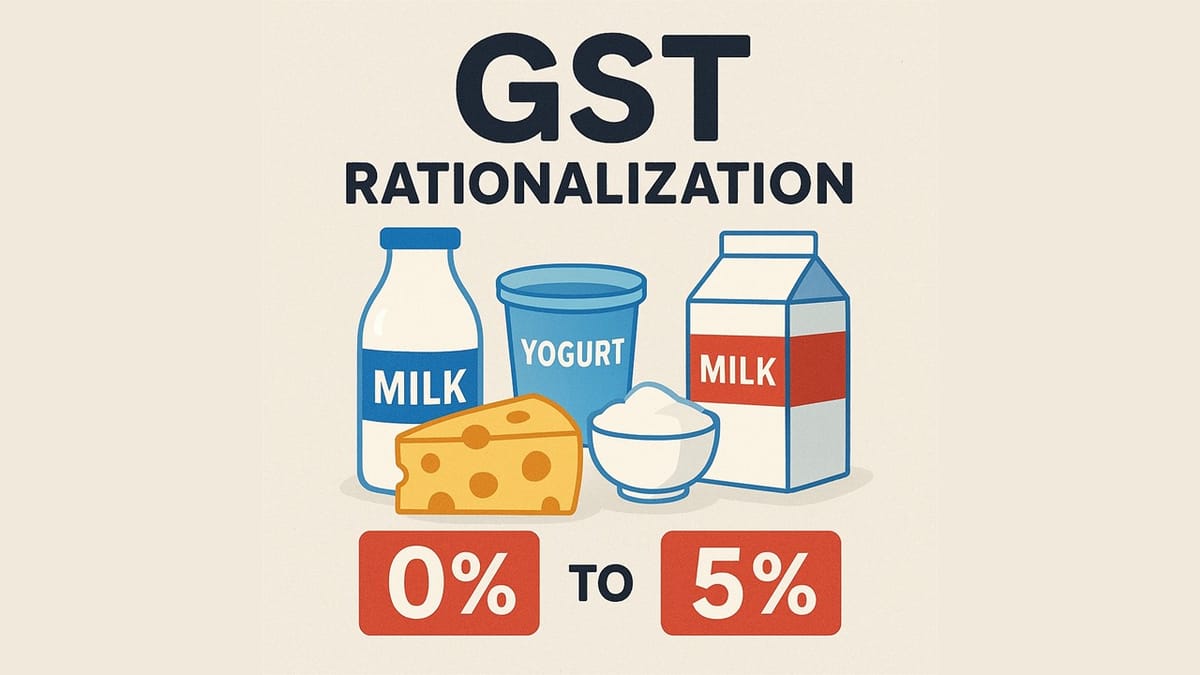

The 56th GST Council has cut tax rates on major dairy products to 0% or 5%, bringing relief to farmers and making dairy items more affordable for consumers

Saloni Kumari | Sep 8, 2025 |

From Ghee to Cheese: GST Council’s 56th Meet Cuts Dairy Taxes

The decision of the 56th GST council meeting held on September 3-4, 2025, has played a major role in strengthening India’s dairy sector. The council has approved a big change of tax rationalisations on milk and milk products.

These GST reforms are one of the most extensive amendments ever made to GST rates in this sector, aimed towards shifting most dairy products to either a nil or only 5% GST rate. These overhauls to GST rates are scheduled to take effect from September 22, 2025. Here’s the list of dairy products that will be influenced by these GST cuts and either attract NIL or a 5% GST rate:

This key GST rationalisation is likely to improve India’s dairy sector, increase benefits to both farmers and consumers, and ultimately contribute to the overall social and economic development of the country. More than 8 crore rural farmer families are likely to benefit from these reforms, mainly small, marginal, and landless labourers involved in rearing milch animals for their survival. This will not only benefit rural farmers but also a large segment of consumers. Reduction of GST rates will decrease adulteration, increase competition of Indian dairy products in both domestic and export markets, and decrease operational costs.

India is the largest producer of milk worldwide, generating 239 million tonnes in 2023–24, which is about 24% of global production. The dairy industry is very important; it supports farmers, provides jobs to millions, and ensures food security. Dairy is the biggest part of agriculture, adding 5.5% to India’s economy. In 2023–24, the value of milk output was Rs. 12.21 lakh crores, and the total dairy market was around Rs. 18.98 lakh crores in 2024. The new GST reforms are anticipated to further enhance productivity, make the sector more competitive, and ensure sustainable earnings for farmers.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"