Reetu | Mar 20, 2025 |

List of Goods Notified Under RCM for GST

Typically, the supplier of goods bears the tax on supply by Forward Charge Mechanism. The reverse charge mechanism makes the recipient of goods liable to pay the tax, effectively reversing the chargeability.

The aim of shifting the burden of GST payments to the recipient is to broaden the scope of taxation on various unorganized industries, to exempt specified groups of suppliers, and to charge the import of services (since the supply is headquartered outside India).

Only specific types of business entities are liable to the reverse charge mechanism.

The reverse charge scenarios for intrastate transactions are governed by Sections 9(3), 9(4), and 9(5) of the Central GST and State/Union Territories GST Acts. Sections 5(3), 5(4), and 5(5) of the Integrated GST Act govern reverse charge scenarios for interstate transactions.

The provisions of Section 9(4) of the CGST Act, 2017, will not be applicable to supplies made to a TDS deductor in terms of notification no.9/2017-Central Tax (Rate) dated 28.06.2017. Thus, government entities that are TDS deductors under Section 51 of the CGST Act, 2015, need not pay GST under reverse charge in cases of procurements from unregistered suppliers.

1. Cashew Nuts, not Shelled or Peeled

The RCM levied on Cashew nuts, not shelled or peeled, when the supplier is an “agriculturist” and the receiver is “any registered person.” This is notified by Master Notification 4/2017-Central Tax (Rate).

2. Bidi Wrapper Leaves (Tendu)

The RCM levied on Bidi wrapper leaves (tendu), when the supplier is an “agriculturist” and the receiver is “any registered person.” This is notified by Master Notification 4/2017-Central Tax (Rate).

3. Tobacco Leaves

In the case of Tobacco Leaves, the RCM is levied when the supplier is an “agriculturist” and the receiver is “any registered person.” This is notified by Master Notification 4/2017-Central Tax (Rate).

4. Silk Yarn

In the case of Silk Yarn, the RCM is levied when the supplier is “any person who manufactures silk yarn from raw silk or silk worm cocoons for supply of silk yarn” and the receiver is “any registered person.” This is notified by Master Notification 4/2017-Central Tax (Rate).

5. Raw Cotton

The RCM is imposed on specified goods, like Raw Cotton, when the supplier is “agriculturist” and the receiver is “any registered person.” This was added in Master Notification 4/2017-Central Tax (Rate) by Notification 43/2017-Central Tax (Rate)

6. Supply of Lottery

In the case of Supply of Lottery, the RCM is levied when the supplier is “State Government, Union Territory or any local authority” and the receiver is “Lottery Distributor of Selling Agent”. This is notified by Notification 4/2017-Central Tax (Rate).

7. Used vehicles, Seized and Confiscated Goods, Old and Used Goods, Waste and Scrap

On the goods like Used vehicles, seized and confiscated goods, old and used goods, waste and scrap, RCM is levied when the supplier is “Central Government, State Government, Union territory or a local authority” and the receiver is “any registered person.” This was added in Master Notification 4/2017-Central Tax (Rate) by Notification 36/2017-Central Tax (Rate).

8. Priority Sector Lending Certificate

In the case of the Priority Sector Lending Certificate, the RCM is levied when the supplier is “any registered person” and the receiver is also “any registered person.” This was added in Master Notification 4/2017-Central Tax (Rate) by Notification 11/2018 Central Tax (Rate).

9. Metal Scrap

The RCM is imposed on specified goods, like Metal Scrap, when the supplier is “Any Unregistered Person” and the receiver is “any registered person.” This was added in Master Notification 4/2017-Central Tax (Rate) by Notification 6/2024 Central Tax (Rate).

