Studycafe | Mar 10, 2021 |

Uploading Invoices in IFF? Please take care of the Limit of Rs 50 Lakh

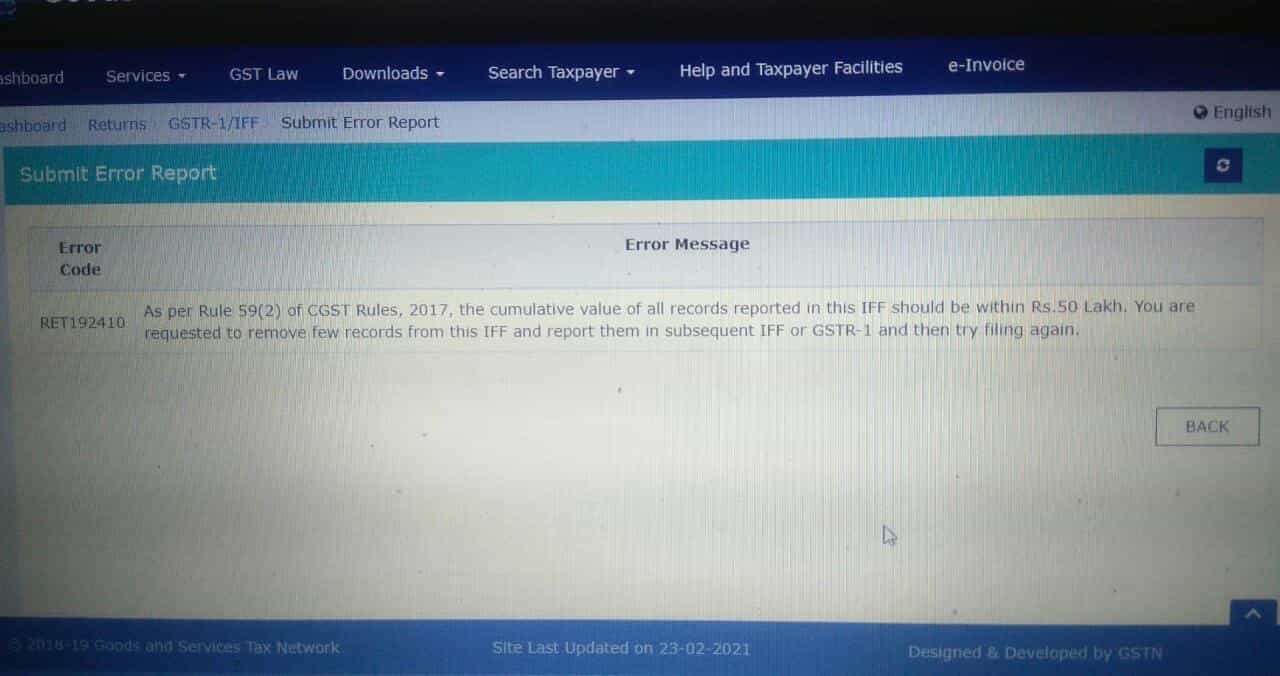

As the due date of uploading Invoices in the Invoice furnishing Facility [IFF] for those who opted for the Quarterly Return & Monthly Payment [QRMP] Scheme is coming near, many are getting the below-mentioned error:

Error Code: RET192410

As per Rule 59(2) of CGST Rules 2017, the cumulative value of all records reported in the IFF should be within Rs. 50 Lak. You are requested to remove the few records from the IFF and report them in subsequent IFF or GSTR-1 and then try filling again.

What to do in this case?

The resolution to Error Code RET192410 is that:

What is the due date for Uploading Invoices in IFF?

The due date of uploading Invoices in the Invoice furnishing Facility [IFF] is the 13th of next month.

Is 50 Lakh a Taxable value or Invoice Value?

50 Lakh a Taxable value

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"