Studycafe | Oct 14, 2019 |

Taxation of Gift under Income Tax Act 1961

Introduction

Gift is transfer of certain movable or immovable property from one person to another without consideration. Gift tax was introduced in India in the year 1958 and continued for more than 40 years. It was by the Finance Act, 1998 that the Gift Tax Act, 1958 was abolished. The Finance Minister then in the course of his budget speech stated that the collection of gift tax was insignificant. It was also conceded that Gift Tax Act had not been successful as an instrument to curb tax evasion and avoidance. As a result Gift Tax was abolished. At the same time, to ensure that there are no leakages of income tax revenue through the mechanism of gifts, the Income Tax Act was proposed to be amended to tax gifts as income in the hands of the recipient. Therefore the Finance Minister had by Finance Act, 1998 made a proposal to tax the properties movable or immovable – without consideration in money or monies worth as income on or after 1st October, 1998 in the hands of the recipient. However, as a result of representations received, the proposal to tax gifts as income was dropped. From October, 1998 to August, 2004 any amount received as gift or without consideration no tax was leviable either for giver or receiver. There was a widespread transfer of insincere gifts from the non-relatives.

Provision in Income Tax Act

In order to fill up the void, Section 56 (2)(v) of Income Tax Act was passed in 2004 and correspondingly section (24)(xiii) was defined. In the course of the presentation of the Budget Speech of 2004, the Finance Minister then stated, “The objective of amendment is to prevent money laundering. Purported gifts from unrelated persons are therefore to be taxed as income”.

As per Section 56 (2)(v) of the Income Tax Act, 1961 any amount exceeding Rs. 25,000 obtained by a person or a Hindu Undivided Family (HUF) without any consideration from any person would be taxed from 1st September, 2004 under the head Income from other Sources.

However, this clause shall not apply to any sum of money or any property received

(a) From any relative; or

(b) On the occasion of the marriage of the individual; or

(c) Under a will or by way of inheritance; or

(d) In contemplation of death of the payer or donor, as the case may be; or

(e) From any local authority as defined in the Explanation to clause (20) of section 10; or

(f) From any fund or foundation or university or other educational institution or hospital or other medical institution or any trust or institution referred to in clause (23C) of section 10; or

(g) From any trust or institution registered under section 12AA.

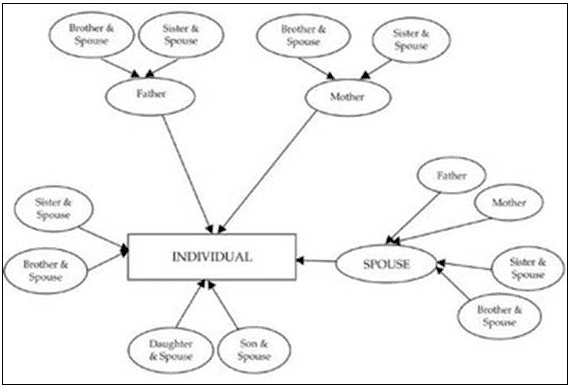

For the purpose of this clause the term Relative was defined as :

While introducing the said section the term Gift was nowhere used. Transfer of sum of money exceeding Rs. 25,000 [Not the aggregate amount] was taxable in hands of recipient. Gifts in kind and gifts received without adequate consideration [Deemed gift] were non-taxable.

Amendment Finance Act, 2006

In Finance act, 2006 clause (vi) to Section 56(2) was introduced. It was proposed that the sum of money whose aggregate value exceeds Rs. 50,000 was taxable. It was operative up to 1st October, 2009.

Finance Act, 2009

The Finance Act, 2009 inserted a new clause (vii) to tax gifts received by on Individual or Hindu Undivided Family (HUF) on or after 1st October, 2009. With this amendment, gifts in kind received without consideration and gifts received without adequate consideration [Deemed gift] were also made taxable.

Gift became chargeable to tax if it falls under any of below category :

Any sum of money (gift in cash or by cheque or draft) – If aggregate amount of sum of money received by an individual/ HUF from one or more persons during a previous year (but on or after 1st October, 2009) exceeds Rs. 50,000, then the whole of such aggregate value will be chargeable to tax.

Immovable property without consideration –

If any immovable property is received without any consideration on or after 1st October, 2009 and the stamp duty value of which exceeds Rs. 50,000, then the stamp duty value will be chargeable to tax in every such transaction.

