PRATEEK MAURYA | May 28, 2024 |

$1382 CPP Increase in May 2024: Check Eligibility, Deposit Dates and Important Information

The Canada Revenue Agency (CRA) pays eligible beneficiaries enrolled in the Canada Pension Plan monthly CPP payments. The payment has been increased to $1382 and will be given to these beneficiaries by the end of May 2024, through their bank accounts. For Canadian residents who are in receipt of CPP benefits, this article is a resource for them on the $1382 CPP increase, which includes qualifications, how to capture this extra income and the date it will be distributed.

Canadians have commonly contributed some part of their monthly earning to a retirement savings plan called Canada Pension Plan (CPP). This investment eventually comes back as a government pension paid every month and helps provide basic financial support for elderly people such as medical bills, housing rentals/groceries.

May 2024 $1382 CPP Increase Payment

The government is raising the Canada Pension Plan (CPP) payment by $1,382 in May 2024 to cater for the needs of senior citizens. This is caused by the current increase in the cost of living and inflation.

According to financial statements, inflation has been on an upward trajectory since COVID-19 struck. While many people can manage their expenses and income streams, seniors have difficulties in finding alternative sources of income because of disabilities as well as health related problems and thus need help from the state.

CPP Increase Payment Eligibility 2024

To qualify for this increased CPP payment in 2024 make sure you meet these requirements:

Citizenship: Only Canadian citizens are eligible for CPP benefits.

Age: Any Canadian citizen over 19 years old can contribute to the CPP.

Contributions: Self-employed individuals must pay all of it themselves while employees have to pay half each with their employers covering the other half respectively.

Retirement Age: You can start receiving CPP at 65. You can take it early at age 60 (though lesser in value) or postpone it until after your sixty-fifth birthday (in which case you would be entitled to a higher sum).

Tax Compliance: The taxes required for this accounting year should all have been paid.

Latest News on the $1382 CPP Increase Payment

There are online rumors regarding the $1382 increase but no official statement has been made yet. The financial analysts have however advised the government to either make a one-time payment or increase monthly pensions. We will notify you as soon as the Canada Revenue Agency (CRA) confirms any changes.

$1382 CPP Increase Payment Release Date: May 2024

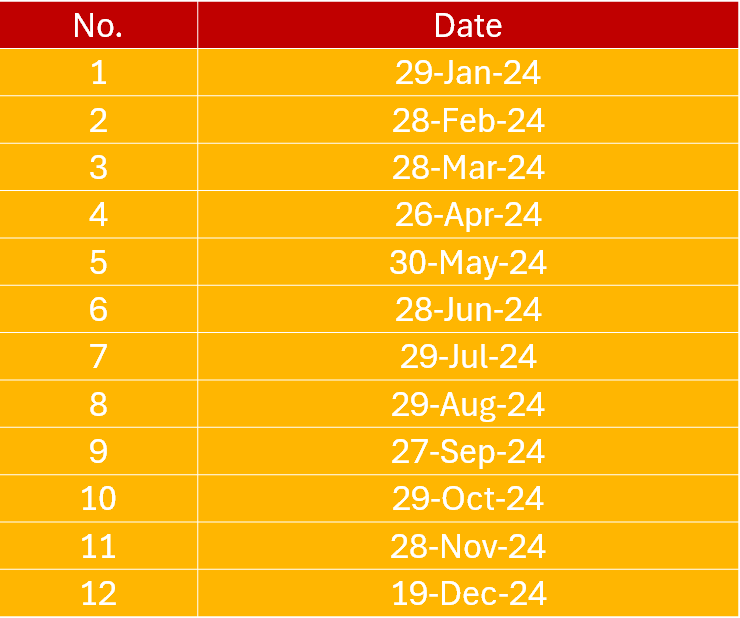

This last week of May 2024 the CRA is scheduled to pay out CPP payments. Here’s the 2024 payment schedule:

On May 30, 2024, beneficiaries will be paid their May payment. The next payment will be released on June 28, 2024, and will be subject to what is given above.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"