CA Pratibha Goyal | Aug 1, 2023 |

Summary of CBIC Notification dated 31/07/2023

The Central Board of Indirect Taxes and Customs (CBIC) has notified some more notifications, based on recommendations of the GST Council in its 50th meeting. The summary crux is given below for your reference.

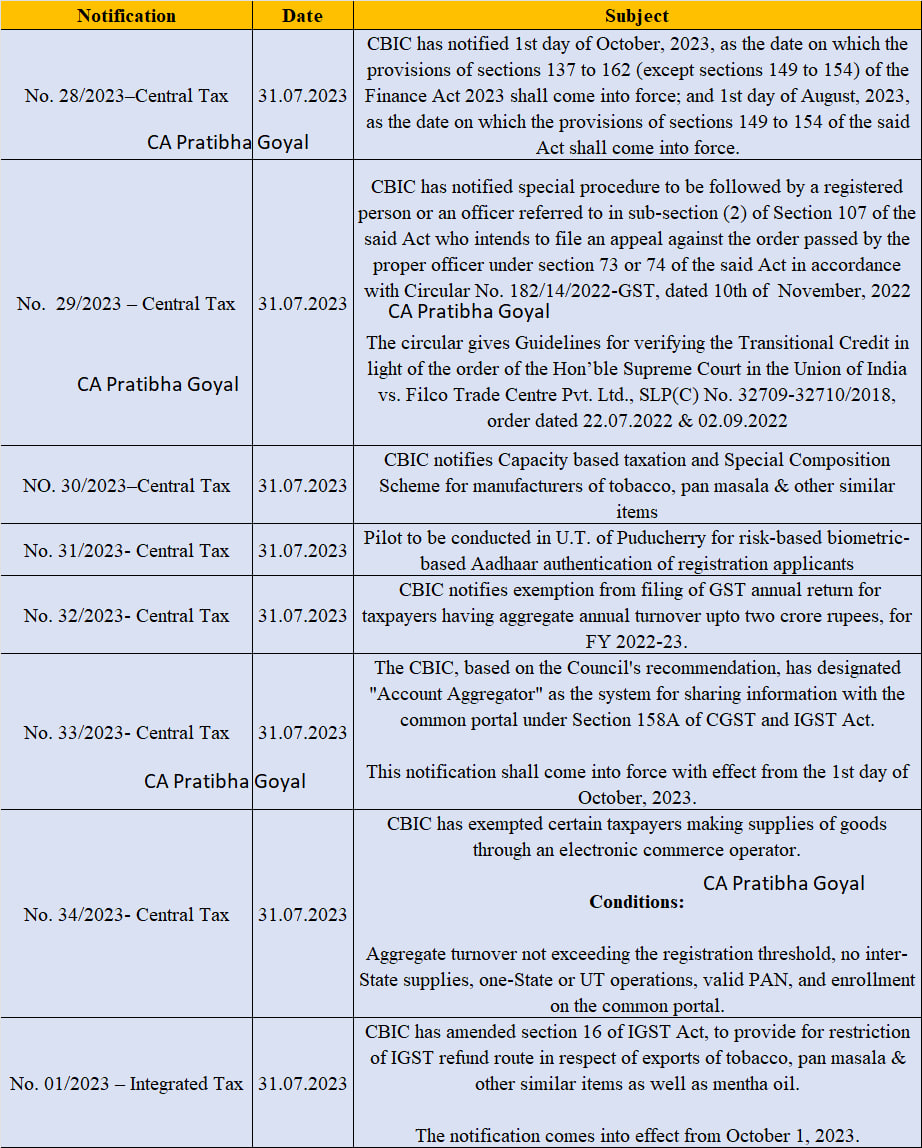

Notification No. 28/2023–Central Tax

CBIC has notified 1st day of October, 2023, as the date on which the provisions of sections 137 to 162 (except sections 149 to 154) of the Finance Act 2023 shall come into force; and 1st day of August, 2023, as the date on which the provisions of sections 149 to 154 of the said Act shall come into force.

Notification No. 29/2023 – Central Tax

CBIC has notified special procedure to be followed by a registered person or an officer referred to in sub-section (2) of Section 107 of the said Act who intends to file an appeal against the order passed by the proper officer under section 73 or 74 of the said Act in accordance with Circular No. 182/14/2022-GST, dated 10th of November, 2022

The circular gives Guidelines for verifying the Transitional Credit in light of the order of the Hon’ble Supreme Court in the Union of India vs. Filco Trade Centre Pvt. Ltd., SLP(C) No. 32709-32710/2018, order dated 22.07.2022 & 02.09.2022″

Notification No. 30/2023–Central Tax

CBIC notifies Capacity based taxation and Special Composition Scheme for manufacturers of tobacco, pan masala & other similar items

Notification No. 31/2023- Central Tax

Pilot to be conducted in U.T. of Puducherry for risk-based biometric-based Aadhaar authentication of registration applicants. Puducherry is the second state after Gujarat to have risk-based biometric-based Aadhaar authentication.

Notification No. 32/2023- Central Tax

CBIC notifies exemption from filing of GST annual return for taxpayers having aggregate annual turnover up to two crore rupees, for FY 2022-23.

Notification No. 33/2023- Central Tax

The CBIC, based on the Council’s recommendation, has designated “Account Aggregator” as the system for sharing information with the common portal under Section 158A of CGST and IGST Act.

This notification shall come into force with effect from the 1st day of October 2023.

For the purpose of this notification, “Account Aggregator” means a non-financial banking company which undertakes the business of an Account Aggregator in accordance with the policy directions issued by the Reserve Bank of India under section 45JA of the Reserve Bank of India Act, 1934 (2 of 1934) and defined as such in the Non-Banking Financial Company – Account Aggregator (Reserve Bank) Directions, 2016.

Notification No. 34/2023- Central Tax

CBIC has exempted certain taxpayers from making supplies of goods through an electronic commerce operator.

Conditions:

Notification No. 01/2023 – Integrated Tax

CBIC has amended section 16 of the IGST Act, to provide for restriction of IGST refund route in respect of exports of tobacco, pan masala & other similar items as well as mentha oil.

The notification comes into effect from October 1, 2023.

Summary of CBIC Notification dated 31072023

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"