Income Tax Deduction of Rs. 577.98 Crores claimed by companies on account of Donation to political parties

CA Pratibha Goyal | Apr 1, 2025 |

Deduction of Rs. 577.98 Crores claimed by companies on account of Donation to political parties

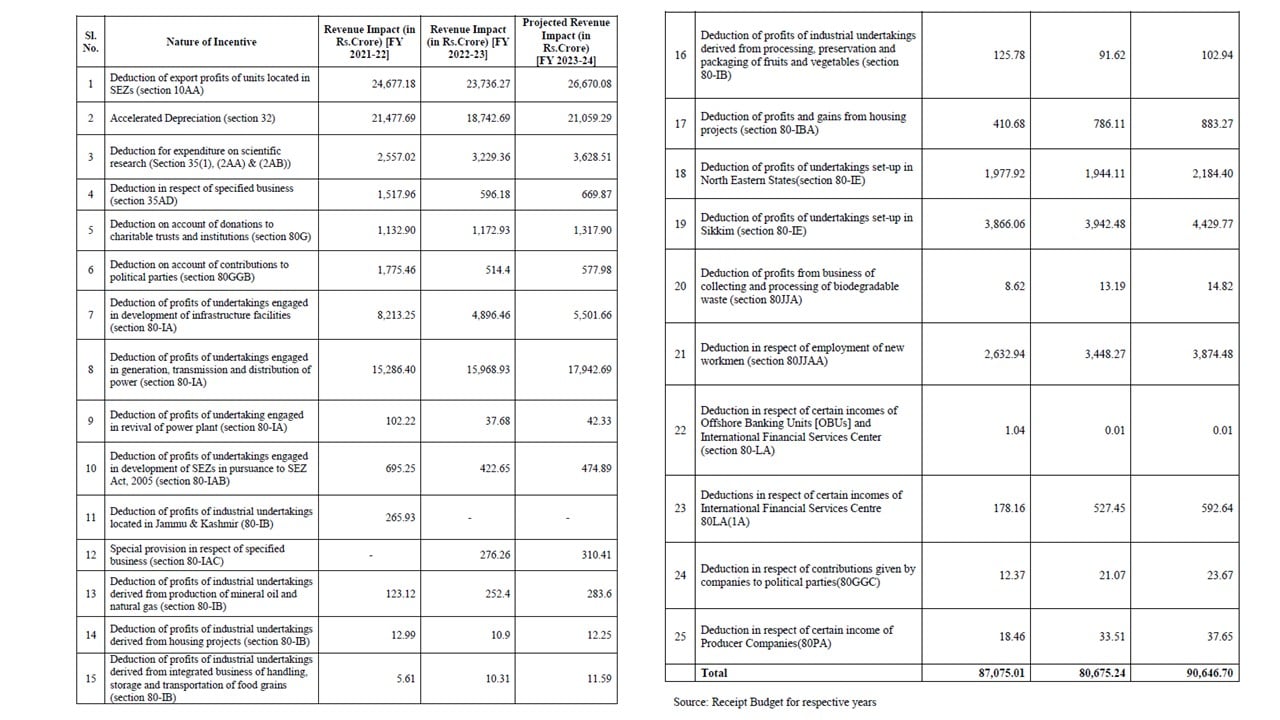

As answered by the Minister of State for Finance (Shri Pankaj Chaudhary), total tax concessions amounting to Rs. 90,646.70 crores were given to companies in FY 2023-24.

This includes the Income Tax Deduction of Rs. 577.98 Crores claimed by companies on account of contributions to political parties (section 80GGB) and Rs. 1,317.90 Crores on account of donations to charitable trusts and institutions (section 80G).

The revenue impact of tax concessions given in respect of corporate companies from F.Y. 2021-22 to 2023-24 is mentioned in Annexure B.

Tax concessions are a component of government’s direct tax policy. Income-tax Act, inter alia, provides for tax concessions to eligible corporates in the form various deductions and exemptions from the taxable income to promote exports; balanced regional development; creation of infrastructure facilities; employment; rural development; and scientific research and development.

1,120,417 Companies Filed returns of income upto 28.02.2025 for the Financial Year 2023-24. This Number has increased from 1,025,717 in Financial Year 2021-22 and 1,075,866 in Financial Year 2022-23.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"