Reetu | Aug 24, 2023 |

GST Amnesty Scheme: Few days left to avail Benefits; Deadline Extended

GST Amnesty Scheme: The Amnesty Scheme provides assistance to taxpayers who have acquired assessment orders under Section 62 of the CGST Act.

The Central Board of Indirect Taxes and Customs (CBIC) has extended the GST Amnesty Scheme for GSTR 4, GSTR-9, and GSTR-10 non-filers. The form submission deadline of June 30, 2023 has been extended to Aug 31, 2023, according to the notification.

The purpose of the amnesty scheme is to provide assistance to taxpayers who have not submitted GSTR-4, GSTR-9, or GSTR-10, among other GST returns.

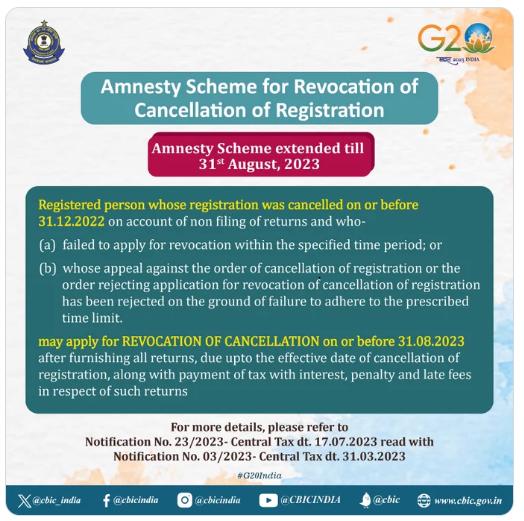

The information published on CBIC official Twitter Handle are as follows-

Registered person whose registration was cancelled on or before 31.12.2022 on account of non filing of returns and who-

(a) failed to apply for revocation within the specified time period; or

(b) whose appeal against the order of cancellation of registration or the order rejecting application for revocation of cancellation of registration has been rejected on the ground of failure to adhere to the prescribed time limit.

may apply for REVOCATION OF CANCELLATION on or before 31.08.2023 after furnishing all returns, due upto the effective date of cancellation of registration, along with payment of tax with interest, penalty and late fees in respect of such returns.

The period for claiming this benefit has been extended from 30 June to 31 August 2023, according to Central Tax Notification 24/2023.

The window for applying for the amnesty scheme for GSTR-9 non-filers has been extended from June 30 to August 31, 2023, as per Central Tax Notification 25/2023. Non-filers of the GST annual return must take advantage of this extension and finish their filing requirements to avoid penalties or other consequences.

According to Central Tax Notification 26/2023, the deadline for GSTR-10 non-filers has been extended from 30 June to 31 August 2023, providing them additional time to comply. It is critical that those who have not yet completed their GSTR-10 returns take advantage of this extended window of opportunity to complete the procedure.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"