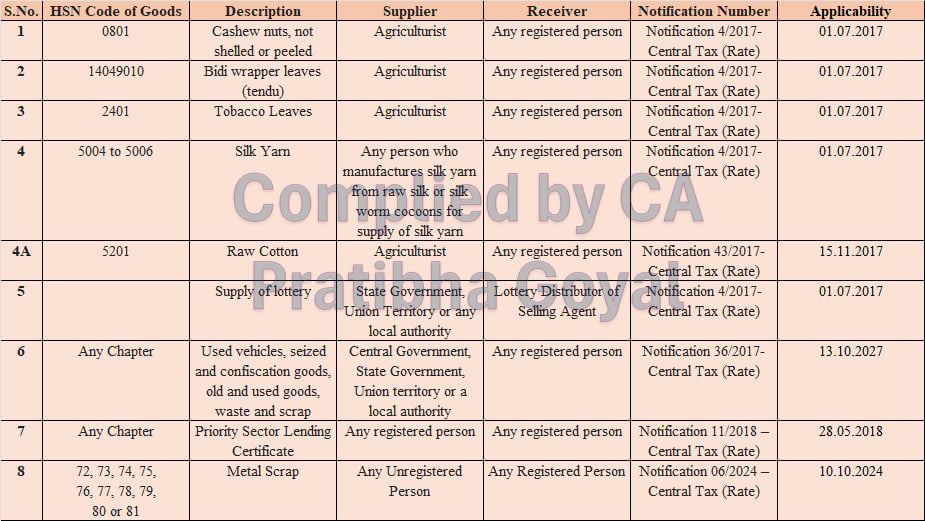

| S.No. | HSN Code of Goods | Description | Supplier | Receiver | Notification Number | Applicability |

| 1 | 0801 | Cashew nuts, not shelled or peeled | Agriculturist | Any registered person | Notification 4/2017- Central Tax (Rate) | 01.07.2017 |

| 2 | 14049010 | Bidi wrapper leaves (tendu) | Agriculturist | Any registered person | Notification 4/2017- Central Tax (Rate) | 01.07.2017 |

| 3 | 2401 | Tobacco Leaves | Agriculturist | Any registered person | Notification 4/2017- Central Tax (Rate) | 01.07.2017 |

| 4 | 5004 to 5006 | Silk Yarn | Any person who manufactures silk yarn from raw silk or silk worm cocoons for supply of silk yarn | Any registered person | Notification 4/2017- Central Tax (Rate) | 01.07.2017 |

| 4A | 5201 | Raw Cotton | Agriculturist | Any registered person | Notification 43/2017-Central Tax (Rate) | 15.11.2017 |

| 5 | -NA- | Supply of lottery | State Government, Union Territory or any local authority | Lottery Distributor of Selling Agent | Notification 4/2017- Central Tax (Rate) | 01.07.2017 |

| 6 | Any Chapter | Used vehicles, seized and confiscation goods, old and used goods, waste and scrap | Central Government, State Government, Union territory or a local authority | Any registered person | Notification 36/2017-Central Tax (Rate) | 13.10.2027 |

| 7 | Any Chapter | Priority Sector Lending Certificate | Any registered person | Any registered person | Notification 11/2018 – Central Tax (Rate) | 28.05.2018 |

| 8 | 72, 73, 74, 75, 76, 77, 78, 79, 80 or 81 | Metal Scrap | Any Unregistered Person | Any Registered Person | Notification 06/2024 – Central Tax (Rate) | 10.10.2024 |

Notification 4/2017 – Central Tax (Rate) is the master notification for Reverse Charge Applicability in case of supply of goods.

1.) If purchases/services are availed within the state (Intra State)

Purchase / Expense A/c. ———10,000

Input CGST A/c. ——————- 900

Input SGST A/c. ——————- 900

To Creditors A/c. or Cash/Bank Ac —— 10,000

To CGST A/c Payable ———————–900

To SGST A/c Payable ———————–900

2.) If purchases / services are availed from other state (Inter State)

Purchase / Expense A/c. ———10,000

Input IGST A/c. ——————– 1,800

To Creditors A/c. or Cash/Bank A/c. —— 10,000

To IGST A/c Payable ———————–1,800

3.) If purchases / services are availed from other Country (Import)

Purchase / Expense A/c. ———10,000

Input IGST A/c. ——————– 1,800

To Creditors A/c. or Cash/Bank A/c. —— 10,000

To IGST A/c Payable ———————–1,800

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"