CA Pratibha Goyal | Feb 4, 2023 |

Taxpayers can now opt for Composition Scheme for FY 2023-24 on GST Portal

The Goods and Services Tax Network (“GSTN”) has enabled functionality for regular taxpayers can opt for the Composition Scheme for Financial Year 2023-2024.

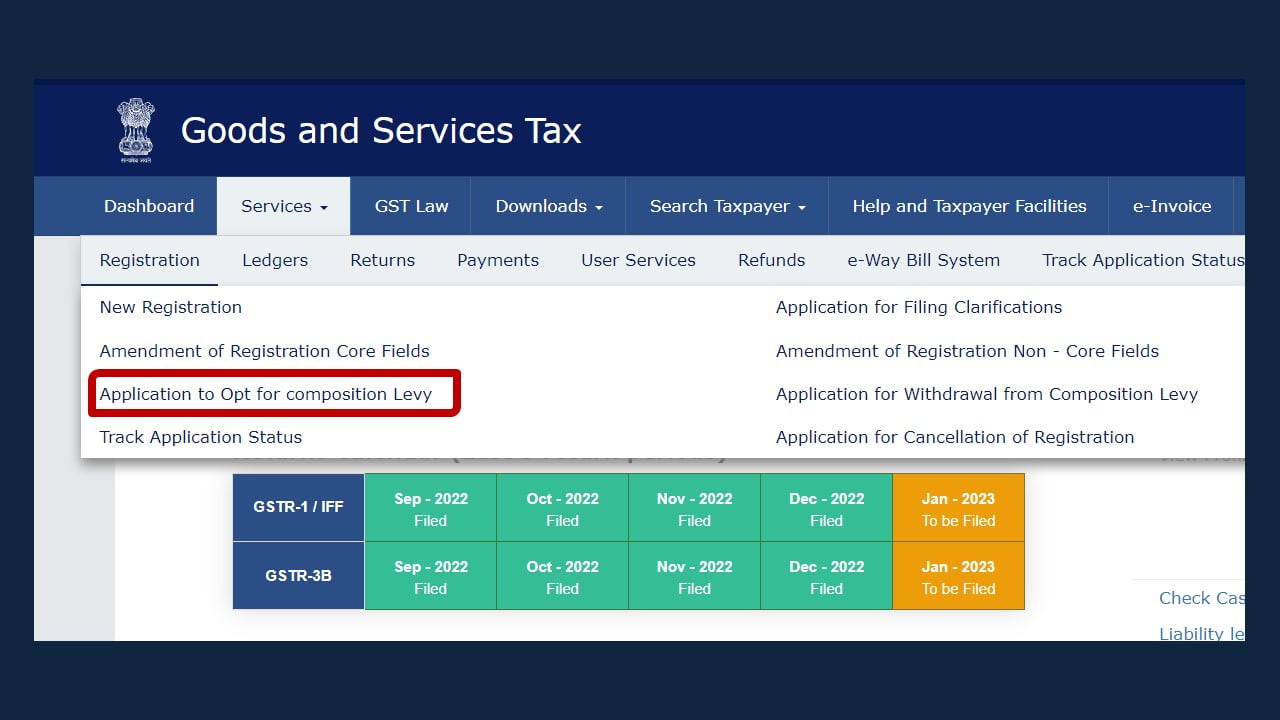

regular taxpayers can opt for the Composition Scheme for Financial Year 2023-2024 by navigating to ‘Services -> Registration -> Application to Opt for composition Levy’ and filing Form CMP-02 on the GST Portal.

The registered person shall be eligible to opt, if he is not a manufacturer of such goods as may be notified by the Government on the recommendations of the Council. Please ensure you are not a manufacturer of any of the below commodities:

| S.No. | Tariff item, subheading, heading or Chapter | Description |

|---|---|---|

| 1. | 2105 00 00 | Ice cream and other edible ice, whether or not containing cocoa. |

| 2. | 2106 90 20 | Pan masala |

| 3. | 24 | All goods, i.e. Tobacco and manufactured tobacco substitutes |

| 4. | 2202 10 10 | Aerated Water |

| 5. | 6815 | Fly ash bricks or fly ash aggregate with 90 per cent. or more fly ash content; Fly ash blocks and Articles Of Stone Or Of Other Mineral Substances (Including Carbon Fibres, Articles Of Carbon Fibres And Articles Of Peat), Not Elsewhere Specified Or Included. |

| 6. | 6901 00 10 | Bricks of fossil meals or similar siliceous earths |

| 7. | 6904 10 00 | Building bricks |

| 8. | 6905 10 00 | Earthen or roofing tiles |

This functionality is available on the GST Portal till March 31, 2023.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"