CA Pratibha Goyal | Apr 5, 2020 |

Who is liable to deduct Tax at Source (TDS)

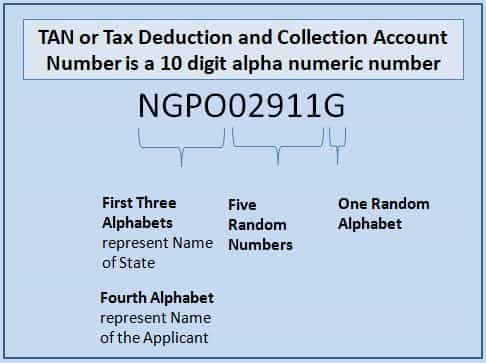

The Article deals with person who is liable to deduct TDS. TAN or Tax Deduction and Collection Account Number is a 10 digit alpha numeric number required to be obtained by all persons Who are Liable to Deduct Tax at Source (TDS) or collecting tax. It is compulsory to quote TAN in TDS/TCS return (including any e-TDS/TCS return), any TDS/TCS payment challan and TDS/TCS certificates.

TDS is treated as pre-paid taxes as it is paid in advance to the government. It is the duty of the person who paid to someone for his service, goods etc. These payments are specified by the act like salary payment, interest on securities, contract payment, dividends etc. Who deduct TDS of payee is called deductor and whose tax is deducted called deductee. The following persons are liable to deduct TDS and deposit to government on behalf of deductee.

Income Tax Act require specified persons to deduct tax on particular types of payments being made by them. The list of such persons requiring to make TDS is contained in TDS provision listed here.

You May Also Refer: TDS Rate Chart For Assessment year 2021-22 or Financial Year 2020-21

