ITR Filing season is going on and filing before the due date is beneficial, but, which form to choose is a significant task for a taxpayer.

Reetu | Jul 24, 2024 |

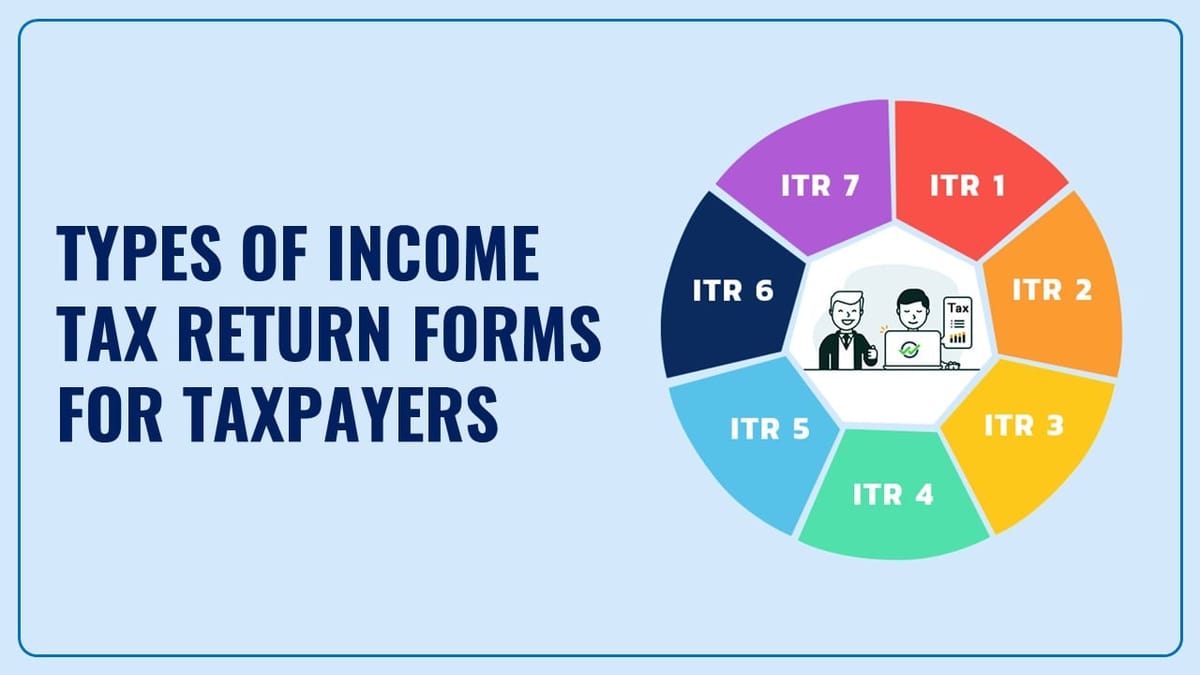

ITR Filing: Types of Income Tax Return Forms available for Taxpayers; Let’s Know About it

Income tax returns (ITR) Filing season is going on and the due date to file a Return of income tax is 31st July 2024. Filing tax returns is significant for every taxpayer in the first place and if filing is done before the due date, it is beneficial for them in many ways.

But, the question is which ITR form to choose to file the return as per individual income sources. Choosing the right form will result in accurate filing and the person will not be bothered by scrutiny of the tax department. So, first, know how many income tax returns (ITRs) are provided by the income tax department. There are mainly seven types of ITR Forms (ITR-1 (Sahaj), ITR-2, ITR-3, ITR-4 (Sugam), ITR-5, ITR-6, and ITR-7) for different kinds of taxpayers and business professionals. Three other types of ITR forms (ITR-A, ITR-U, ITR-V) are for other common purposes. Let’s understand them in detail.

ITR-1 (Sahaj)

For resident and ordinarily resident individual who has income from salary/ family pension/ one house property (not being brought forward loss or loss to be carried forward) / income from other sources property (not being loss and not being winning from lottery/income from race horses ) and who has not claimed deduction under section 57 (except standard deduction pertaining family pension).

ITR-2

For an individual/HUF where the total income does not include income under the head business or profession.

ITR-3

For an individual/HUF having income under the head business or profession.

ITR-4 (Sugam)

For an individual or a resident and ordinarily resident HUF or a resident firm (not being LLP) deriving business income and such income is computed in accordance with special provisions referred to in section 44AD, 44ADA or 44AE.

ITR-5

For firms, AOPs and BOIs or any other person (not being individual or HUF or company or to whom ITR-7 is applicable).

ITR-6

For companies other than companies claiming exemption under section 11.

ITR-7

For persons including companies required to furnish returns under section 139(4A)/(4B)/(4C)/(4D).

ITR-A

For successor entities to furnish return of income under section 170A consequent to business reorganisation.

ITR-U

For persons who want to update income under section 139(8A) within 24 months from the end of the relevant assessment year.

ITR-V

Where the data of the return of income in Forms ITR-1, ITR-2, ITR-3, ITR-4, ITR-5 and ITR-U were transmitted electronically without digital signature.

ITR-1 is not applicable in the case of a person who, –

ITR-4 cannot be filed for a person mentioned in ITR-1 above. Besides, ITR-4 cannot be filed in the case of a person having brought forward loss or loss to be carried forward under any head of income.

Therefore, having an depth understanding of the ITR Form will help guide you uprightly in this taxation game. Choosing the right or correct form of tax return according to your eligibility criteria is one hell of a good task. By doing this, you will keep yourself safe from unnecessary problems from the tax department.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"