Reetu | Jul 4, 2023 |

2 Paper Exempt for CA Inter Exam? Know the whole issue

The Institute of Chartered Accountants of India (ICAI) has issued Clarification regarding CA Intermediate Examination. ICAI clarifies that those who have passed in Group 1 of Intermediate will not be required to give Paper – 4 of Group 2 in New Scheme.

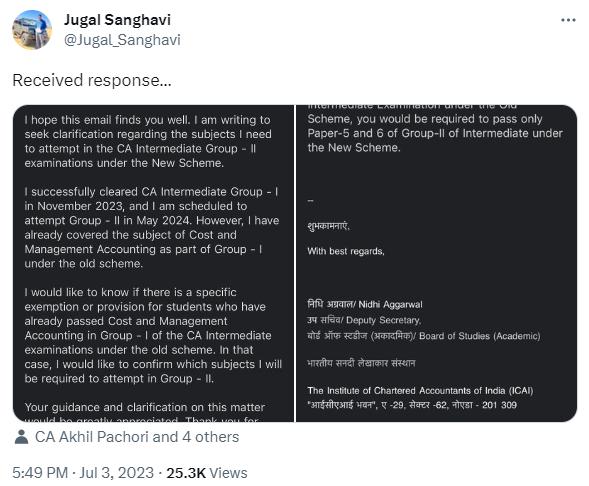

One of the CA aspirant writes to ICAI seeking the clarification on the confusion she is having for her CA Inter Examination. She successfully cleared CA Intermediate Group – I in November 2023, and scheduled to attempt Group – II in May 2024. However, she has already covered the subject of Cost and Management Accounting as part of Group – I under the old scheme.

She would like to know if there is a specific exemption or provision for students who have already passed Cost and Management Accounting in Group – I of the CA Intermediate examinations under the old scheme. In that case, she would like to confirm which subjects she will be required to attempt in Group – II.

By replying to her mail, ICAI writes, “If you have already passed Group-l of Intermediate Examination under the Old Scheme, you would be required to pass only Paper-5 and 6 of Group-II of Intermediate under the New Scheme.”

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"