Reetu | May 13, 2023 |

GST: Know three Important Due Dates of Today

Every Month GST Taxpayers need to file GST Returns. Taxpayers who are registered under QRMP Scheme or Taxpayers who are Input Service Distributor, they all need to file their Tax Returns within time period provided. Due date of Filing these return is approaching, Let’s know about it more.

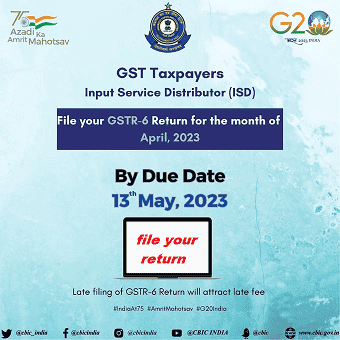

Attention, GST Taxpayers who are Input Service Distributor (ISD)!. File your GSTR-6 Return for the month of April, 2023. The Due Date to file GSTR-6 is 13th May 2023, i.e. today. File your return by today itself, who haven’t file yet.

Attention, GST taxpayers who are under QRMP Scheme!. File your Return for the month of April, 2023 and enjoy the convenience of Invoice Furnishing Facility(IFF) to enable the flow of ITC to the recipients by uploading B2B invoices for April 2023. Due date to file this return is 13th May 2023. Hurry! and file your return if you haven’t file it yet.

And today is also the last date to file GSTR-5 for the month of April 2023 For Non Resident Taxpayers.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"