The Central Board of Direct Taxes(CBDT) has notified Procedure for compulsory selection of returns for Complete Scrutiny during FY 2023-24.

Reetu | Aug 10, 2023 |

CBDT Notifies Procedure for compulsory selection of returns for Complete Scrutiny during FY 2023-24

The Central Board of Direct Taxes(CBDT) has notified Procedure for compulsory selection of returns for Complete Scrutiny during FY 2023-24.

Kindly refer to Boards’ Guidelines dated 24.05.2023 issued from F.No. 225/66/2023 /ITAII on the above subject. Based on these guidelines, various letters/queries have been received in the Board from DsGIT(lnv.) and CCslT(Central) regarding centralization of cases u/s 127 of the Income-tax Act,1961 (‘the Act’) subsequent to issuance of notices u/s 143(2)/142(1) of the Act in various category of cases.

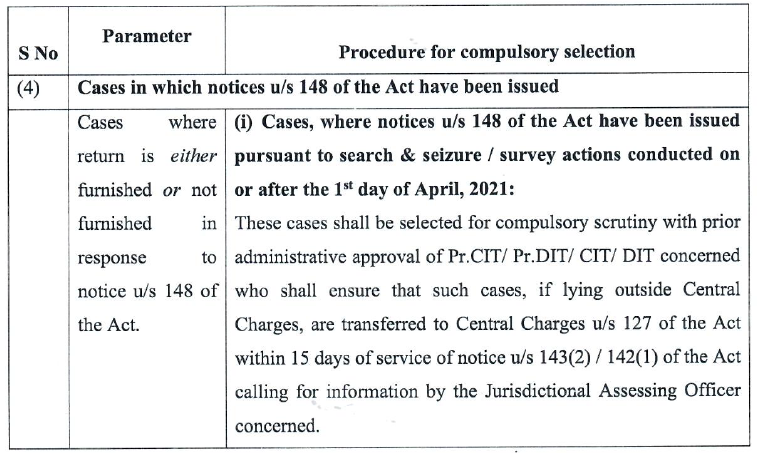

Parameter 4 of Para 2 of the above-referred to Guidelines dated 24.05.2023 reads as under:

During the course of Search and Seizure action, information relating to some other persons, who may have one-off/very few or limited financial transaction(s) with the main assessee group covered in the search u/s 132/132A of the Act, may be found. Such persons are not integrally connected with the core business of the main assessee searched and do not belong to the same business group. Often such persons are also not residing in the same city as that of the main assessee. In such cases, the relevant information is generally passed on to the jurisdictional AO for assessing them u/s 148(for searches conducted/requisition made after 01.04.2021) of the Income tax Act, 1961.

Accordingly, with reference to Parameter 4 of Para 2 of the above-referred to Guidelines dated 24.05.2023, it is clarified that all such non-search cases selected are not required to be transferred to the Central Charges unless covered by the Board’s guidelines under F.No. 299/107/2013-IT(Inv.III)/1568 dated 25.04.2014.

For Official Guidelines Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"