currency loan acquired for purchase of indigenous assets will have to be added or reduced to the cost of assets.

Accordingly, ITAT has stated that nothing can be added or reduced to actual cost of assets except a situation which is envisaged in Section 43A because of its non-obstinate clause.

Thereafter, the ITAT has referred to the decision of Honorable Supreme Court in the matter of Tata Iron & Steel Company Limited (supra) and stated that the activity of loan repayment and actual cost of asset are two different things and cannot be read one into another. Then, the ITAT proceeded to examine the provisions of Section 36(1)(iii) and stated that the utilization of loan for capital account or revenue account purpose has nothing to do with allowability of interest expenditure. The only restriction to Section 36(1)(iii) is that interest till the date of asset being put to use is not allowed as revenue deduction.

In other words, the ITAT has held that interest is allowed as revenue expenditure after the asset is being put to use even though the interest expenditure is pertaining to capital account. The ITAT then stated that impugned fluctuation loss therefore has a direct nexus to the saving in interest costs without bringing new capital asset into existence.

Since the business exigencies are implicit as well as explicit in the action of the assessee and the argument that the act of conversion has served a hedging mechanism against revenue receipts from exports also portrays commercial expediency, the interest can be held to be related to revenue account and accordingly eligible for deduction under Section 37(1).

8. IN THE MATTER OF TVS MOTOR COMPANY LIMITED – CHENNAI ITAT

In the facts of this matter, the assessee has taken external commercial borrowing (ECB). The actual loss on exchange difference in repayment of ECB which was used toward non-imported assets was claimed as revenue expenditure. The Revenue has disallowed such expenditure and allowed depreciation on the extent of loss instead of completely allowing the loss.

The assessee claimed before the Tribunal that the actual loss on exchange difference in repayment of ECB should be allowed as revenue expenditure on the ground that provisions of Section 43A shall not be applicable and placed reliance on judgement of Cooper Corporation (supra). However, AO invoked the provisions of the Section 43A and accordingly allowed depreciation.

The ITAT placing reliance on Cooper Corporation (supra) has allowed the actual loss as revenue expenditure.

PLEASE NOTE THAT:

The ITAT has relied upon the judgment of ITAT Pune in Cooper Corporation (supra)[12] and passed order in favour of assessee. The ITAT has not made any specific observations as to the actions of AO invoking provisions of Section 43A.

9. IN THE MATTER OF COUNTRY CLUB HOSPITALITY & HOLIDAYS LIMITED – HYDERABAD ITAT:

In the facts of the matter, the assessee company has raised term funds from international market by issuing Foreign Currency Convertible Bonds (FCCB), which is having the convertible option to equity shares or repayment of bonds after 5 years. The assessee has incurred forex loss of Rs 21.92 Crores on FCCB and the assessee has re-instated the bonds at currency rates prevailing at year end and the difference is transferred to ‘Foreign Currency Monitory Translation Difference Account’ to be written off over a period of 3 years accordingly for the relevant assessment year under consideration, the assessee has written off 1/3rd of such loss to profit & loss account.

The AO in light of CBDT Circular stated that where the financial instruments are valued at market price so as to report the actual value on the reporting date which is required from the point of view of transparent accounting practices for the benefits to the shareholders of the company, but is notional loss as the asset continues to be owned by the company and accordingly held that was a notional loss and cannot be allowed.

The ITAT by placing reliance on judgement of Supreme Court in the matter of Woodward Governor India Private Limited (supra) has held that such loss is not a notional loss and accordingly can be allowed.

The AO has disallowed the loss on the other ground stating that loss on FCCBs is capital loss and not a revenue loss.

The ITAT following the decision of M/s Crane Software India Limited has held that the expenses relating to FCCBs till they get converted into equity are to be considered as revenue and accordingly allowed the loss.

PLEASE NOTE THAT:

The ITAT has followed the decision of Woodward Governor India Private Limited (supra) and held that loss on balance sheet is not a notional loss and can be claimed.

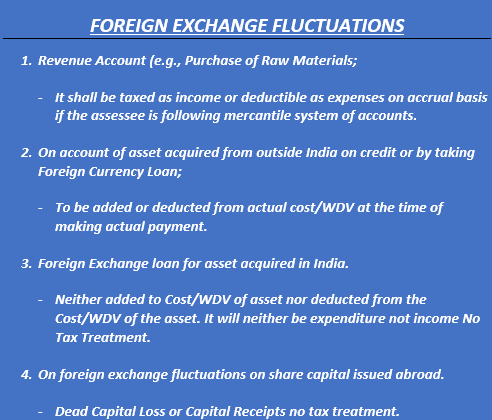

CONCLUSION: after insertion of provisions of Section 43AA has changed the way of treatment of Foreign Exchange Fluctuation expenses. Lets consider some instances of foreign exchange;

Answer: in this case any foreign exchange expenditure ,whether gain or loss will be deducted/added from the Actual Cost/ WDV of Assets acquired by use of Foreign Exchange Loan at the time of payment.

The assessee can take aid of the preamble of ICDS-06 which states that in case of conflict between provisions of IT Act and ICDS, the provisions of the IT Act shall prevail. Accordingly, since capital items are not subject matter of tax, the assessee can very well claim that to such an extent the provisions of ICDS will not be applicable and accordingly such forex gains may not be brought to tax. However, this has to be tested in the days yet to come.

Answer: in case of foreign exchange fluctuations loss/gain in revenue nature same will be charged in revenue account as expense /revenue.

There would not be any issue post introduction under Section 43AA because the said section states that forex fluctuations arising from monetary items has to be taken for the purposes of computation of income. The above treatment would put rest to certain judicial precedents like Bestobell (India) Limited and others which followed them.

Section 43AA is applicable for all forex transactions including those relating to monetary, non-monetary, translation of Financial Statements of Foreign Operations, Forward Exchange Contracts and Foreign Currency Translation Reserves. In other words, except for situations stated in Section 43A, for all other situations, the gain/loss arising from forex transactions is to be dealt in accordance with Section 43AA read with relevant ICDS.

DISCLAIMER: the article produced here is only for information and knowledge of readers. The article has been prepared on the basis of available materials on different forums and author has taken all precautions to share right information with readers. It is advisable to consult with professional in case of necessity.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"