Anshumaan Das | Jul 2, 2024 |

7 Years of GST: GST brought Relief to Households with Price Reduction; says FinMin

The Goods and Services Tax (GST), after seven years of its rollout, made home commodities cheaper, enhanced the tax organizability of businesses and extended the tax net, according to the finance ministry.

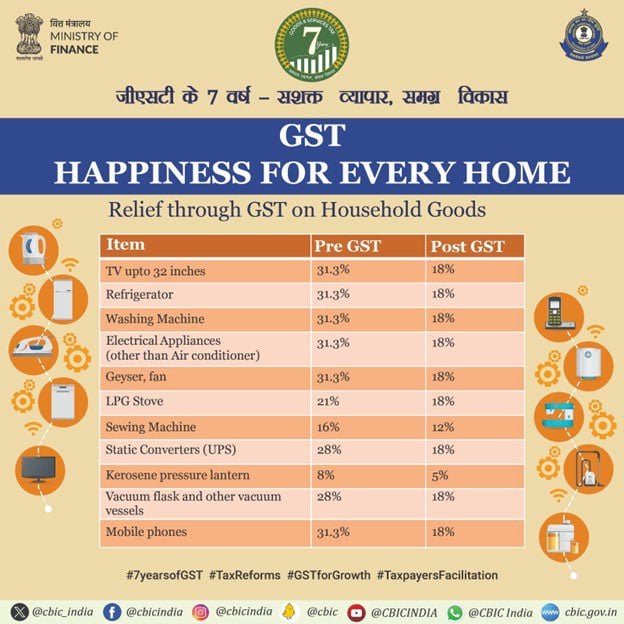

“With lower taxes post-GST on household items, 7yearsofGST has brought smiles and sighs of relief to every home through affordable prices on home appliances and mobile phones,” the Department of Revenue said in a series of tweets on the platform X.

The finance ministry stated that the GST taxpayer base is now higher and will stand at 1.46 crore in April 2024 from 1.05 crore in April 2018.

Hence, one has seen a quantum jump in the base of taxpayers, let alone the enhancement in the level of compliance, said the Central Board of Indirect Taxes and Customs (CBIC) Chairman Sanjay Kumar Agarwal.

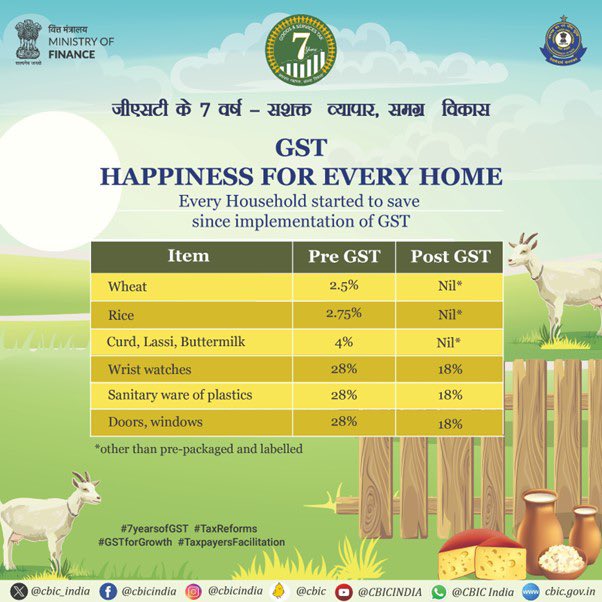

For instance, the ministry said that the inflation rate of unpacked wheat, rice, curd and lassi, which were in the range of 2.5%-4% before the introduction of GST, is now zero after the introduction of GST.

The ministry pointed out that there was a cut in expenditure on many items of popular consumption after GST implementation, such as cosmetics, wristwatches, furniture and mattresses, all of which attract a lower tax on the implementation of GST than before.

Any electrically operated devices that gained the most popularity among all the products, and constituted 31.3% taxes in the era before GST, are now in the 18% GST band in the regime of GST.

The finance ministry also revealed that GST has also made it easier in terms of compliance costs for small taxpayers, they will not need to file the annual return if their turnover is less than Rs.2 crore in the FY 2023-24.

According to the opinion of analysts, more carefully afterwards, it is possible to speak about further rationalizing rates of GST, the elimination of restrictions on ITC and the subsequent implementation of specific sectoral changes that will establish a new stage of GST reform. The enhanced positive sentiment in industry and the sustained uptick in GST collections laid today, on the 7th anniversary of GST in India, make it appropriate for the nation to look forward to the futuristic reforms envisaged under GST 2.0.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"