CBDT has begun the process of automatically extinguishing tax demand notices of up to Rs. 1 lakh per the assessee, which is equivalent to a waiver in layman's words.

Reetu | Jun 27, 2024 |

Wavier of Income Tax Demand; How to know if it is waived?

The Central Board of Direct Taxes (CBDT) has begun the process of automatically extinguishing tax demand notices of up to Rs. 1 lakh per assessee, which is equivalent to a waiver in layman’s words.

This is a follow-up to the announcement made by the finance minister during the Interim Budget 2024. While some taxpayers had their old tax demands extinguished, others are still awaiting the extinguishment of their outstanding income tax demand notice. In this article, we will explain how to check the status of a demand notice and your options if the notice has not yet been extinguished.

A total waiver of all qualified tax demand notices up to Rs 1 lakh per assessee by January 31, 2024, was announced in the interim budget and the CBDT has issued conditions.

A total cap of Rs. 1 lakh applies to each assessee, regardless of the assessment year for which the income tax demand is automatically dropped.

The following are the conditions for waiver of tax demands, as indicated in the CBDT order released on February 13, 2024:

Any doubt about the role of interest in this computation was resolved as well.

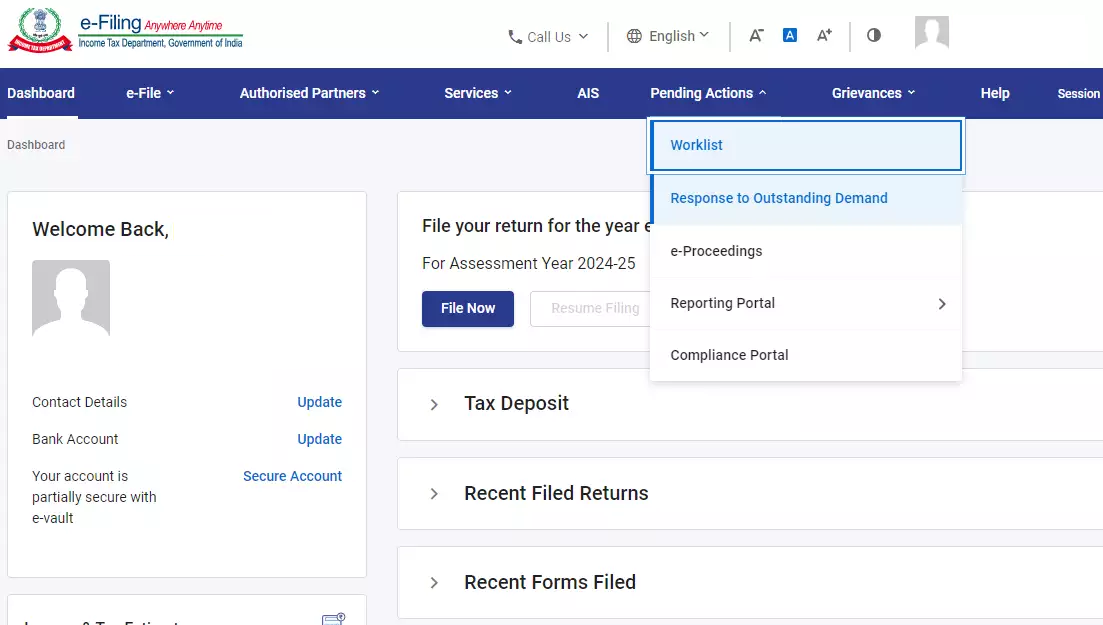

To check the status of your income tax demand notice, first log into the e-filing ITR portal. Follow the steps mentioned below after login:

Step 1: Go to the ‘Pending Action’ tab and then select and click on ‘Response to Outstanding Demand’.

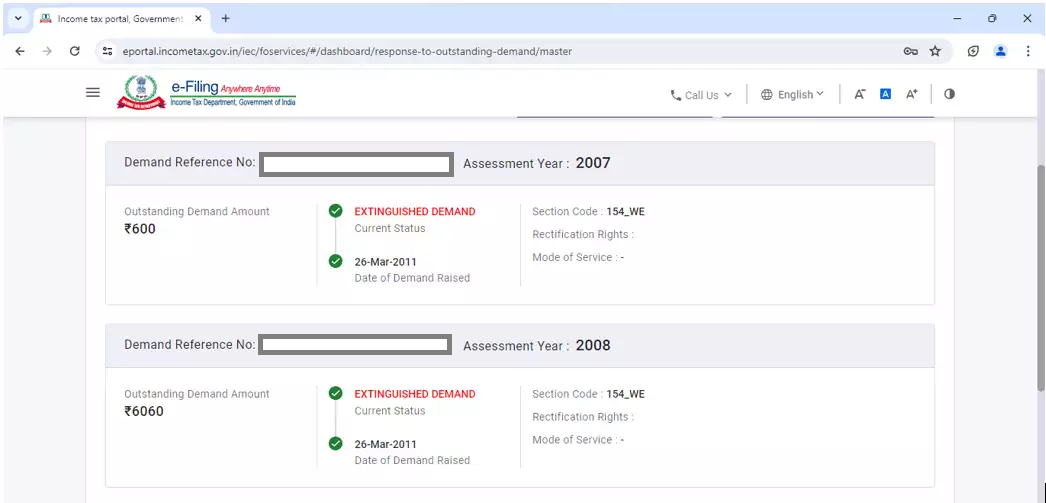

Step 2: If the old tax demands have been extinguished, the page will reflect that.

The income tax department updated the status of the income tax demand notice on the e-filing ITR portal. However, not all taxpayers may get an intimation that the tax demand has been extinguished.

However, not all taxpayers have had the same experience, with experts stating that some of their clients have yet to see their tax demand waived through being eligible.

There is a specific email address where you can seek assistance with the extinguishment of such an old income tax demand notice. The email ID is [email protected].

Taxpayers who have received notification confirming that their former income tax demand notice has been extinguished should take the following steps:

Confirmation Review: Examine the confirmation carefully to ensure that it appropriately reflects the extinguishment of the tax demands.

Save an electronic copy and print it: Save an electronic copy of this confirmation message. You can also print it and keep it somewhere easily accessible.

Update the records: Check if the e-filing ITR portal also shows the status of the extinguished tax demand as the same. If there is any mismatch between the confirmation intimation and the data on the e-filing ITR portal, file a grievance right away.

Following these steps will guarantee that taxpayers have appropriately documented the confirmation of the extinguishment of their tax demands for future reference.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"