Immovable property for a consideration less than the stamp value –

If any immovable property is received on or after 1st October, 2009 for a consideration which is less than the stamp duty value of the property by an amount exceeding Rs. 50,000, then the difference between stamp duty value and consideration is chargeable to tax in every such transaction.

Movable property without consideration –

If any movable property is received without any consideration on or after 1st October, 2009 and the fair market value of which exceeds Rs. 50,000, then fair market value will be chargeable to tax in every such transaction.

Movable property for a consideration less than fair market value –

If any movable property is received on or after 1st October, 2009 for a consideration which is less than the fair market value of the property by an amount exceeding Rs. 50,000, then the difference between fair market value and consideration is chargeable to tax in every such transaction.

For purpose of this section “Property” means the following capital asset [the term Capital asset was inserted by Finance Act, 2010] :

(i) Immovable property being land or building or both;

(ii) Shares and securities;

(iii) Jewellery [as defined us 2(14)(ii)];

(iv) Archaeological collections;

(v) Drawings;

(vi) Paintings;

(vii) Sculptures;

(viii) Any work of art;

(ix) Bullion [w.e.f. 1st June, 2010];

Finance Act, 2010

In Finance Act, 2010 Clause (viia) was inserted in section 56(2) with effect from 1st June, 2010. The provisions were intended to extend the tax net to such transactions in kind. The intent is not to tax the transactions entered into in the normal course of business or trade, the profits of which are taxable under specific head of income. It is, therefore, proposed to amend the definition of property so as to provide that section 56(2)(vii) will have application to the Property which is in the nature of a capital asset of the recipient and therefore would not apply to stock-in-trade, raw material and consumable stores of any business of such recipient.

The clause is applicable if the following conditions are satisfied :

1. Recipient is a firm or closely held company [Company in which the public are not substantially interested]

2. The asset that is received is in the form of share in closely held company.

3. These shares are received from any person.

4. Such shares are received without consideration or for inadequate consideration.

5. Such shares are not received by way of transaction referred to in Sec. 47(via)/(vic)/(vicb)/(vid)/(vii) [i.e. Shares are received in the course of amalgamations, mergers, demergers and re-organisations].

6. Such shares are received on or after 1st June, 2010.

Consequences if above mentioned conditions are satisfied :

| Situations | Taxability |

| 1. Shares are received without consideration and aggregate value of shares does not exceed Rs. 50,000. | Nothing is taxable |

| 2. Shares are received without conside–ration and aggregate value of shares exceeds Rs. 50,000. | Aggregate fair value of shares shall be taxable in the hand of recipient |

| 3. Shares are received for consideration that is less than the fair market value and the aggregate difference does not exceed Rs. 50,000. | Nothing is taxable |

| 4. Shares are received for consideration which is less than the fair market value and the aggregate difference exceeds Rs. 50,000. | Aggregate fair market value mi-nus the aggregate consideratio-n will be taxable in the hand of the recipient |

Rule for computing Fair market value of Movable property

The Central Board of Direct Taxes (CDBT) has prescribed method to calculate fair market value of movable property. Rule 11U and rule 11UA specifies the same. In rule 11U, various terms used in rule 11UA are defined. In rule 11UA methods for computation are specified. Those are as follows :

| Properties | Valuation |

| 1. Jewellery, Archaeological collection, Drawings, Painting, Sculpture, Any art of work or Bullion | 1. If purchased from registered dealer, then Invoice value shall be the fair market value. 2. In any other case, the price of the assets shall be if it is sold in the open market. |

| 2. Quoted shares and securities through transaction in recognized stock exchange | Value as recorded in stock exchange. |

| 3. Quoted shares and securities [Not being received through tra-nsaction in recognized stock exchange] | Lowest price of such shares traded in any recognized stock exchange in India. |

| 4. Unquoted equity shares | =Net worth*paid up value one share/ total amount of paid up equity shares capital as shown in the balance sheet. |

| 5. Other unquoted shares and securities | Market value shall be the price it would fetch if sold in the open market on the valuation date and the assessee may get report from category-1 Merchant Banker or Chartered Accountants in respect of such valuation |

Finance Act, 2012

In Finance Act, 2012 Clause (viib) was inserted in section 56(2) with effect from 1st April, 2013. If a company, not being a company in which the public are substantially interested receives consideration more than fair market value of shares, then aggregate consideration received for such shares as exceeds the fair market value of the shares shall be chargeable.

