TCS on Foreign Remittance: MOF releases FAQs clarifying the covered Transactions

CA Pratibha Goyal | May 18, 2023 |

TCS on Foreign Remittance: MOF releases FAQs clarifying the covered Transactions

Ans. Section 206C of the Income-Tax Act 1961 provides for res in the business of trading in alcohol, liquor, forest produce, scrap etc. Sub-section (IG) of the aforesaid section provides for res on foreign remittance through the Libe1·alised Remittance Scheme and on the sale of overseas tour packages.

Ans. No. Only such remittances which are covered under LRS are liable to TCS. These have been detailed in the answer to Q (5) in Part B of the clarifications.

Ans. The reasons for the amendment are:

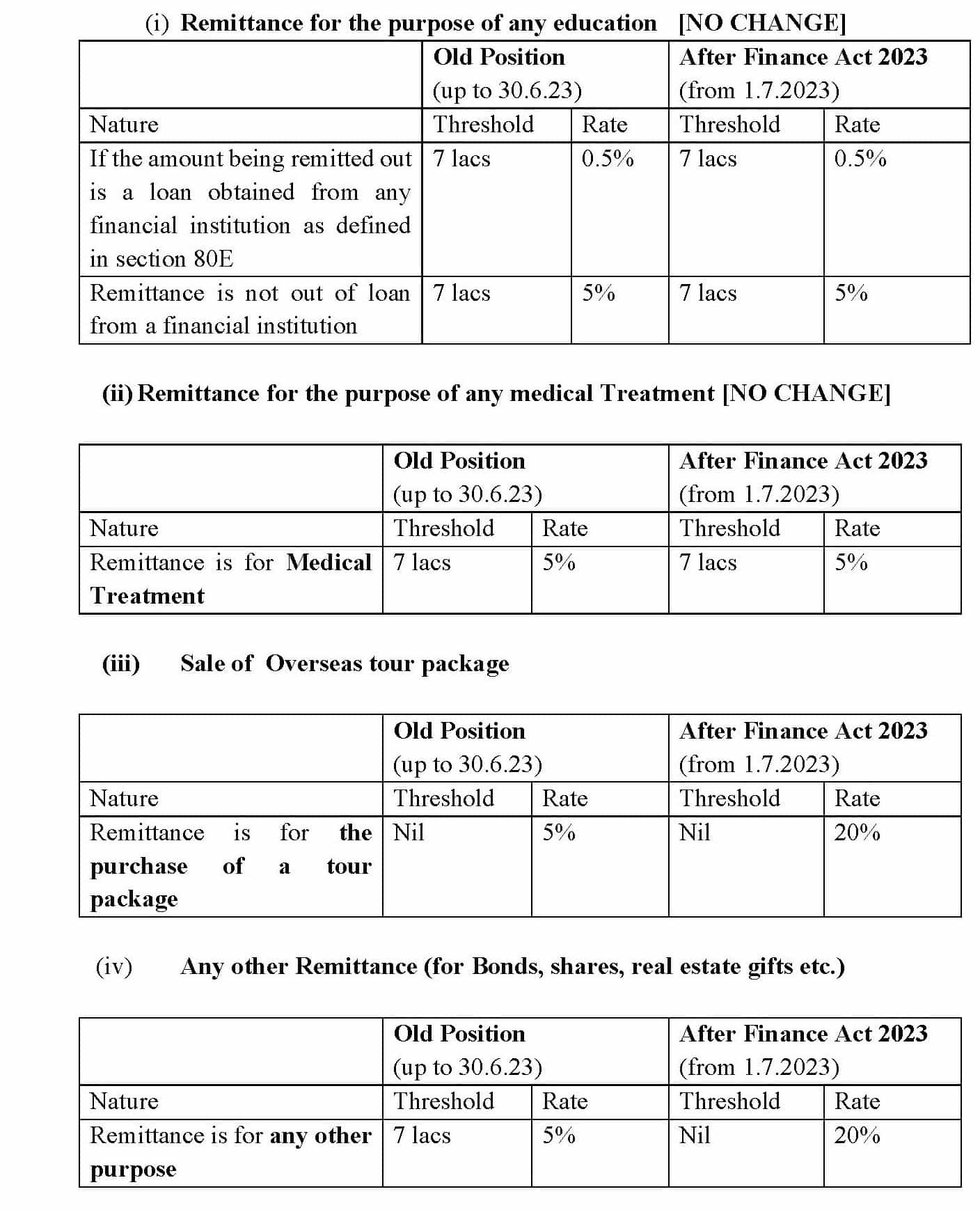

Ans. The TCS rates with the changes brought about in Finance Act 2023 are tabulated as under.

Ans. For res on remittance for travel and incidental expenses related to education and medical treatment, the rates of res as applicable to remittances for education and medical treatment, respectively, shall apply. A detailed clarification will be issued separately.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"