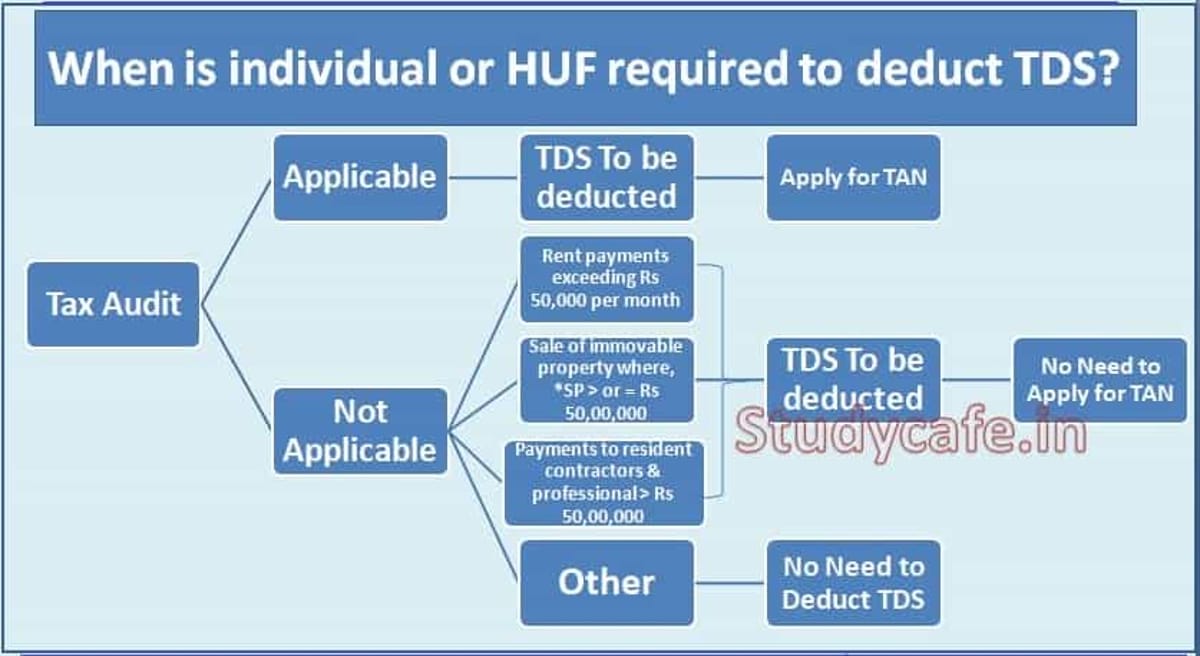

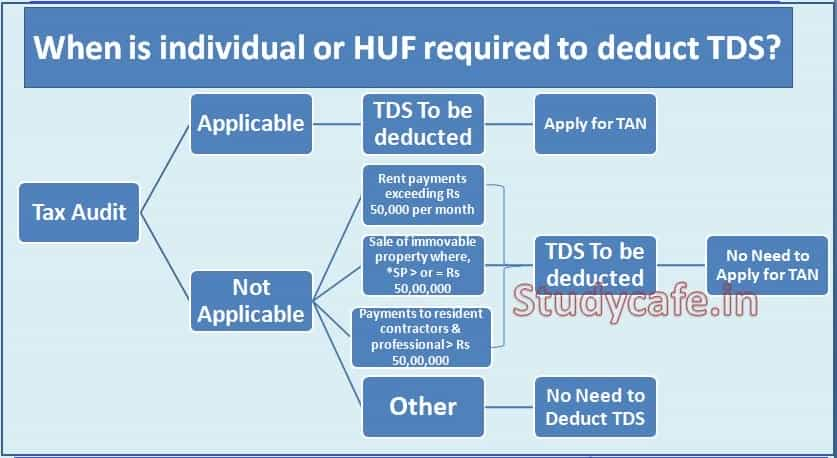

An Individuals or an H.U.F. is liable to deduct TDS in case Tax Audit is applicable:

An Individuals or an H.U.F. is not liable to deduct TDS on such payment except where the individual or H.U.F. is carrying on a business/profession where accounts are required to be audited u/s 44AB, in the immediately preceding financial year.

Cases where an individual or HUF is required to deduct TDS even is he is not liable for a tax audit:

TDS on Rent Payment:

An Individuals or an H.U.F. is liable to deduct TDS in case of rent payments exceeding Rs 50,000 per month. Taxpayer requires to deduct TDS @ 5%.

TDS on sale of immovable property:

An Individuals or an H.U.F. is liable to deduct TDS in case of sale of immovable property (excluding rural agricultural land), where, consideration is Rs 50,00,000 or more. Taxpayer requires to deduct TDS @ 1%.

TDS on Payments to Resident Contractors and Professionals

An Individuals or an H.U.F. is liable to deduct TDS in case of PAYMENTS TO RESIDENT CONTRACTORS AND PROFESSIONAL exceeding Rs 50,00,000 during the year. Taxpayer requires to deduct TDS @ 5%.

Who is liable to deduct Tax at Source

Other than Individual or HUF, any person making specified payments mentioned under the Income Tax Act are required to deduct TDS at the time of making payment or crediting in their books, whichever is earlier.

This TDS Rate Chart applicable for FY 2020-21

| Section | Description & Rate | Threshold for no deduction of TDS |

| 192 | Salary. @ normal tax rate applicable for the financial year in which the payment is made | (Salary) Estimated salary does not exceeds exemption limit, i.e. Rs. 250000/-, 300000/-, 500000/-. ( It is applicable even employee does not have PAN) |

| 192 A | Payment of accumulated balance due to an employee from PF. @ 10% | (Withdrawal from employees provident fund scheme) Withdrawal is less than Rs. 50000/- |

| 193 | Interest on Securities. @ 10% | (Interest on securities) Does not exceed Rs. 5000/- Bank, Post office, Co operative society engaged in banking business – Sr. citizen-on FD- Rs. 50000/-, To other person- Rs. 40000/- |

| 194 | Dividends. @ 10% | For an Individual aggregate of amount of Dividends does not exceed Rs. 5000/- |

