Sushmita Goswami | Feb 18, 2022 |

Employees Provident Fund (EPF) Contribution Rate 2020-2021

In 1952, the Ministry of Labor and Employment established the Employee’s Provident Fund. Since its inception, the ministry has been actively administering and executing this fund to encourage working professionals in the country to save. The goal of putting this programme in place was to offer employees with social security and a secure future as a reward for their hard work and devotion to the companies. The Employees’ Provident Funds Act established EPF as a mandatory contribute fund for all working professionals.

Both the employer and the employee are required to contribute 12% of the employee’s dearness allowance and basic salary to the employee’s EPF account every month under the EPF plan. According to the law, any company with 20 or more employees is required to join the Employees’ Fund Provident Organization. Furthermore, each employee can only have one EPF account.

Because the EPF scheme’s goal is to help employees financially, EPFO permits all employees to take a portion of their EPF after a year of service in the event of an emergency. Furthermore, the funds accumulated in the employee’s EPF are compounded at an annual rate of 8.5 percent.

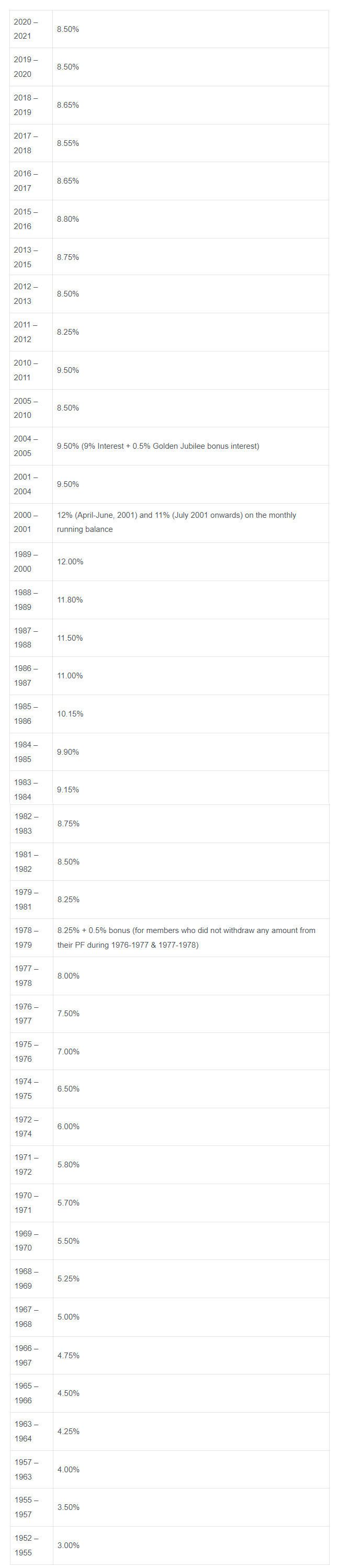

Every year, the Government of India sets/revises this interest rate. Continue reading this blog to learn more about the 2020-2021 EPF contribution rate.

Every year, the EPFO examines the interest rate on the money received in employees’ EPF accounts. At the end of each financial year, the EPFO Central Board of Trustees and the Ministry of Finance meet to debate the interest rate.

For the financial year 2021, the EPF contribution rate is 8.5 percent. A list of interest rates from prior years is provided below.

What is the EPF contribution amount?

EPF contributions are made in two instalments, once a month.

Employer contribution– The employer contributes a total of 12% of the employee’s dearness allowance and base wage to the following:

The Employees’ Pension Scheme receives 8.33% of the total (EPS) 3.67 percent to the Provident Fund for Employees (EPF) Employees’ Deposit Linked Insurance receives 0.50 percent of the total (EDLI)

Aside from that, on June 1, 2018, the employer must pay an additional 0.50 percent charge for administrative accounts. If an employer fails to contribute for a month, he or she must pay a charge of Rs. 75 for that month; however, the administrative charge must be at least Rs. 500.

Employee contribution– The employee contributes 12% of his or her dearness allowance and basic salary to his or her personal EPF account. If the employee works for a company with fewer than 20 employees or in industries such as jute, beedi, brick, coir, or guar gum factories, he or she will contribute 10% to his or her EPF account.

It’s worth noting that, even though EPF interest is calculated monthly, it’s transferred into the employee’s EPF account once a year. With the help of an example, let’s look at how interest is calculated on EPF.

Assume Mr. X receives a monthly salary of Rs. 15,000 (base salary + Dearness allowance).

Now-

Employee’s contribution towards his EPF account will be Rs. 1800 (12% of 15,000)

Employer’s contribution towards EPS would be Rs. 1250 (8.33% of 15,000)

Employer’s contribution towards EPF would be Rs. 550 *3.67% of 15,000)

Total monthly contribution towards EPF = Rs. 2,350 (Rs. 1800 + Rs. 550)

Considering the current EPF contribution rate to be 8.5%, the monthly interest on EPF would be-

8.5% of 2,350 (8.5% of monthly EPF contribution) = 0.7083%

Assuming the employee began working for the company on April 1, 2019, his contributions to his EPF account will be calculated for the financial year 2019–2020.

In the month of April, the total EPF contribution was Rs. 2,350. For the month of April, there was no interest on EPF (since no interest is offered on the first month of contribution to EPF) End-of-April EPF account balance – Rs. 2,350 For the month of May (next month), the total EPF contribution is Rs. 4700 (2350 + 2350). For the month of May, the interest on the EPF contribution was Rs. 33.39. (0.7083 percent of 4700) It should be noted that, while EPF interest will be calculated monthly, it will not be deposited until the conclusion of the financial year.

To calculate the interest on your EPF, you’ll need the following information.

Current age of the employee EPF balance at the moment A monthly salary of Rs. 15,000 plus a maximum of Rs. 15,000 in dearness allowance Percentage of EPF contributions The retirement age of an employee

Every financial year, the EPFO and the Ministry of Finance determine the EPF contribution rate. It should be noted that, while EPF interest is calculated monthly, the entire interest is deposited to the employee’s EPF account at the conclusion of each financial year. The monthly interest rate would be estimated as 0.708 percent if the interest rate for the financial year 2019-2020 is 8.5 percent.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"