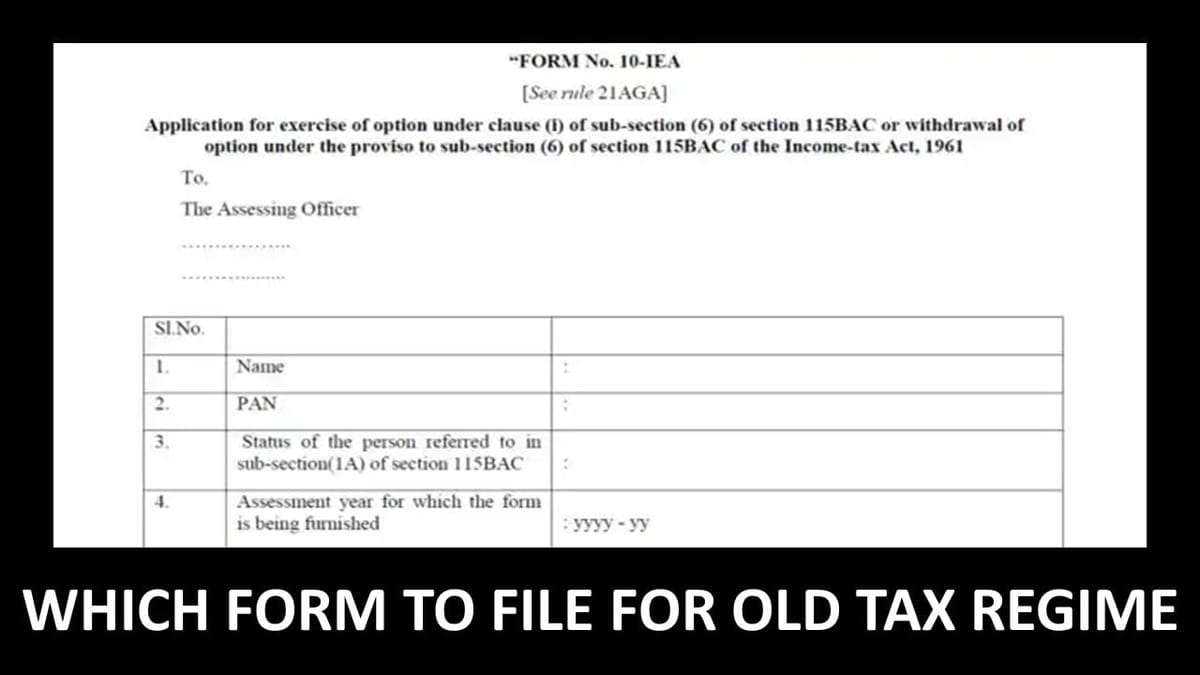

Form 10-IEA is filed by individuals and HUFs with business income who want to continue with the old tax regime

Nidhi | Jun 21, 2025 |

Wants to OPT for OLD Tax Regime; Know Which Form to File to opt for OLD Tax Regime

Form 10-IEA is filed by individuals and HUFs with business income who want to continue with the old tax regime. As the new tax regime is the default tax regime, and if the taxpayer wants to go with the old tax regime, then they must file Form 10IEA. It should be filed before the due date as specified under section 139(1).

Individuals and HUFs who want to select the Old tax regime and have business income during the year.

It is compulsory to submit Form 10-IEA online before the deadline specified under section 139(1) of the Income Tax, 1961.

If you do not file 10-IEA within the prescribed timeline, then you will not get the benefits under the old tax regime, and the status of your form will be invalid. However, you can file a new Form in the subsequent assessment year.

If you have chosen the old tax regime in the previous year (AY 2024-25) and filed Form 10-IEA, and in the current year (AY 2025-26), you want to select Old tax regime, then you are not required to file a fresh Form 10-IEA for the current assessment year. You just need to submit the previous year’s details of 10-IEA.

However, if you want to opt for the new tax regime in the current year (AY 2025-26), then you must file a new Form 10-IEA. Taxpayers must note that in such a case, the taxpayer cannot opt for the old tax regime again.

While filing the ITR form, taxpayers are required to fill the following field asked in the ITR utility:

1. Have you opted out new tax regime u/s 115BAC (6) in Assessment Year 2024-25?

2. Option for new tax regime u/s 115BAC in Current Assessment Year?

Let us understand this with the help of an example, having two different cases:

Case 1: Assume that Mr A, who has income from business, wants to file ITR-4 for the Assessment year 2024-2025 and he is opting for the new tax regime; then he is not required to form 10-IEA. However, if Mr A wants to choose the old tax regime for filing ITR-4 for the assessment year 2025-26, then he is required to file Form 10-IEA.

In such a case, while filing ITR, you have to answer the field as :

Case 2: Assume that Mr B, who has income from business, wants to file ITR-4 for the assessment year 2024-25 under the old tax regime; then he is required to file Form 10-IEA. However, if he is continuing with the old tax regime for the assessment year 2025-26, then he is not required to file the form again, as he has already filed it for AY 2024-2025.

In such a case, while filing ITR, you have to answer the field as:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"