| 194A | Interest other than “ Interest on Securities”. @ 10% | (Interest other than interest on securities) Any other person- Rs. 5000/- |

| 194 B | Winnings from lottery or crossword puzzle. @30% | (Winning from lottery or crossword puzzles) Does not exceed Rs. 10000/- |

| 194 BB | Winning from horse race. @ 30% | (Winning from horse race) Exceeds Rs. 10000/- |

| 194 C | Payments to contractors. @ 1% to individual or HUF and @ 2% other than individual or HUF i.e company, firm etc., | (payment to contractors) Single payment does not exceeds Rs. 30000 and the aggregate of such payment during the financial year does not exceed Rs. 100000/- |

| 194 C | Payments to contractors. @ 1% to individual or HUF and @ 2% other than individual or HUF i.e company, firm etc., | (Payment to transport operators) Who has furnished PAN to deductors and having 10 or less than 10 goods carriages at any time during the financial year. Payment by an individual or HUF to a resident contractors for personal purposes. |

| 194 D | Insurance commission. @ 5% for resident other than company, 10% for company | (Insurance Commission) Does not exceed Rs. 15000/- |

| 194DA | Payment in respect of life insurance policy. @ 5% w.e.f September 1, 2019. Up to 31st August, 2019 @ 1% | (Life Insurance Policy) Does not exceed Rs. 100000/- |

| 194 E | Payment to non-residents sportsmen or sports association. @ 20% | NA |

| 194 EE | Payments in respect of deposit under National Savings Scheme, etc. @ 10% | NA |

| 194 F | Payments on account of repurchase of units by Mutual Fund or Unit Trust of India. @ 20% | NA |

| 194 G | Commission, etc., on sale of lottery tickets. @ 5% | (On sale of lottery tickets) Does not exceed Rs. 15000/- |

| 194 H | Commission or brokerage. @ 5% | (Commission or brokerage) Does not exceed Rs. 15000/- |

| 194 I | Rent @ 2% for plant & machinery, @ 10% for land or building or furniture or fitting. | (Rent income) Does not exceed Rs. 240000/- |

| 194 IA | Payment on transfer of certain immovable property other than agricultural land. @ 1% | (Transfer of certain immovable property other than agriculture land) Consideration for immovable property is less than Rs. 50 lakhs |

| 194 IB | Payment of rent by certain individuals or HUF. @ 5% | (by certain Individual or HUF whose books of account are not required to be audited u/s 44AB(a)/(b) in the immediate preceding F.Y.) Rent of land or building does not exceed Rs. 50000/ per month. |

| 194 IC | Payment under specified agreement. @ 10% | NA |

| 194 J | Fees for professional or technical services. @ 10%, @2% for technical services | (Professional or technical service) Does not exceed Rs. 30000/- |

| 194 K | Any income in respect of Units of Mutual Fund or units from specified undertaking or company @ 10% {Introduced in finance bill 2020 shall be effective from April 2020} | (Income from units of Mutual fund) Does not exceed Rs. 5000/- |

| 194 LA | Payment of compensation on acquisition of certain immovable property. @ 10% | NA |

| 194 LB | Income by way of interest from infrastructure debt fund. @ 5% | NA |

| 194 LBA | Certain income from units of a business trust. @ 10% to resident, @5% [sub sec. (a) of clause (23FC) of section 10 and @ 10% (b) of clause (23FC) of section 10] to non resident or a foreign company. | NA |

| 194 LBB | Income in respect of units of investment fund. @ 10% | NA |

| 194 LBC | Income in respect of investment in securitization of trust. @ 25%. @ 30% other than individual or HUF | NA |

| 194 LC | Income by way of interest from Indian Company. @ 5% [@4% in case interest income referred to clause (ib) of sub section (2)] | NA |

| 194 LD | Income by way of interest on certain bonds and Government securities. @ 5% | NA |

| 194 M | Payment of certain sums by certain individuals or Hindu undivided family. @ 5% | (Payment of certain sums by certain individuals or Hindu undivided family). If payment during the previous year does not exceed Rs. 50 lakhs |

