Deepak Gupta | Feb 23, 2022 |

GSTN Updates: Upcoming GSTR-1 enhancements & improvements

This Article contains upcoming updates being bought by Goods & Service Tax Network (GSTN) in Form GSTR-1 and Invoice Furnishing Facility (IFF).

All typical taxpayers are required to file FORM GSTR-1, a statement of external supplies, on a monthly or quarterly basis, depending on the circumstances. Quarterly GSTR-1 filers now have the option of using the Invoice Furnishing Facility (IFF) to report outward supplies to registered individuals (B2B supplies) in the first two months of the quarter. GSTR-1/IFF has undergone continuous updates and technology changes to improve its performance and user experience, resulting in improvements in the Summary Generation process, faster response times, and a better user experience for taxpayers.

In November 2021, the prior phase of GSTR-1/IFF improvement was released on the GST Portal. During that time, new features such as a redesigned dashboard, better B2B tables, and information on the number of table/tile documents were made available. In addition, the next phase of the GSTR-1/IFF upgrades will be introduced on the Portal in the near future.

Return Dashboard > Selection of Period > Details of outward supplies of goods or services GSTR-1 > Prepare Online

The following changes are being done in this phase of the GSTR-1/IFF enhancements:

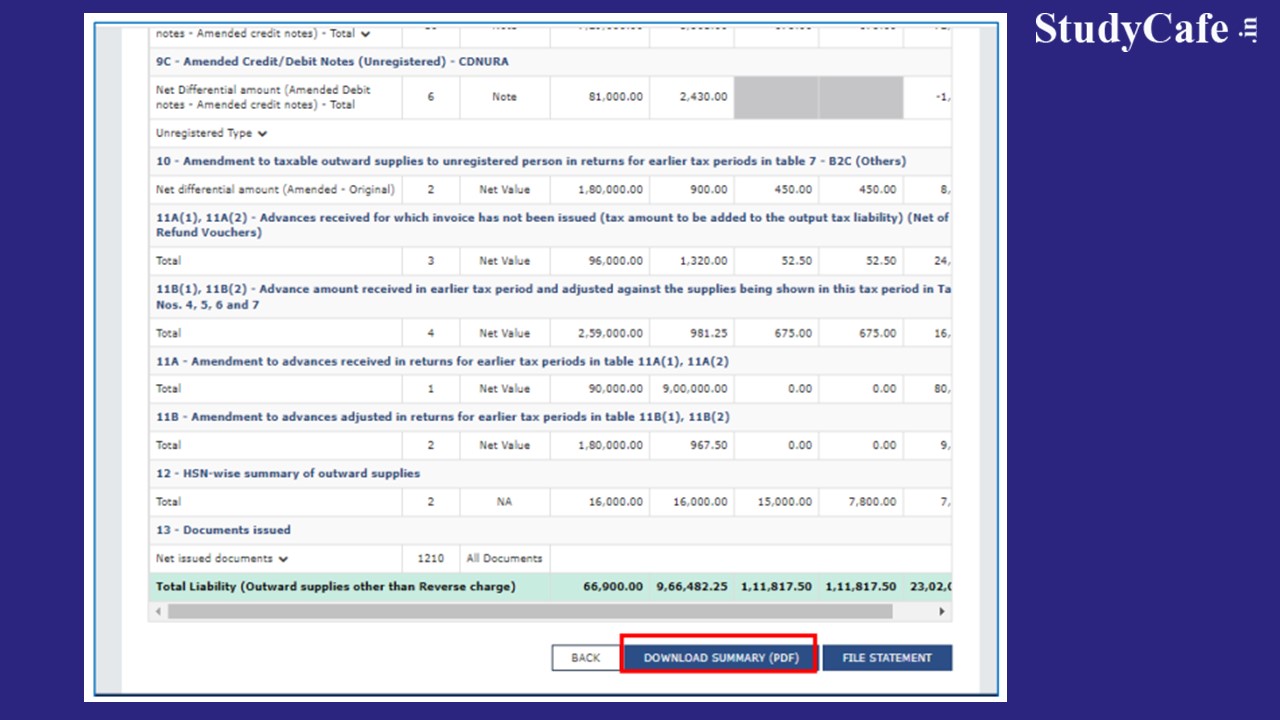

Before filing, the ‘Submit’ button should be removed. The current two-step GSTR-1/IFF filing method, which includes the ‘Submit’ and ‘File’ buttons, will be replaced by a single-step filing process. The new ‘File Statement’ button will replace the current two-step filing method, allowing taxpayers to add or change records until the filing is complete simply hitting the ‘File Statement’ button.

Consolidated Summary: Before submitting GSTR-1/IFF, taxpayers will now be presented a table-by-table consolidated summary. This aggregated summary will include a complete and table-by-table summary of the taxpayers’ records. Before filing, this will provide a thorough picture of the records added in GSTR-1/IFF.

Receiver-by-recipient summary: The consolidated summary page will also include a recipient-by-recipient summary, which will include the total value of the supplies as well as the total tax associated with such goods for each recipient. The recipient-by-recipient summary will be made available for the following GSTR-1/ IFF tables that have counter-party recipients:

– Table 4A: B2B supplies

– Table 4B: Reverse charge attracting supplies

– Table 6B: Supplies in Special Economic Zones

– Table 6C: Deemed Exports

– Table 9B: Credit/Debit Notes

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"