Deepak Gupta | Mar 23, 2019 |

How to save tax on Salary Income

Dear friends, the month of January is already here and less than three months are left with tax payers so that they can invest and save there taxes.

While making an investment, tax savings should not be only sole purpose. But we need to keep other things in mind such as, what is the return of investment, what is the lock in period, what would be the tax implications when investment is redeemed, what is the risk involve in the investment etc.

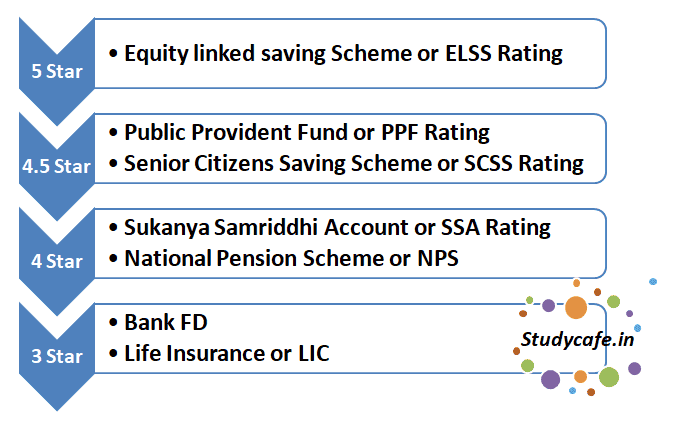

I am suggesting some of the best Investment options, which I find lucrative for tax saving as well as earning good interest.

1.) Equity linked saving Scheme or ELSS

Rating : 5 Star

| Interest | Not Fixed |

| Minimum Investment Requirement | No Specific Requirement |

| Maximum Investment that can be made | No Specific Limit |

| Features | The investment has minimum lock-in period of 3 Years Investors may choose between dividend or growth option available. Dividend option can be used by investor who needs to have regular Income where as Growth Option is for person who need to save for long term. |

| Tax Benefit | Deduction of 80C is available |

Tax Considerations of Income earned out of ELSS Scheme

From April 1, 2018 any LTCG made on transfer of equity MFs that have an equity exposure of 65 per cent or more including Equity-linked savings schemes (ELSS) will have to pay a 10 per cent tax on long-term gains. It is important to note that gains made above Rs 1 lakh per annum will only be subject to tax and any gains made below that limit in one FY remains tax-exempt.

2.) Public Provident Fund or PPF

Rating : 4.5 Star

| Interest | 8.00% |

| Minimum Investment Requirement | Rs. 500/- |

| Maximum Investment that can be made | Rs. 1,50,000/- |

| Features | The investment has minimum lock-in period of 15 Years |

| Tax Benefit | Deduction of 80C is available |

Tax Considerations of Income earned out of PPF Scheme

PPF interest is Exempt form Tax

3.) Senior Citizens Saving Scheme or SCSS Rating : 4.5 Star

| Interest | 8.50% |

| Minimum Investment Requirement | Rs. 500/- |

| Maximum Investment that can be made | Rs. 1,50,000/- |

| Features | The investment has no specific Lock-in period. However If the account is closed before two years, the investor has to pay 1.5% of the balance in the account. After two years, the penalty is lowered to 1% of the balance. |

| Tax Benefit | Deduction of 80C is available |

Tax Considerations of Income earned out of SCSS Scheme The interest earned from the SCSS is fully taxable as income.

4.) Sukanya Samriddhi Account or SSA Rating Rating : 4 Star

| Interest | 8.50% |

| Minimum Investment Requirement | 250 |

| Maximum Investment that can be made | A parent can open an account for a maximum of two daughters, but the combined investment in the two accounts cannot exceed Rs 1.5 lakh in a year. |

| Features | The account shall mature on when the Girl child completes her 21 years but if her marriage takes place before being 21 years then it shall be deemed as mature. Read this article on SSA Account for learning complete features of this scheme |

| Tax Benefit | Deduction of 80C is available |

Tax Considerations of Income earned out of SSA Scheme

The interest earned from the SSA is fully Exempt from Tax.

What are the best investments to avail deductions for Income Tax

5.) National Pension Scheme or NPS Rating

Rating : 4 Star

| Interest | 4-10% |

| Minimum Investment Requirement | 500 |

| Maximum Investment that can be made | No Specific Limit |

| Features | Limit for maximum deduction available u/s 80C, 80CCC, 80CCD+80CCD(1B) is Rs. 2 Lakh The Lock-in period of NPS is till retirement |

| Tax Benefit | Deduction of 80C is available |

Tax Considerations of Income earned out of NPS Scheme

The present Tax consideration of NPS has been explained through below mentioned image

| However as per MOF press release dated 10th December 2018, there is a proposal that Tax exemption limit for lump sum withdrawal on exit should be been enhanced to 60%. With this, the entire withdrawal will be exempt from income tax. This will be applicable only when notification is made by the MOF. |

6.) Bank FD of 5 Years

Rating : 3 Star

| Interest | 5.5% – 7.5% |

| Minimum Investment Requirement | 500 |

| Maximum Investment that can be made | No Specific Limit |

| Features | The investment has minimum lock-in period of 5 Years |

| Tax Benefit | Deduction of 80C is available |

Tax Considerations of Income earned out of Fixed Deposit

The interest earned from the Fixed deposit is fully taxable.

Tax Considerations of Income earned from Insurance

7.) Life Insurance or LIC Rating Rating : 3 Star

| Interest | 0-6% |

| Minimum Investment Requirement | No Specific Requirement |

| Maximum Investment that can be made | No Specific Limit |

| Features | The investment has minimum lock-in period of 5 Years |

| Tax Benefit | Deduction of 80C is available |

The income earned from insurance is exempt.

Disclaimer: The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness and reliability of the information provided, I assume no responsibility therefore. Users of this information are expected to refer to the relevant existing provisions of applicable Laws. The user of the information agrees that the information is not a professional advice and is subject to change without notice. I assume no responsibility for the consequences of use of such information. In no event shall I shall be liable for any direct, indirect, special or incidental damage resulting from, arising out of or in connection with the use of the information

For Regular Updates Join : https://t.me/Studycafe

Tags : Income Tax, Income Tax Deductions

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"