CA Pratibha Goyal | Apr 29, 2022 |

Arrest of Chartered Accountant: ICAI Requests Standard operating procedure to be followed on Arrest of CA

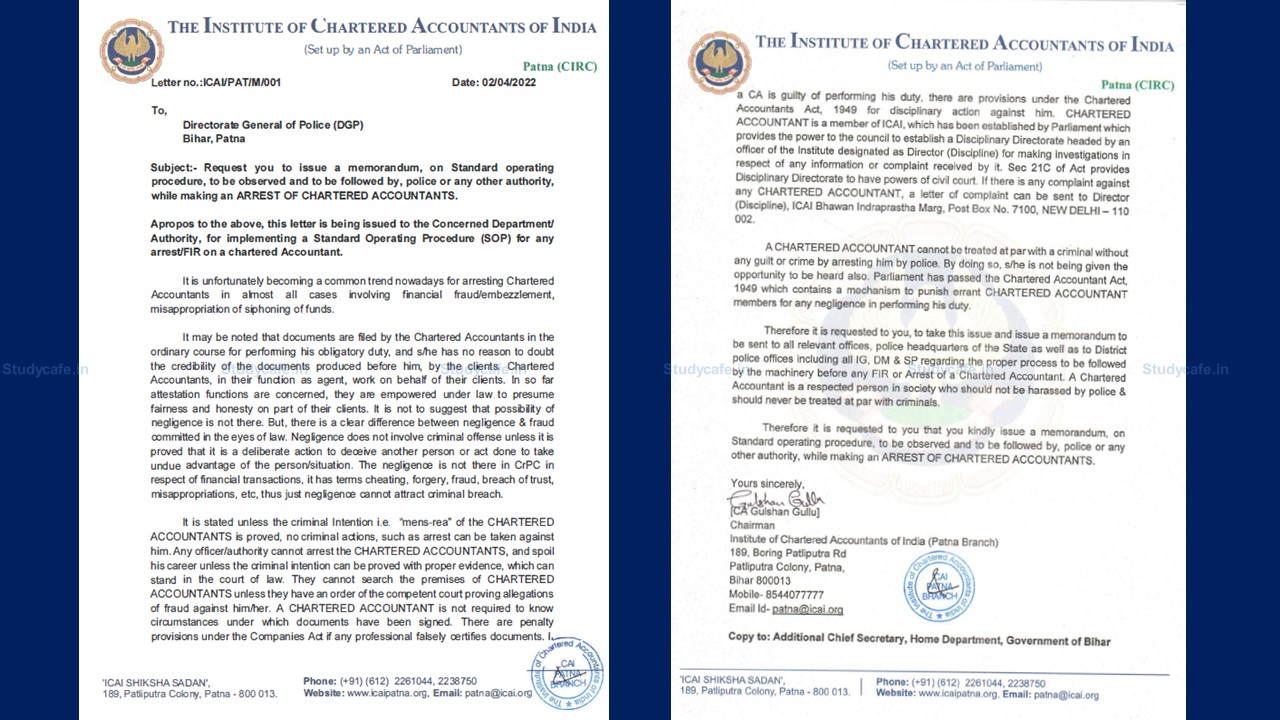

The Institute of Chartered Accountants of India (The ICAI) Patna has Requested the Directorate General of Police (DGP) to issue a memorandum, on Standard operating procedures, to be observed and to be followed by, police or any other authority, while making an “ARREST OF CHARTERED ACCOUNTANTS”.

It is, unfortunately, becoming a common trend nowadays for arresting Chartered Accountants in almost all cases involving financial fraud/embezzlement, misappropriation of siphoning of funds.

It may be noted that documents are filed by the Chartered Accountants in the ordinary course for performing his obligatory duty, and s/he has no reason to doubt the credibility of the documents produced before him, by the clients. Chartered Accountants, in their function as agent, work on behalf of their clients. In so far attestation functions are concerned, they are empowered under law. to presume fairness and honesty on part of their clients. It is not to suggest that possibility of negligence is not there. But, there is a clear difference between negligence & fraud committed in the eyes of law. Negligence does not involve criminal offense unless it is proved that it is a deliberate action to deceive another person or act done to take undue advantage of the person/situation. The negligence is not there in CrPC in respect of financial transactions, it has terms cheating, forgery, fraud, breach of trust, misappropriations, etc, thus just negligence cannot attract criminal breach.

It is stated unless the criminal Intention i.e. “mens-rea” of the CHARTERED ACCOUNTANTS is proved, no criminal actions, such as arrest can be taken against him. Any officer/authority cannot arrest the CHARTERED ACCOUNTANTS, and spoil his career unless the criminal intention can be proved with proper evidence, which can stand in the court of law. They cannot search the premises of CHARTERED ACCOUNTANTS unless they have an order of the competent court proving allegations of fraud against him/her. A CHARTERED ACCOUNTANT is not required to know circumstances under which documents have been signed. There are penalty provisions under the Companies Act if any professional falsely certifies documents.

If a CA is guilty of performing his duty, there are provisions under the Chartered Accountants Act, 1949 for disciplinary action against him. CHARTERED ACCOUNTANT is a member of ICAI, which has been established by Parliament which provides the power to the council to establish a Disciplinary Directorate headed by an· officer of the Institute designated as Director (Discipline) for making investigations in respect of any information or complaint received by it. Sec 21C of Act provides Disciplinary Directorate to have powers of civil court. If there is any complaint against any CHARTERED ACCOUNTANT, a letter of complaint can be sent to Director (Discipline), ICAI Bhawan lndraprastha Marg, Post Box No. 7100, NEW DELHI – 110 002.

A CHARTERED ACCOUNTANT cannot be treated at par with a criminal without any guilt or crime by arresting him by police. By doing so, s/he is not being given the opportunity to be heard also. Parliament has passed the Chartered Accountant Act, 1949 which contains a mechanism to punish errant CHARTERED ACCOUNTANT members for any negligence in performing his duty.

Therefore it is requested to you, to take this issue and issue a memorandum to be sent to all relevant offices, police headquarters of the State as well as to District police offices including all IG, OM & SP regarding the proper process to be followed by the machinery before any FIR or Arrest of a Chartered Accountant. A Chartered Accountant is a respected person in society who should not be harassed by police & should never be treated at par with criminals.

Therefore it is requested to you that you kindly issue a memorandum, on Standard operating procedure, to be observed and to be followed by, police or any other authority, while making an ARREST OF CHARTERED ACCOUNTANTS.

ICAI representation to issue a Standard operating procedure on Arrest of Chartered Accountant

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"