Reetu | Mar 8, 2022 |

DGFT Extends Last Date for Submission of Applications under certain Scrip based FTP Schemes

The Directorate General of Foreign Trade (DGFT) extends last date for submission of applications under certain Scrip based FTP Schemes vide Notification No : 58 /2015-2020 Dated 7th March 2022.

The Notification is Given Below:

S.O.(E): In exercise of the powers conferred by Section 5 of the Foreign Trade (Development and Regulation) Act, 1992 read with Para 1.02 of the Foreign Trade Policy, 2015-20, the Central Government hereby makes the following amendments in the Foreign Trade Policy 2015-20 , as notified vide Notification no. 30 dated 01.09.2020 and Notification no. 53 dated O 1.02.2022 with immediate effect, as below:

1. Amendment in Para 3.04 A of FTP 2015-20, as notified vide Notification No. 30 dated 01.09.2020:

The total reward which may be granted to an IEC holder under the Merchandise Exports from India Scheme (MEIS) shall not exceed Rs.2 Crore per IEC on exports made m the period 01.09.2020 to 31.12.2020 [period based on Let Export Order (LEO) date of shipping bill(s)]. Any IEC holder who has not made any export with LEO date during the period 01.09.2019 to 31.08.2020 or any new IEC obtained on or after 01.09.2020 would not be eligible for submitting any claim for benefits under MEIS for exports made with effect from 01.09.2020. The aforesaid ceiling may be subject to further downward revision to ensure that the total claim under the Scheme for the period (01.09.2020 to 31.12.2020) does not exceed the allocation prescribed by the Government, which is Rs 5,000 Cr.

The total reward which may be granted to an IEC holder under the Merchandise Exports from India Scheme (MEIS) shall not exceed Rs.2 Crore per IEC on exports made in the period 01.09.2020 to 31.12.2020 [period based on Let Export Order (LEO) date of shipping bill(s)]. Any IEC holder who has not made any export with LEO date during the period 01.09.2019 to 31.08.2020 or any new IEC obtained on or after 01.09.2020 would not be eligible for submitting any claim for benefits under MEIS for exports made with effect from 01.09.2020.

2. Amendment in Para 3.13A of FTP 2015-20:

In supersession of the existing laid down provisions in the Hand Book of Procedures, 2015-20 with regard to last date for submitting online applications for scrip based claims, the last date for submitting online applications stands revised to 28th February 2022 the following schemes i.e.

i. for MEIS (for exports made in the period (s) 01.07.2018 to 31.03.2019, 01.04.2019 to 31.03.2020 and 01.04.2020 to 31.12.2020),

ii. for SEIS (for service exports rendered for FY 18-19 and FY 2019-20),

iii. for 2 % additional ad hoc incentive (under para 3.25 of the FTP – for exports made m the period 01.01.2020 to 31.03.2020 only)

iv. for ROSCTL (for exports made from 07.03.2019 to 31.12.2020) and

v. for ROSL (for exports made upto 06.03.2019 for which claims have not yet been disbursed under scrip mechanism).

After 28.02.2022, no further applications would be allowed to be submitted and they would become time-barred. Late cut provisions shall also not be available for submitting claims at a later date.

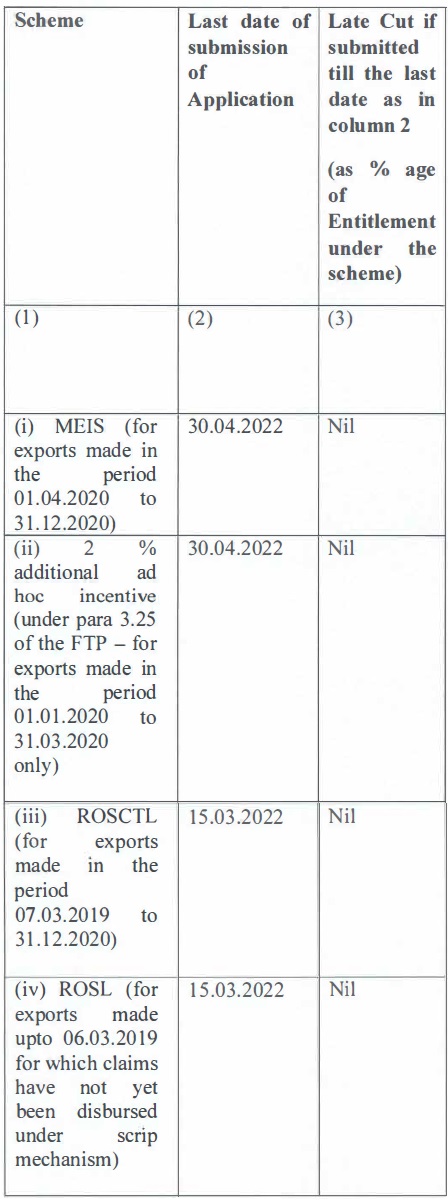

With effect from 07.03.2022, the last date for submission of online applications for certain scrip based Schemes and applicable late cut on such applications would be:

No further applications would be allowed to be submitted after the prescribed last date (as above) as they would become time-barred. Late cut provisions shall also not be available for submitting claims thereafter.

Effect of this Notification: The last date for submitting applications under MEIS (for exports made in the period – 01.04.2020 to 31.12.2020), ROSCTL, ROSL and 2% additional ad hoc incentive (under para 3.25 of FTP, only for exports made in the period 01.01.2020 to 31.03.2020) has been extended . The provisions as notified vide Notification No. 30 dated 01.09.2020 with regard to allocation of Rs 5,000 Cr. stand omitted.

For Official Notification Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"