Reetu | Nov 23, 2021 |

Exemption U/S Section 54, 54EC & 54F

CAPITAL GAIN: It is the profit earned on sale of assets like stocks, bonds or real estate.

This benefit is only available for individual or HUF. Taxpayer like companies, firms, LLPs are not eligible for such benefit.

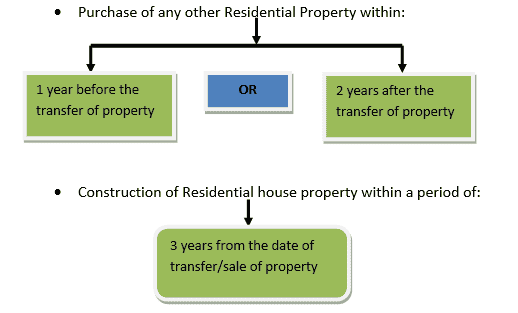

An individual or HUF selling a residential property (whether self-occupied or rent) and arising any Long-Term capital gain is eligible for tax exemptions if such capital gain is invested in:

CONDITIONS THAT MUST BE SATISFIED TO AVAIL THE BENEFIT OF EXEMPTIONS ARE AS FOLLOWS

As per Section 54 of Income Tax Act, 1961 the amount of exemption will be lower of:

Hence the balance capital gain will be taxable.

If the house property on which benefit was claimed earlier is sold within 3 years from the date of purchase or construction, then the exemption claimed earlier under section 54 shall be indirectly taxable in the year of sale of new house property.

As per Section 54EC of Income Tax Act, 1961 capital gains are exempt from tax, if gain or a part of gain is invested in any bond redeemable after five years and issued by National Highways Authority of India (NHAI) or by Rural Electrification Corporation Limited or any other bond notified by central government within a period of 6 months from the date of transfer.

The asset being transferred is either land or building or a combination of both.

The gain arising from sale of asset must Long Term Capital Gain.

The amount of Capital gain or part of gain invested in specified long term capital asset. Subject to a maximum limit of 50 lakhs.

If the long term specified asset is transferred or converted into money at any time within a period of 3 years from the date of its acquisition, the amount of capital gain exempt u/s 54EC, shall be deemed to be long term capital gain of the previous year in which the long term specified asset is transferred or converted into money.

As per Section 54F of income tax act exemption on Capital gain is available on sale of any long term capital asset other than house property and invested in purchase/construction of house property.

Exemption = Cost of new asset x Capital Gains / Net Consideration

Maximum Exemption is up to Capital Gains.

lock-in period of 3 years is applicable when exemption u/s 54F of the income tax act is claimed.

The Article has been written by Roshni Proveen <roshniproveen@gmail.com>

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"