Reetu | Mar 16, 2024 |

CA Exams 2024 set to be Postponed Amid General Elections

There were speculations that after the Lok Sabha Elections dates are revealed, the Institute of Chartered Accountants of India (ICAI) will postpone the CA Exam scheduled to be held in the May 2024 session.

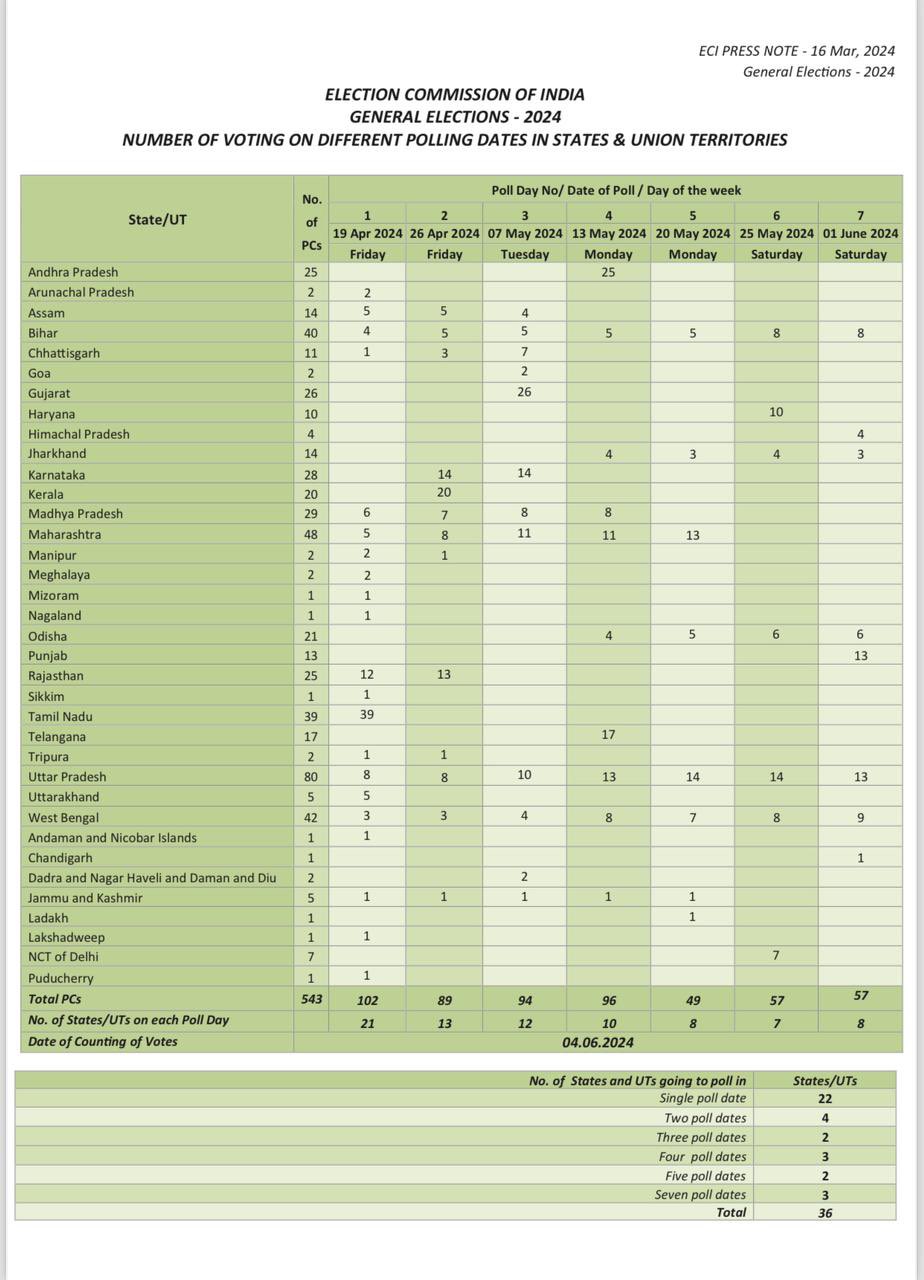

Now after the schedule of Lok Sabha Election Dates, it is almost confirmed the CA Exams 2024 are set to be Postponed as dates of elections are clashing with examination dates. CA Dhiraj Khandelwal who is also one of the Central Council Members of ICAI wrote on his official Twitter account that:

“Impact of Election Date on Exam :

After the announcement of the election date I think the exam schedule should be the same in May itself only Clashing dates like the 7th and 13th of May exams should be postponed to the 15th and 16th of May. This is my prediction, pls wait for ICAI notification.

However, he presented the scenario where only clashing exams will be postponed. Now a scenario where only Clashing Exams are to be Postponed can be confusing for Students. So Ideally Exams should be conducted after Elections are over.

Another Senior Chartered Accountant CA Anupam Sharma wrote on his Twitter handle:

In my view, the ICAI May 2024 exam will be held after 4 June 2024. This is my personal opinion, but please wait 2-3 days for ICAI official notifications.

It’s High Time for ICAI to issue an official Notification.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"