Nidhi | Sep 30, 2025 |

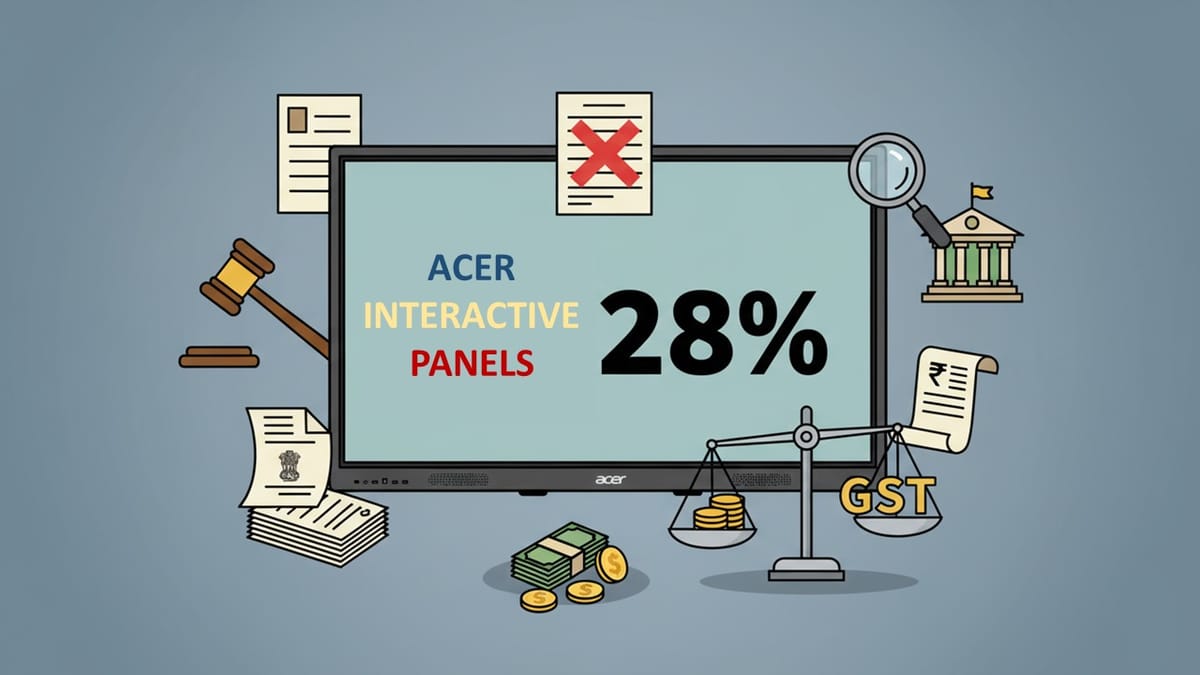

Acer Interactive Panels Attract 28% GST: Tamil Nadu AAR

The applicant, M/s. Acer India Private Limited manufactures and trades business laptops, desktops, workstation computers, Chromebooks, tablets, monitors, projectors, digital signage, smart devices, electronics and accessories and provides support in IT peripherals and also the ancillary services. Under their business, Acer India supplies various models of branded Interactive Flat Panels within India. These are either imported as finished goods or manufactured on a contract basis through the third party.

The IFP is a huge-sized automatic data processing machine with an interactive screen having Open Pluggable Specification (OPS). The product has 4 GB/8 GB RAM and 32 to 512 GB storage. It has many input and output connectivity ports, like HDMI, VGA, USB, LAN network, RS232, RJ-45, touch ports, Bluetooth, MIC/earphone, etc.

The applicant filed an application to get an advance ruling on the following questions:

“a) What is the appropriate classification of various models of ACER Interactive Flat Panels for the purpose of GST?

b) What is the applicable rate of GST?”

As per the Tamil Nadu Authority for Advance Ruling (AAR), the models of ACER Interactive Flat Panels with extra features are still classified under 85285900, and the GST applicable on them is 28%.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"