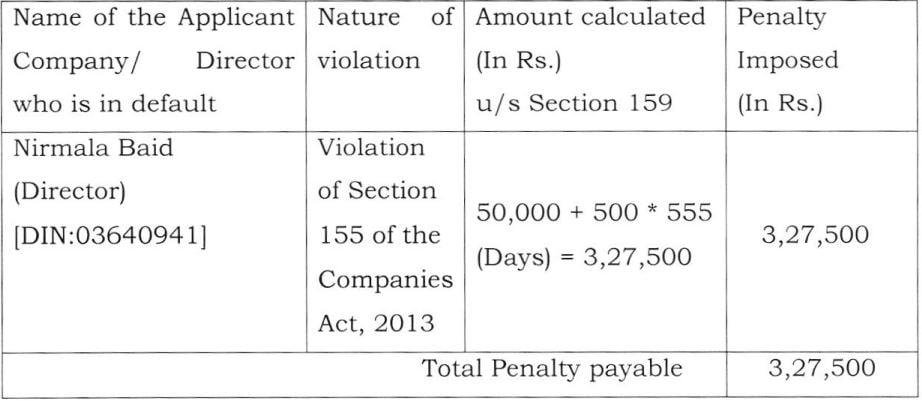

ROC Imposes Penalty of Rs. 3,27,500 on a director named Nirmala Baid for holding duplicate DIN for violation of Section 155 of the Companies Act 2013.

Saloni Kumari | Jun 6, 2025 |

ROC Imposes Penalty of 3.275 Lakh for Holding Duplicate DIN

The Registrar of Companies (ROC), West Bengal, has imposed a penalty of Rs. 3,27,500 on a director named Nirmala Baid for violating Section 155 of the Companies Act, 2013, passed by the Adjudicating Authority, i.e., the Registrar of Companies, Kolkata, West Bengal, under Section 159 of the Act for failure to comply with the Act u/s. 155 of the Act.

Section 155 of the Companies Act, 2013, restricts individuals from applying for, obtaining, or possessing more than one Director Identification Number (DIN) after already being allotted one under section 154. This section ensures that each director has a unique DIN, facilitating regulatory compliance and oversight.

The present appeal was filed under Section 454(5) of the Companies Act, 2013, and the Companies (Adjudication of Penalties) Rules, 2014, using Form ADJ (SRN No. A82443565 dated 16.01.2025). It challenges the penalty order dated 03.12.2024 for violating Section 155 of the Companies Act, issued by the Registrar of Companies, Kolkata. The order was communicated to the appellant through letter No. ROC/ADJ/650/2024/8637 on the same date. The appeal was submitted within the 60-day time limit as required under Section 454(6) of the Act.

The Registrar of Companies (ROC), West Bengal, had issued a notice on 27.11.2022 (Notice No. ROC/ADJ/65012024 18475) to the director for violating Section 155 of the Companies Act. However, the director (Appellant) did not respond to the notice.

Later, on 03.12.2024, the ROC passed an Adjudication Order (No. ROC/ADJ/65012024 18637) after holding a hearing where Ms. Jayshri Tulsyan, a company secretary, appeared on behalf of the director. The ROC then passed the order, as shown in the table below.

This penalty has been imposed for a total of 555 days, i.e., from 17.04.2023 (i.e., the date of obtaining the duplicate DIN) to 23.10.2024 (i.e., the date of filing of DIR-S to surrender the Duplicate DIN).

The appellant is instructed to follow the order of the ROC dated 03.12.2024 and pay the penalty mentioned in that order within the time period of 90 days. If the penalty is not paid within the designated time period, then further action will be taken against the individual under Section 454(ii) of the Companies Act, 2013.

Therefore, this appeal is now closed.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"