Reetu | Mar 29, 2024 |

Government revised Interest Rate of PPF, SSY and Senior Citizen Savings Scheme for April- June Quarter 2024

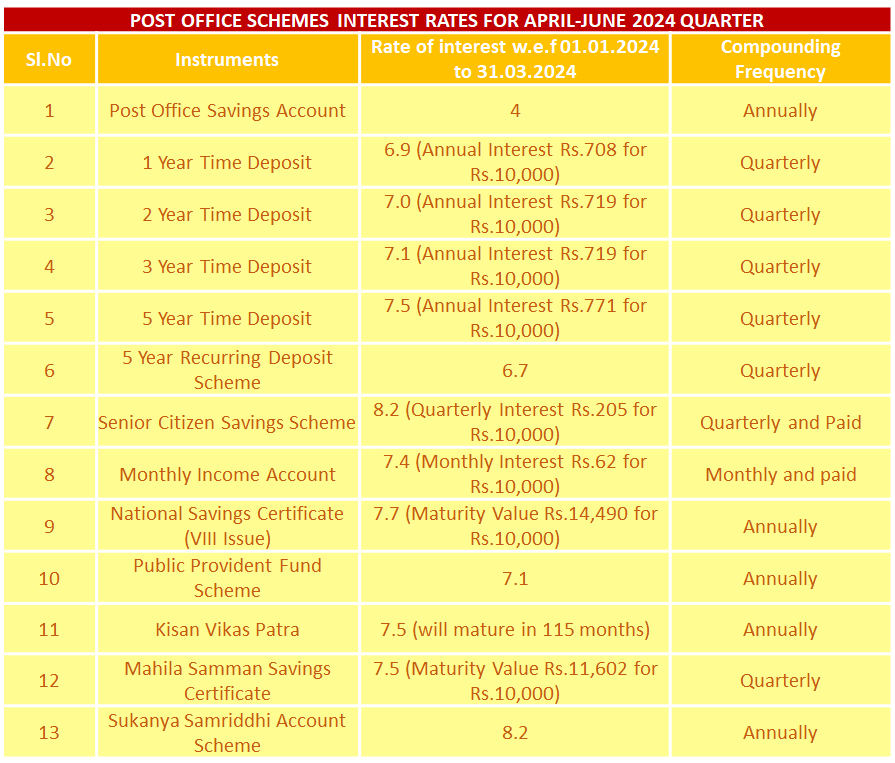

The Government revises the interest rates for small savings schemes, every quarter. The government has maintained the interest rates of post office schemes for the quarter of April – June 2024 at the same levels as they were in the January – March 2023 quarter.

“The rates of interest on various Small Savings Schemes for the first quarter of FY 2024-25, beginning on April 1, 2024 and ending on June 30, 2024, shall remain unchanged from those notified for the fourth quarter (January 1, 2024 to March 31, 2024) of FY 2023-24,” stated an office memorandum issued by the Ministry of Finance on March 8, 2024.

Some of the most popular small savings schemes include the Public Provident Fund (PPF), Sukanya Samriddhi Yojana (SSY), Mahila Samman Savings Certificate, Senior Citizen Savings Scheme (SCSS), and National Savings Certificate.

Here’s a glance at the interest rates on various small savings schemes for the first quarter of the financial year 2024-25, along with their compounding frequency.

Not all small savings schemes offer tax benefits. Section 80C of the Income-tax Act of 1961 defines these post office schemes as NSC, SCSS, SSY, and PPF.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"