Studycafe | Dec 17, 2019 |

Tax Implications of Investing in Public Provident Fund (PPF) Before knowing the Tax Implications of Investing in Public Provident Fund first of all let us discuss the concept of Public Provident Fund (PPF) . PPF was introduced by Indian Government with an objective to mobilize small saving in the form of an investment, coupled with a return on it. PPF is a safe investment option along with guaranteed returns.

Who are eligible for Public Provident Fund Scheme Accounts

Where Can One open a PPF Account

The PPF account can be opened at either of the following :

(a) Branches of State Bank of India and its subsidiaries,

(b) Other designated nationalised banks,

(c) Selected Post Offices across India.

What are documents required for Opening of PPF Account :-

Following documents are usually required for opening a PPF account :-

Account Opening Form (Form A)

Copy of PAN Card

Copy of Aadhar Card

Residence proof – Passport / Electricity Bill / Aadhar Card

Identity proof – Voter ID/ Driving License/ Aadhar Card

Two passport size photographs

Deposits upto Rs 1,50,000 p.a. into your PPF account are deductible under Section 80C of Income Tax Act 1961.

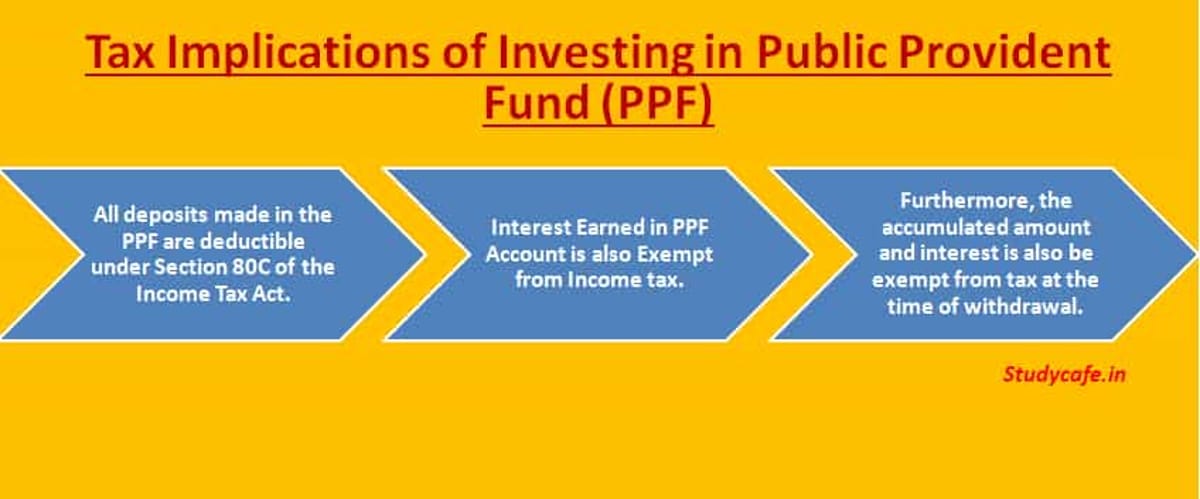

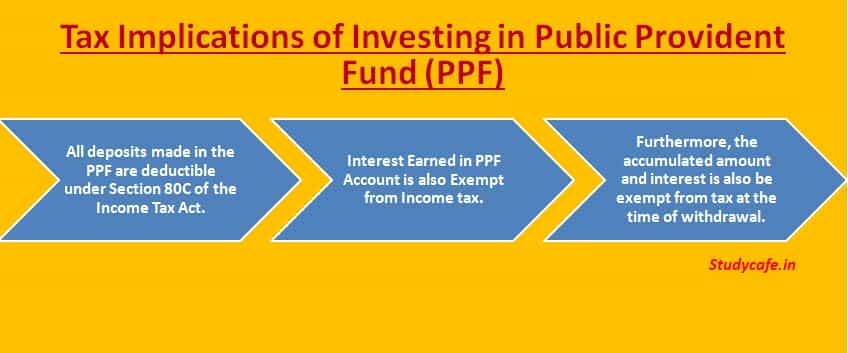

It is interesting to note that PPF an investment vehicle that falls under the category of Exempt-Exempt-Exempt (EEE). All deposits made in the PPF are deductible under Section 80C of the Income Tax Act. Interest Earned in PPF Account is also Exempt from Income tax. Furthermore, the accumulated amount and interest is also be exempt from tax at the time of withdrawal.

Other Considerations to be taken care of while Investing inPublic Provident Fund (PPF)

A PPF account cannot be closed before maturity. The maturity period of PPF is 15 Years after which the amount outstanding in the PPF Account along with the interest accrued shall be duely credited in the account of investor. However, if the taxpayer is in need of funds, and wish to withdraw before the maturity period of 15 years, the scheme permits partial withdrawals from year 7 i.e. on completing 6 years. An account holder can withdraw prematurely, up to a maximumof 50% of the amount that stood in the account at the end of 4th year preceding the year in which the amount is withdrawn or at the end of the preceding year, whichever is lower. Further,withdrawal can be made only once in a financial year.

Interest rate of PPF changes every year. Current rate of interest on PPF deposit is 7.9 %

A subscriber is eligible to take a loan from PPF account from the third financial year but this facility is available only till the end of the sixth financial year.The loan amount is capped at a maximum of 25 per cent of the balance available at the close of two years immediately preceding the year in which the loan is being applied for.

Tags : Provident Fund, Income Tax, Income Tax Deduction, Deduction from Gross Total Income

For Regular Updates Join : https://t.me/Studycafe

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"