The said clause is not applicable if shares are issued to :

a) Venture capital undertaking from a venture capital company or a venture capital fund [as defined us 10(23FB)]

b) A class or classes of persons as may be notified by Central Government in this behalf

For purpose of this clause, fair market value means higher of the following amount :

a) As determined in accordance with rule 11 and rule 11UA

b) As may be substantiated by the company to the satisfaction of the Assessing Officer (AO), based on the value of its assets, including intangible assets, being goodwill, know-how, patents, copyrights, trademarks, licenses, franchises or any other business or commercial rights of similar nature

Finance Act, 2013

Finance Act, 2013 substituted Section 56(2)(vii)(b) by new provisions. It comes in to effect from 1st April, 2014. If any immovable property is received for a consideration which is less than the stamp duty value of the property by more than Rs. 50,000, the stamp duty value of such property which is in excess of such consideration, shall be chargeable to tax in the hands of the transferee being individual or Hindu Undivided Family (HUF). Where the date of agreement fixing the value of consideration for the transfer of asset and the date of registration of the transfer of the asset are not same, the stamp duty value as on the date of agreement for transfer shall be considered for the purposes of this section. This exception shall be applicable only where the amount of consideration or part thereof for transfer has been received by any mode other than cash on or before the date of agreement.

The provisions relating to tax on Gift have travelled as under:

Related issues and anomalies

| Period | Taxability |

| Up to 30/09/1998 | Liable for tax as gift under the GiftTax Act in the hands of the donor if amount of gift exceeded Rs.30,000 in ayear |

| 01/10/1998 to 31/08/2004 | No tax |

| 01/09/2004 to 31/03/2006 | Taxable u/s 56(2)(v) as income butonly if sum of money of the same exceeds Rs.25,000 from each person |

| 01/04/2006 to 30/09/2009 | Taxable u/s 56(2)(vi) as income butonly aggregate of sum of money if the same exceeded in aggregate Rs.50,000 in a year in the hands of the recipient from all donors |

| 01/10/2009 onwards | Taxable Receipt of sum of Money,Immovable property as well as certain specified movable property if theamount exceeds Rs.50,000 in aggregate in case of each of such category of assets |

| 01/06/2010 onwards | Section56(2)(viia) inserted to tax Partnership Firms and unlisted companies [i.e.companies in which public are not substantially interested] when shares ofspecified companies are received without consideration or at inadequate consideration |

| 01/04/2013 onwards | Section56(2)(viib) inserted by Finance Act, 2012 to tax unlisted companies [i.e.companies in which public are not substantially interested] if shares areissued to a resident person for consideration more than fair market value,then the difference is chargeable |

Any sum of money received from any relative is exempt only for Individuals and for Hindu Undivided Family (HUF) any member thereof. Whether such relation is to be interpreted by the relation of Karta or all members of Hindu Undivided Family including all female members, still remains a question.

Assessable value under stamp duty act in many states needs to be rationalized before the enactment of Section 56(2)(vii)(b). In many cities it is seen that that the market value of the property is less than the value adopted for stamp duty purposes. Enactment of these provisions will lead to unfair taxation on notional income that never existed. Hence it is doubtful as to how the amendment will prevent the circulation of unaccounted money.

If an employer company is dealing in the items covered [Movable assets] for the purpose of the said section and such company provides products to his employee at concessional rate then there would be double taxation.

Sometime the movable assets covered in section 56(2)(vii) might be provided free along with other products sold by a trader, whether the fair market value of the items received without consideration in such a case will be falling in the mischief of the said section, will again be a disputable question.

Conclusion

Tax on gifts as per Income Tax Act, 1961 is one of the complicated provisions. Taxation on deemed basis and fair market value concept are not taxpayers friendly measures. The better approach for the legislature may be to take the value of the gifts at their cost or actual value in the hands of the donor.

This Article is contributed by Saurabh Wagle. He can be reached atsaurabh.wagle@gmail.com

Click here to follow us on Telegram :https://t.me/studycafe

Click Here to Buy CA Final Pendrive Classes at Discounted Rate

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"