CA Pratibha Goyal | Jun 16, 2022 |

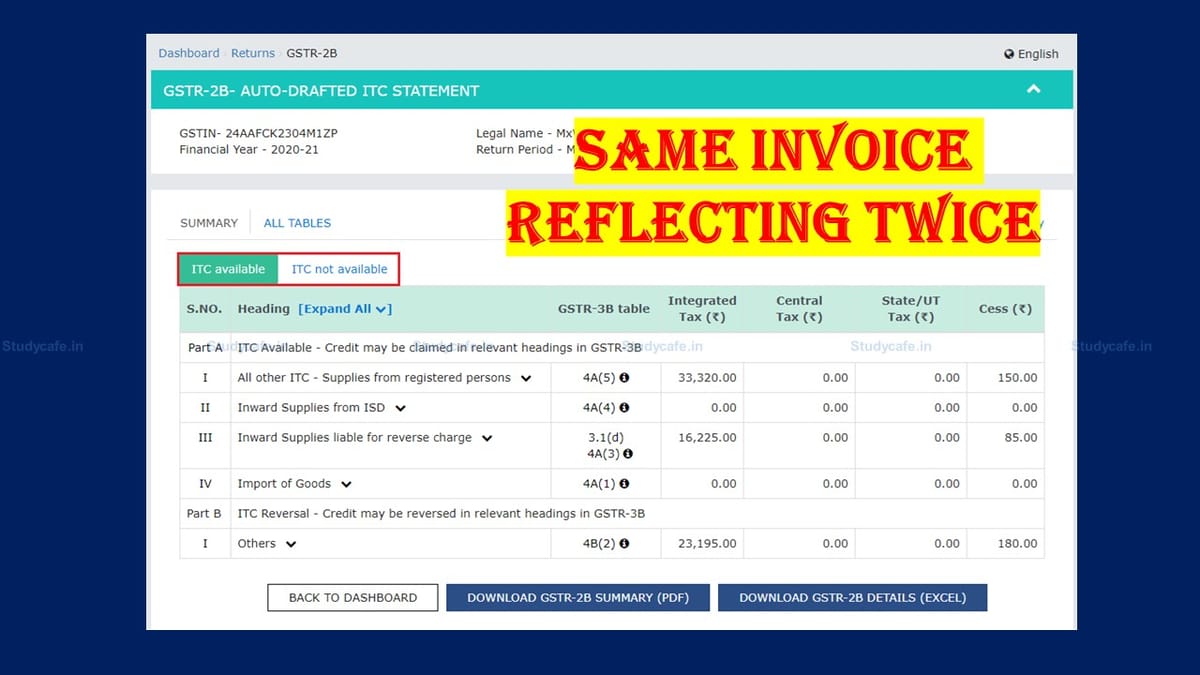

Taxpayers Beware! Another Glitch in GSTR-2B: Same Invoice reflecting Twice

The Goods and Service Tax Network (GSTN) has issued an advisory on the new issue faced by the taxpayer in GSTR-2B. The issue is that the same invoice is reflected twice in GSTR 2B i.e. April and May 2022.

GSTN has advised the Taxpayers not to avail the Input Tax Credit (ITC) on the same invoice twice. Also, the GST Network has assured that a solution to the issue would be implemented shortly.

The Advisory is as follows:

“Few taxpayers (recipients of supply) have reported that they have observed same invoice twice in GSTR 2B i.e. April April and May, 2022. Taxpayers are advised not to avail ITC on same invoice twice. A solution to the issue would be implemented shortly.”

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"