Reetu | Jul 4, 2023 |

GSTN Portal enabled Form DRC-01B

The Goods and Services Tax Network (GSTN) has enabled the Form DRC-01B for filing.

In terms of Notification No. 26/2022 – Central Tax Dated 26-12-2022, Rule 88C was inserted to seek an explanation for difference in GSTR 1 and GSTR 3B through Form DRC – 01B.

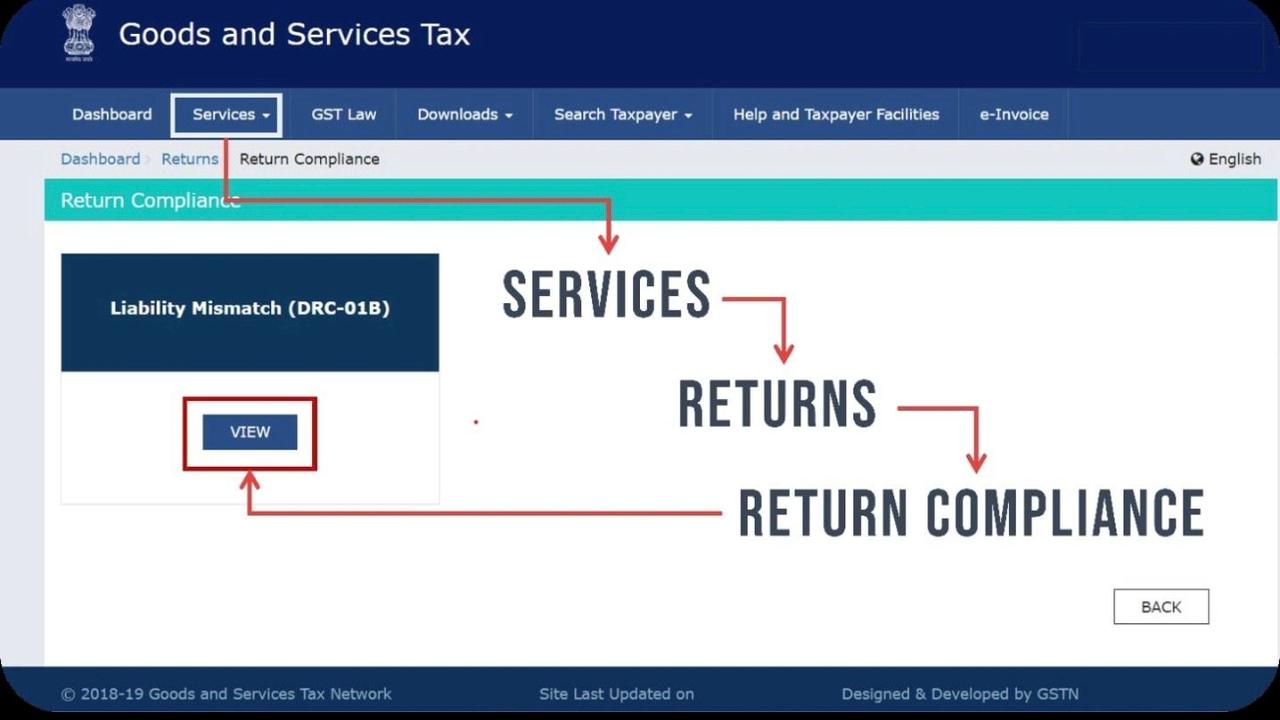

It is informed that GSTN has developed a functionality to enable the taxpayer to explain the difference in GSTR-1 & 3B return online as directed by the GST Council. This feature is now live on the GST portal.

The functionality compares the liability declared in GSTR-1/IFF with the liability paid in GSTR-3B/3BQ for each return period. If the declared liability exceeds the paid liability by a predefined limit or the percentage difference exceeds the configurable threshold, taxpayer will receive an intimation in the form of DRC-01B.

When a taxpayer receives an intimation, he or she must respond using Form DRC-01B Part B. The taxpayer has the option to either provide details of the payment made to settle the difference using Form DRC-03, or provide an explanation for the difference, or even choose a combination of both options.

GSTN has now enabled Form DRC – 01B. In case of difference over defined limit, the taxpayer will receive an intimation in Part A of this form. Taxpayer is required to furnish a reply in Part B of DRC -01B within 7 days.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"