Studycafe | Dec 26, 2019 |

Standard Operating Procedure case of non-filers of GST returns

CBIC has come with circular No. 129/48/2019-GST Standard Operating Procedure to be followed in case of non-filers of returns.

Procedure in brief :

1. A system generated message would be sent to all the registered persons 3 days before the due date to nudge them about filing of the return for the tax period by the due date

2. Once the due date for furnishing the return is over, a system generated mail / message would be sent to all the defaulters immediately after the due date to the effect that the said registered person has not furnished his return for the said tax period.

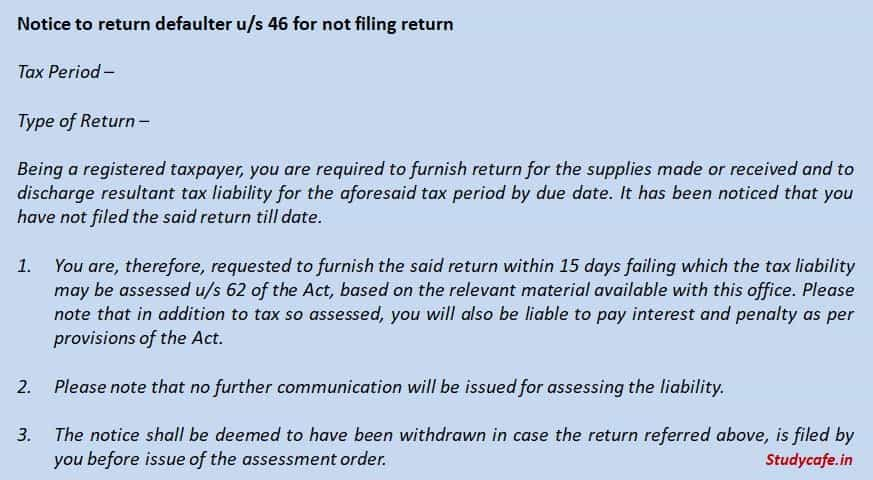

3. Five days after the due date of furnishing the return, a notice in FORM GSTR-3A shall be issued electronically to such registered person.

FORM GSTR-3A

4. In case the said return is still not filed by the defaulter within 15 days of the said notice, the proper officer may proceed to assess the tax liability of the said person, to the best of his judgement taking into account all the relevant material [ best judgement assessment ]which is available or which he has gathered and would issue order in FORM GST ASMT-13.

Note 1. In addition to tax so assessed, you will also be liable to pay interest and penalty as per provisions of the Act.

Note 2. No further communication will be issued for assessing the liability. Issue order in FORM GST ASMT-13.

5. The proper officer would then be required to upload the summary thereof in FORM GST DRC- 07

6. In case the defaulter furnishes a valid return within thirty days of the service of assessment order in FORM GST ASMT-13, the said assessment order shall be deemed to have been withdrawn

7. If the said return remains unfurnished within the statutory period of 30 days from issuance of order in FORM ASMT-13, then proper officer may initiate recovery proceedings.

8. In deserving cases, based on the facts of the case, the Commissioner may resort to provisional attachment to protect revenue under section 83 of the CGST Act before issuance of FORM GST ASMT-13.

Data that can be used by Tax Officer for doing the Best Judgement Assessment

For the purpose of assessment of tax liability, the proper officer may take into account the details of outward supplies available in the statement furnished under FORM GSTR-1, details of supplies auto- populated in FORM GSTR-2A, information available from e-way bills, or any other information available from any other source, including from inspection of books of accounts;

For Regular Updates Join : https://t.me/Studycafe

Tags : GST, GST Return

Click here to Watch the Video on the Same : https://www.youtube.com/watchv=5NTdCEZ-atE

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"