The Income Tax Department has issued an update on the TDS/ TCS deduction for FY 2024-25.

Reetu | Mar 4, 2024 |

Traces Update: Functionality for Application for Lower or Nil TDS/TCS deduction for FY 2024-25 live on Portal

The Income Tax Department has issued an update on the TDS/ TCS deduction for FY 2024-25. The Functionality for Application for Lower or Nil TDS/TCS deduction for FY 2024-25 is live now on the Traces Portal.

The Tax Deducted at Source (TDS) regime is critical to revenue collection. However, taxpayers sometimes find themselves in situations where TDS deductions outweigh their actual tax liability, affecting their cash flow. To solve this, the Tax Deduction and Collection Account Number (TAN) system has implemented the TDS Reconciliation Analysis and Correction Enabling System (TRACES), which allows taxpayers to submit for a lesser or zero TDS deduction, thereby improving their financial situation.

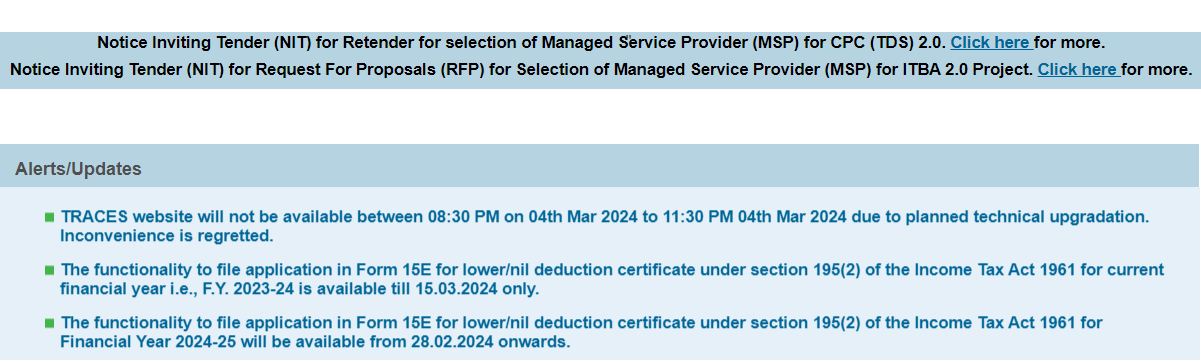

The Updates are as follows:

1. The functionality to file application in Form 13 for lower/nil deduction certificate under section 197 of the Income Tax Act 1961 for Financial Year 2024-25 will be available from 28.02.2024 onwards.

2. The functionality to file application in Form 15E for lower/nil deduction certificate under section 195(2) of the Income Tax Act 1961 for Financial Year 2024-25 will be available from 28.02.2024 onwards.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"