Sushmita Goswami | Mar 17, 2022 |

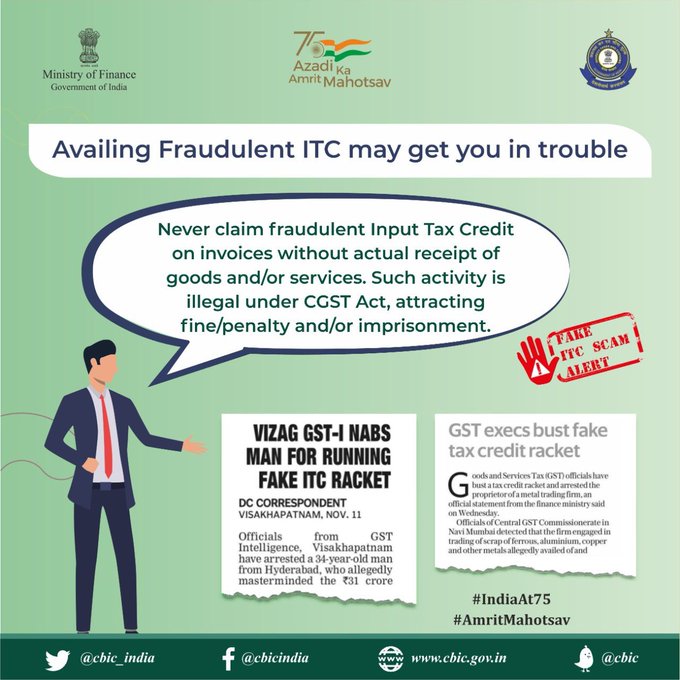

Attention! Availing Fraudulent ITC May Get You in Trouble

Never claim fraudulent Input Tax Credit on invoices without actual receipt of goods and/or services. Such activity is illegal under CGST Act, attracting fine/penalty and/or imprisonment.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"