Deepak Gupta | Oct 17, 2021 |

GSTN Advisory for FY 2020-21 Input Tax Credit

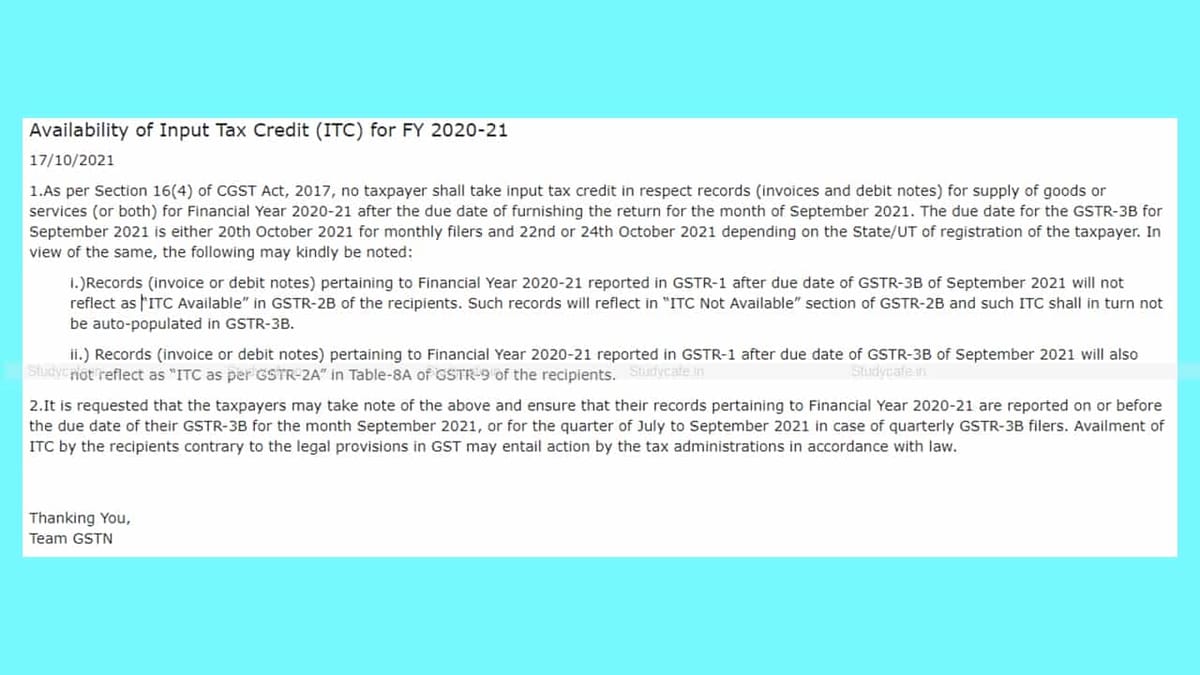

According to Section 16(4) of the CGST Act, 2017, no taxpayer may claim an input tax credit for records (invoices and debit notes) relating to the supply of goods or services (or both) for the Financial year 2020-21 after the due date for filing the return for the month of September 2021. The GSTR-3B for September 2021 is due on the 20th of October 2021 for monthly filers and on the 22nd or 24th of October 2021 for non-monthly filers, depending on the taxpayer’s registration state/UT. In light of this, please take note of the following:

i.) Records (invoices or debit notes) pertaining to Financial Year 2020-21 reported in GSTR-1 after the due date of GSTR-3B of September 2021 will not appear as “ITC Available” in the recipients’ GSTR-2B. Such records will be reflected in the GSTR-2B “ITC Not Available” section, and such ITC will not be auto-populated in GSTR-3B.

ii.) Records (invoice or debit notes) pertaining to Financial Year 2020-21 reported in GSTR-1 after the due date of GSTR-3B of September 2021 will also not reflect as “ITC as per GSTR-2A” in Table-8A of GSTR-9 of the recipients.

It is requested that the taxpayers may take note of the above and ensure that their records pertaining to Financial Year 2020-21 are reported on or before the due date of their GSTR-3B for the month September 2021, or for the quarter of July to September 2021 in case of quarterly GSTR-3B filers. Availment of ITC by the recipients contrary to the legal provisions in GST may entail action by the tax administrations in accordance with the law.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"