Reetu | Mar 25, 2023 |

Mandatory Penalty for Non-linking PAN-Aadhaar: What happens if you dont link by Due date

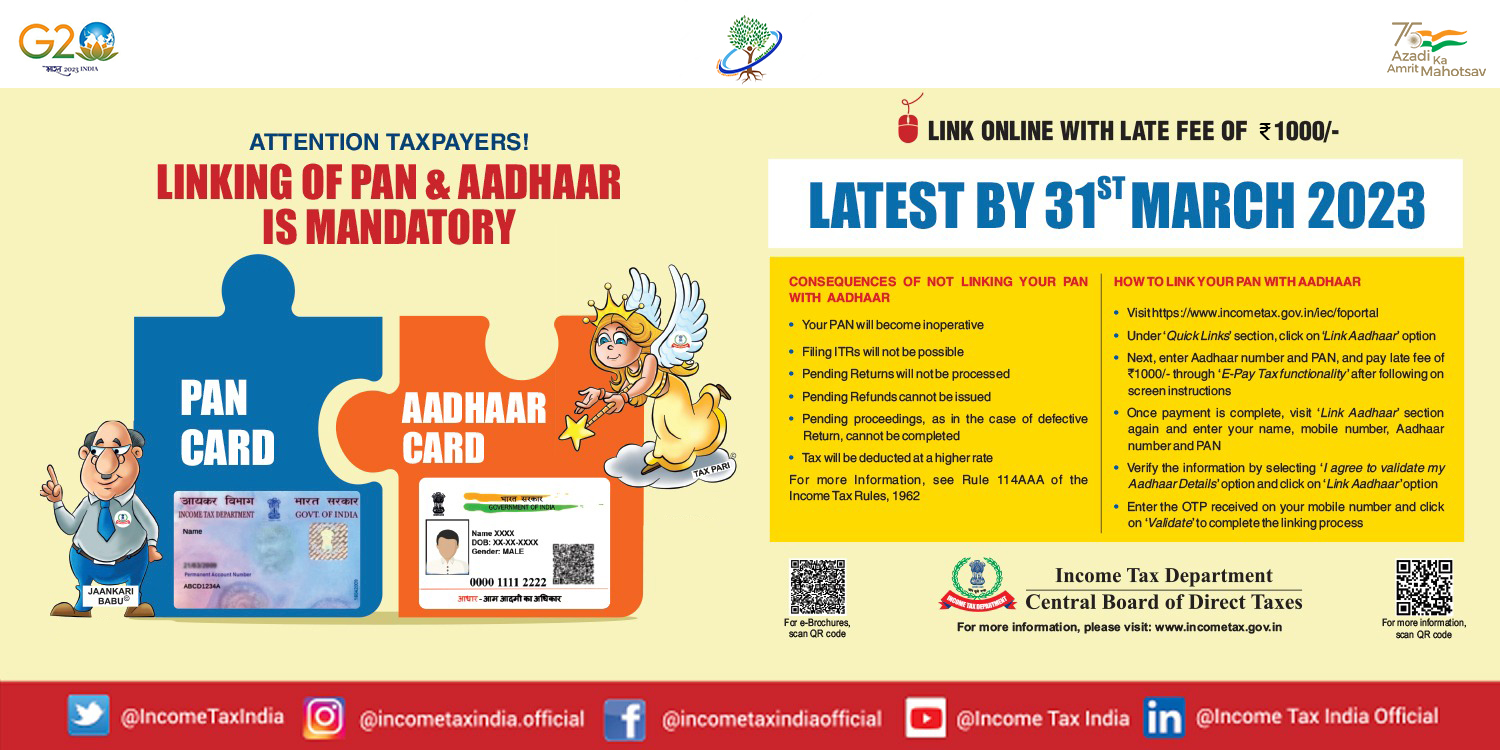

In India, Aadhar and Permanent Account Number (PAN) have become essential components of everyday life for the common man, each fulfilling a specific purpose. The mandatory linking of Aadhaar with PAN is now being considered, with a March 2023 deadline.

The Income Tax Department on his twitter official handle tweeted, “Attention Taxpayers! PAN-Aadhaar linking deadline is approaching! Please do link Aadhaar and PAN before 31.03.2023 to avoid consequences.”

Currently, PAN holders who link PAN-Aadhaar between 1st July 2022 to 31st March 2023 must pay a penalty of Rs. 1,000.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"