CBDT Extends due date for filing Income Tax Audit Report in Form 10B/10BB for Trusts

CA Pratibha Goyal | Sep 18, 2023 |

CBDT Extends due date for filing Income Tax Audit Report in Form 10B/10BB for Trusts

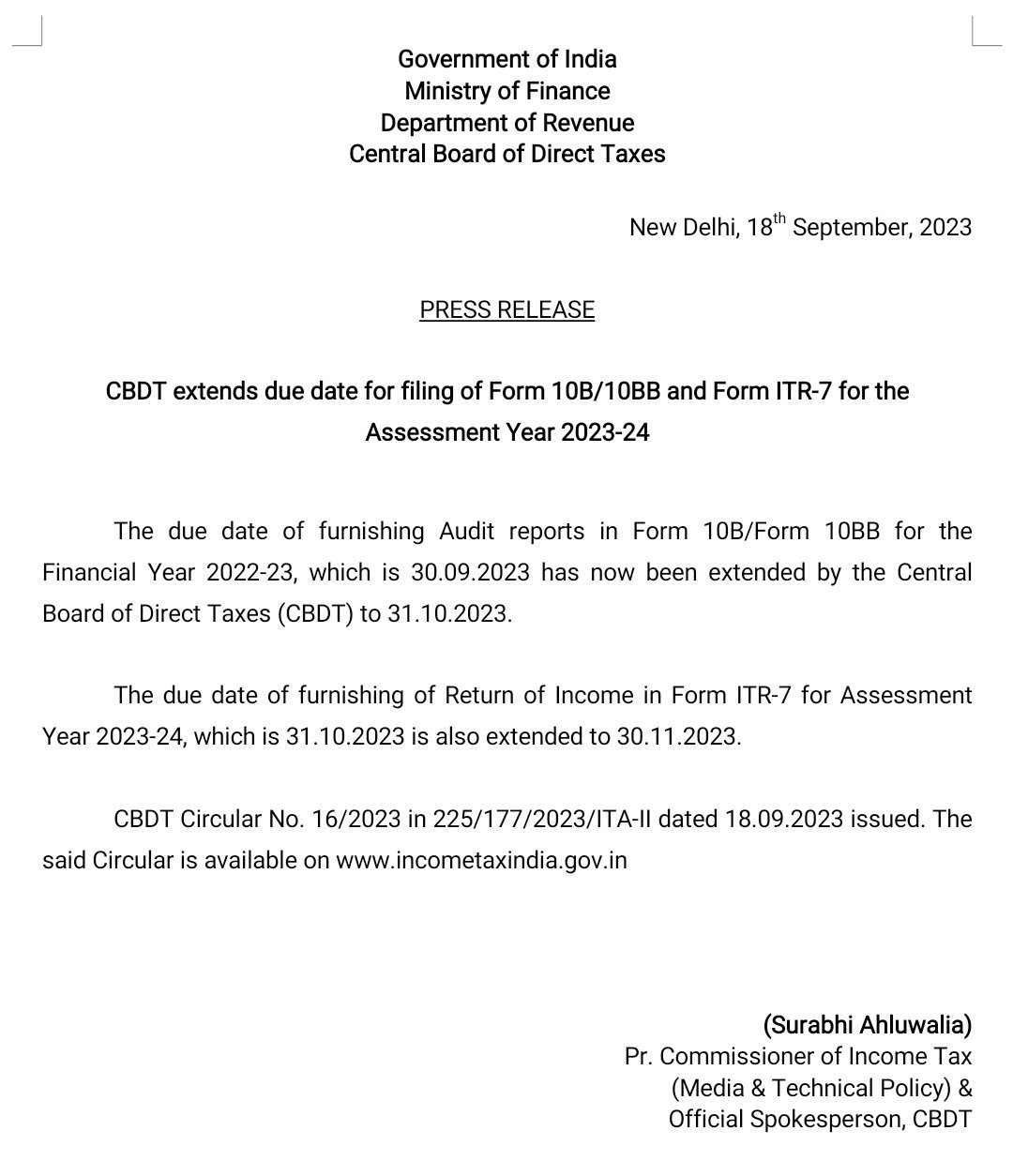

The Central Board of Direct Taxes (CBDT) has extended the due date for filing of Income Tax Form 10B/10BB for FY 2022-23. The Due Date has been extended to 31.10.2023.

Consequentially the Due date for furnishing of Income Tax Return (ITR) in Form ITR-7 for the AY 2023-24 (FY 2022-23) also stands to be extended to 30.11.2023.

1. The due date of furnishing the Audit report under clause (b) of the tenth proviso to clause (23C) of section 10 and sub-clause (ii) of clause (b) of sub-section (1) of section 12A of the Income-tax Act, 1961, in the case of a fund or trust or institution or any university or other educational institution or any hospital or other medical institution in Form 10B/Form 10BB for the Previous Year 2022-23, which is 30th September 2023, is hereby extended to 31st October 2023.

2. The due date of furnishing of Return of Income in Form ITR-7 for the Assessment Year 2023- 24 in the case of assessees referred to in clause (a) of Explanation 2 to sub-section (1) of section 139 of the Act, which js 30th October, 2023, is hereby extended to 30th November 2023.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"