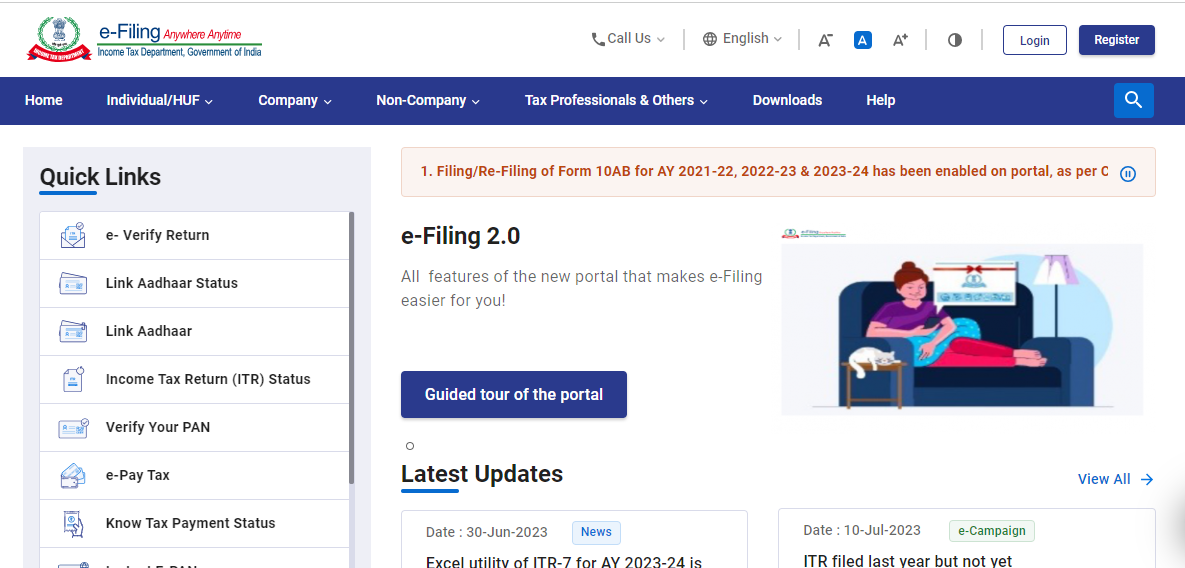

The Income Tax Department has enabled filing and Re-filing of Form 10AB for AY 2021-22, 2022-23 and 2023-24 on Income Tax Portal.

Reetu | Jul 12, 2023 |

Filing/ Re-filing of Form 10AB enabled on Tax Portal

The Income Tax Department has enabled filing and Re-filing of Form 10AB for AY 2021-22, 2022-23 and 2023-24 on Income Tax Portal.

Existing trust registered by under section 12AB of the Income Tax Act that desire to claim exemption under Sections 11 and 12 are needed to register under the Income Tax Act by completing Form No. 10AB. A trust that has been registered under the new law u/s 12AB of the Income Tax Act must apply for registration in Form 10AB.

Form Nos. 10AB shall be supplied electronically online by digital signature if the income return is needed to be given under digital signature, or through electronic verification code if Digital Signature is not available. Form No. 10AB must be validated by the person empowered to verify the applicant’s income tax return under section 140.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"