| 194 N | Payment of certain amounts in cash. @ 2% | (Payment of certain amounts in cash). If payment during the previous year does not exceed Rs. 1 Cr |

| 194 O | Payment made by ecommerce operator to e -commerce participant. @ 1% {Introduced in finance bill 2020 shall be effective from April 2020} | (Payment by e-commerce operator to e- commerce participant). If payment made to Individual or HUF e-commerce participant during the previous year does not exceed Rs. 5 lakhs |

| 195 | Other sums. @ the rates in force | NA |

| 195A | Income payable “net of tax” @ the rates in force | NA |

| 196 | Interest or dividend or other sums payable to Govt., RBI or certain corporations. @ Nil | NA |

| 196 A | Income in respect of units of nonresidents. @20% | NA |

| 196 B | Income from units. @ 10% | NA |

| 196 C | Income from foreign bonds or shares of Indian company. @ 10% | NA |

| 196 D | Income of Foreign Institutional Investors from securities. @ 20% | NA |

Changes by Finance Act 2020

Amendment of Section 194 whereby TDS will now be deducted on complete dividend, as dividend distribution tax (DDT) has been abolished and dividend will now be taxed in the hands of shareholders/unit holders.

Amendment of Section 194J, whereby TDS Rate on Technical services to be reduced to 2% from current 10%.

Introduction of Section 194 O where by TDS to be deducted by E-Commerce operator for sale of goods or provision of service facilitated by it through its digital or electronic facility or platform.

Introduction of Section 194K where by person responsible for paying to a resident any income in respect of units of a Mutual Fund would deduct TDS.

You may Also Refer: TDS Rate Chart for FY 2020-21 or TDS Rates for AY 2021-22

A person is liable to get its accounts audited u/s 44AB if during the relevant financial year its gross sales, turnover or gross receipts exceeds Rs. 1 Crore applicable form A.y 2013-14 (Rs.60 lacs for A.Y.2012-13) in case of a business, or Rs. 50 lacs from Assessment year 2017-18 (Rs. 25 lacs from A.Y. 2013-2014 to 2016-17) in case of a profession.

Finance Act 2020 (Applicable for AY 2020-21)

The Tax Audit Threshold has been increased to 5 Crores, from existing 1 Crore for person carrying bussiness. This facility comes with 2 conditions:

♦ Cash reciepts is not more than 5% of aggregate cash reciepts;

♦ Cash Payment is not more than 5% of aggregate cash payments.

Persons who are liable to deduct TDS as per above stated conditions must apply for allotment of TAX DEDUCTION AND COLLECTION ACCOUNT NUMBER (TAN) in form No. 49B within one month from the end of the month in which tax was deducted. TAN is mandatory to mention on all transaction related to TDS like TDS certificate, TDS Returns and other related documents. There is penalty of Rs. 10,000 on failure to apply TAN.

You May Also Refer: How to apply for TAN

There are also some conditions where is no liability of deductor to deduct TDS. They are as follows:

1.) On declaration furnished by payee on Form 15G or 15H as the case may be

2.) On certificate issued by ITO

3.) Payment to Government/RBI/Statutory Corporation etc.

4.) Exempt Incomes

5.) Interest Payment by Offshore Banking Unites

6.) Payment to New Pension System Trust

7.) Notified payment to Notified Institutions/Associations

| Taxpayer | Date of Deposit |

| Is office of the Govt. and tax is paid without production of income tax challan. | On the same day on which tax is deducted |

| Is office of the Govt. and tax is paid with production of income tax challan. | On or before 7 days from the end of month in which tax is deducted |

| Tax is deducted by a person other than office of Government | On or before 7 days from the end of month in which tax is deductedIncome paid or credited in the month of March: Tax should be deposited by April 30. |

