Deepak Gupta | Apr 14, 2022 |

GST Number Cancelled: Gujarat HC warns GST Department for contempt of Court, Rebukes GST Officer for issuing Vague GST Order

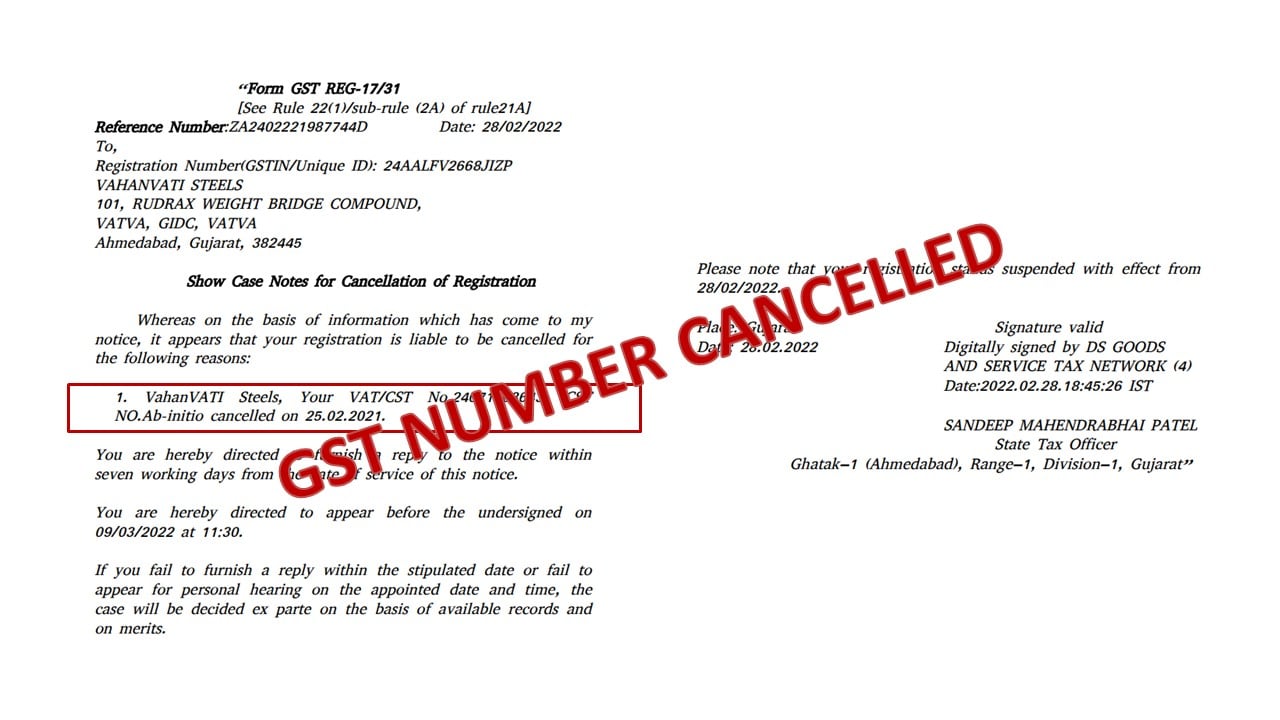

In this matter, a very Vague Show Cause Notice (SCN) was issued by GST Officer for the Cancellation of the GST (Goods & Service Tax) Number. The Notice is given below for reference:

As per the Court “The show-cause notice is bereft on any material particulars or information. In the absence of any material particulars and the details, it is difficult for any individual to respond to such a vague show-cause notice. Probably what the Authority is trying to convey is that earlier VAT/CST registration in case of writ applicant has been canceled ab initio and therefore, the registration is not valid and not recognized in law. If such are the allegations, it is expected of the Authority to furnish some details in this regard.”

In accordance with the order passed by the Court as above, it was expected of the GST Department to issue a fresh show-cause notice containing all the necessary information and material particulars to enable the writ-applicant to meet with the same.

However, the GST Officer proceeded to pass an order cancelling the registration.

Once Again an Absurd Order was passed by GST Officer. Same is given below for referance:

GSTN Cancellation: Gujarat HC warns GST Department for contempt of Court, Rebukes GST Officer for issuing Vague GST Order

12. Mr. Nanavati, the learned counsel appearing for the writ applicant very emphatically submitted that this a fit case, in which the respondent no.2 should be proceeded for contempt of court. He pressed very hard for issue of notice to the respondent no.2 for contempt. Mr. Nanavati is fully justified in making such a submission. However, we are not issuing any notice for contempt today with a warning to the respondent no.2 that henceforth if this court comes across any such vague order or show-cause notice duly signed by him, then that will be his last day in the office.

13. There is nothing which we can say anything further in this matter. The order dated 29.03.2022 cancelling the registration of the writ-applicant is hereby quashed and set aside. The so-called order dated 05.04.2022, Annexure-P/4, Page-18 is also hereby quashed and set aside.

14. With the aforesaid, the GST registration of the writ-applicant stands restored forthwith.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"