Sushmita Goswami | Feb 10, 2022 |

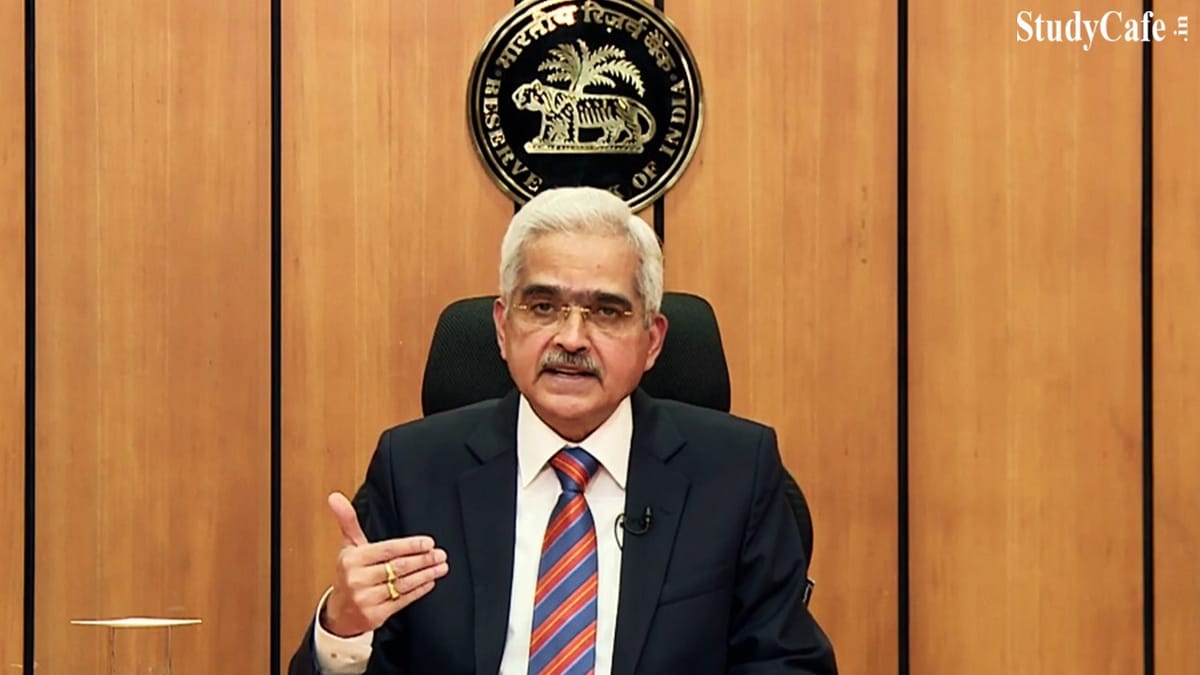

RBI Governor Shaktikanta Das Speech on MPC Policy

The Monetary Policy Committee’s mandate was revealed by RBI Governor Shaktikanta Das on Thursday (MPC). The central bank anticipated 7.8% GDP growth in FY23, 5.3 percent retail inflation in FY22, and kept interest rates constant in the policy.

On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (February 10, 2022) decided to:

The reverse repo rate under the LAF remains unchanged at 3.35 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 4.25 per cent.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth.

The main considerations underlying the decision are set out in the statement below:

2. Since the MPC’s meeting in December 2021, the rapid spread of the highly transmissible Omicron variant and the associated restrictions have dampened global economic activity. The global composite purchasing managers’ index (PMI) slipped to an 18 month low of 51.4 in January 2022, with weakness in both services and manufacturing. World merchandise trade continues to grow. There are, however, headwinds emanating from persistent container and labour shortages, and elevated freight rates. In its January 2022 update of the World Economic Outlook, the International Monetary Fund (IMF) revised global output and trade growth projections for 2022 downward to 4.4 per cent and 6.0 per cent from its earlier forecasts of 4.9 per cent and 6.7 per cent, respectively.

3. After reversing the transient correction that had occurred towards end-November, commodity prices resumed hardening and accentuated inflationary pressures. With several central banks focused on policy normalization, including ending asset purchases and earlier than expected hikes in policy rates, financial markets have turned volatile. Sovereign bond yields firmed up across maturities and equity markets entered correction territory. Currency markets in emerging market economies (EMEs) have exhibited two-way movements in recent weeks, driven by strong capital outflows from equities with elevated uncertainty on the pace and quantum of US rate hikes. The latter also led to an increasing and volatile movement in US bond yields.

4. The first advance estimates (FAE) of national income released by the National Statistical Office (NSO) on January 7, 2022 placed India’s real gross domestic product (GDP) growth at 9.2 per cent for 2021-22, surpassing its pre-pandemic (2019-20) level. All major components of GDP exceeded their 2019-20 levels, barring private consumption. In its January 31 release, the NSO revised real GDP growth for 2020-21 to (-) 6.6 per cent from the provisional estimates of (-) 7.3 per cent.

5. Available high frequency indicators suggest some weakening of demand in January 2022 reflecting the drag on contact-intensive services from the fast spread of the Omicron variant in the country. Rural demand indicators – two-wheeler and tractor sales – contracted in December-January. Area sown under Rabi up to February 4, 2022 was higher by 1.5 per cent over the previous year. Amongst the urban demand indicators, consumer durables and passenger vehicle sales contracted in November-December on account of supply constraints while domestic air traffic weakened in January under the impact of Omicron. Investment activity displayed a mixed picture – while import of capital goods increased in December, production of capital goods declined on a year-on-year (y-o-y) basis in November. Merchandise exports remained buoyant for the eleventh successive month in January 2022; non-oil non-gold imports also continued to expand on the back of domestic demand.

To Read Detailed Press Release Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"