| Tax is deducted by a person other than office of Govt. and The AO has permitted quarterly deposit of tax deducted u/s 192, 194A, 194D and 194H | Tax Quarter ending:June 30: By July 7 September 30: By October 7 December 31: By January 7 March 31: By April 30. |

| Tax is deducted by a person u/s 194-IA (Challan – 26QB)Tax is deducted u/s 194-IB (Challan- 26QC) | Within 30 days from the last date of month in which tax is deducted |

| Situation | Form |

| Tax deduction from Salary under section 192 | In form No. 24Q |

| Tax deduction when deductees are non-resident, foreign company, and persons who are resident but not ordinarily resident | In form No. 27Q |

| Tax deduction under section 194-IA | In form no. 26QB |

| Tax deduction under section 194-IB | In form no. 26QC |

| Tax deduction in any other case | In form no. 26QC |

| Quarter ending | Due date of TDS Return |

| Jun-30 | Jul-31 |

| Sep-30 | Oct-31 |

| Dec-31 | Jan-31 |

| Mar-31 | May-31 |

| Default | Penalty |

| Failure to deduct and pay tax deducted at source under section 192 to 196C [Sec 201(1A)] | Tax with interest shall be payable @ 1% from the date on which actually deductible and to the date on which actually deducted. |

| @ 1.5% from the date on which tax was actually deducted and to the date on which tax is actually paid. | |

| Failure in furnish TDS return within stipulated time [U/S 234E] | Rs. 200 per day and shall not exceed the amount of tax deducted |

| Penalty for failure to furnish quarterly TDS return [271H] | Rs. 10000/- to Rs. 100000/- |

U/S 40(a)(i):- 100% expenditure shall be not allowed to deduct from income chargeable under the “profits and gains from business or profession”, if any assessee fail to deduct tax at source or fail to deposit TDS deducted from interest, royalty, fee for technical services payable outside India, or in India to a non-resident, not being a company or a foreign company.

U/S 40(a)(ia):- 30% expenditure shall be not allowed to deduct from income chargeable under the “profits and gains from business or profession”, if any assessee fail to deduct tax at source or fail to deposit TDS deducted to a resident

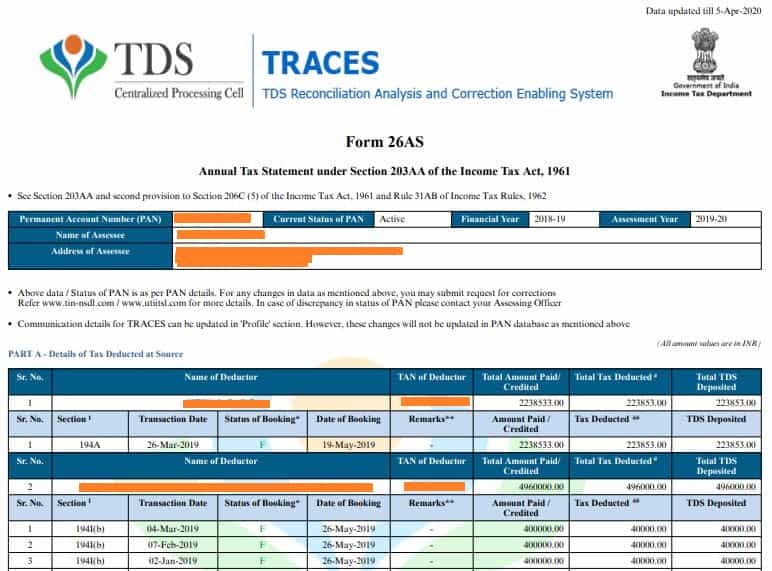

TDS Credit is linked with Form 26AS. Since TDS is deducted with PAN of Deductor. TDS is deducted on the basis of PAN of Deductor. If TDS is deducted it should be reflected in your form 26AS. If TDS is not reflected in form 26AS, this means that TDS return is not properly filed or TDS has not been deposited to government tresurary.

You May Also Refer: How to view & download form 26AS

Who is liable to deduct Tax at Source

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"