Reetu | Nov 26, 2022 |

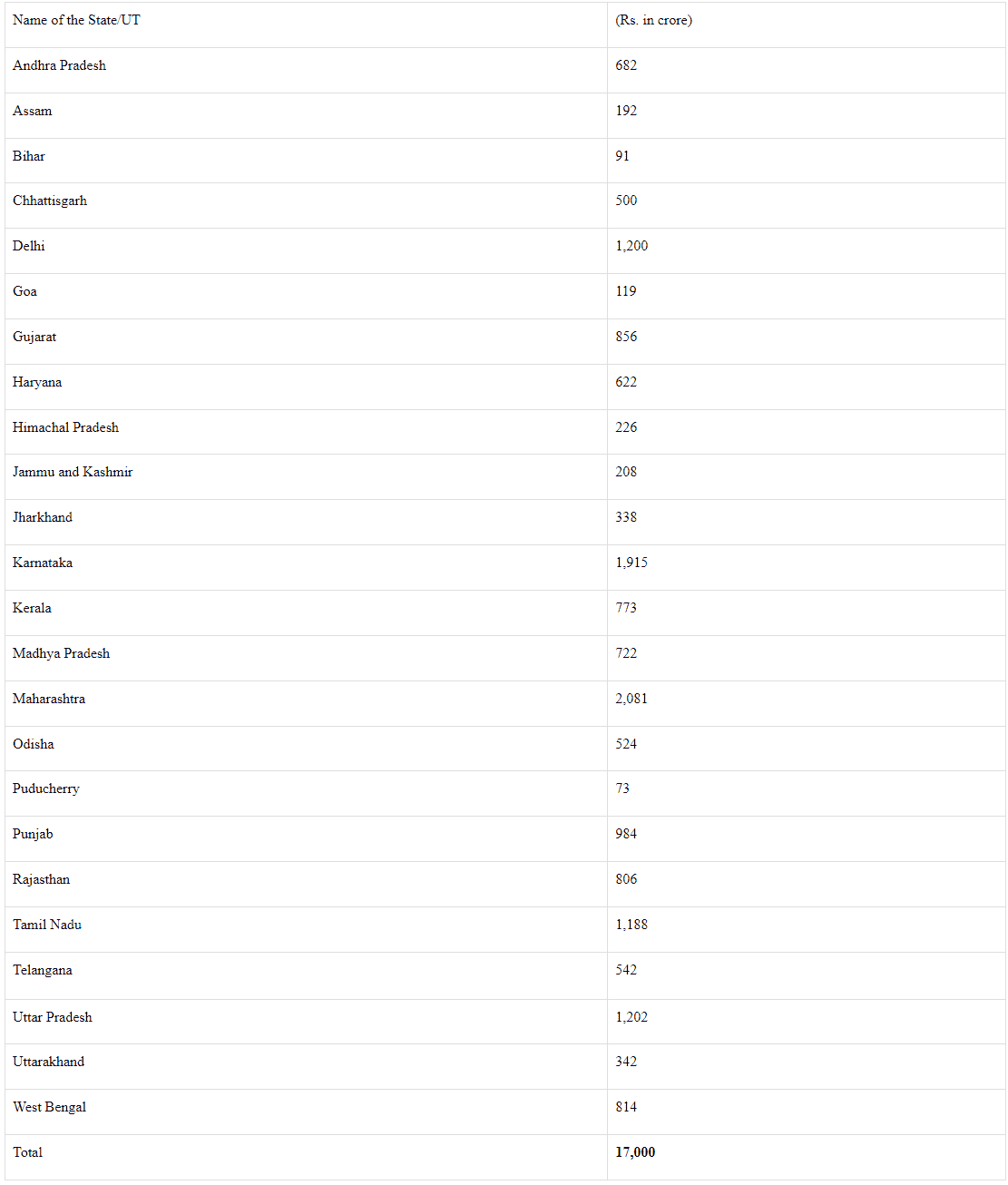

Centre releases GST Compensation of Rs.17000 crore to States and UTs

The Central Government released an amount of Rs. 17,000 crore to States/UTs on 24.11.2022 towards the balance GST compensation for the period April to June, 2022. The total amount of compensation released to the States/UTs so far, including the aforesaid amount, during the year 2022-23 is Rs.1,15,662 crore.

Even though the Center is releasing the remaining amount of Rs. 43,515 crore from its own funds, the total amount of Cess collected up until October 2022 was only Rs. 72,147 crore.

With this release, the Centre has released, in advance, the entire amount of Cess estimated to be collected this year till March-end available for payment of compensation to States. This decision was taken to assist the States in managing their resources and ensuring that their programmes especially the expenditure on capital is carried out successfully during the financial year.

Even in May this year, the Central Government had released Rs. 86,912 crore as provisional GST compensation to States for the period Feb-May’2022 despite the fact that there was only about Rs. 25,000 crore in the GST Compensation Fund, by making arrangement of funds of around Rs. 62,000 crore from its own resources.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"