Nidhi | Oct 7, 2025 |

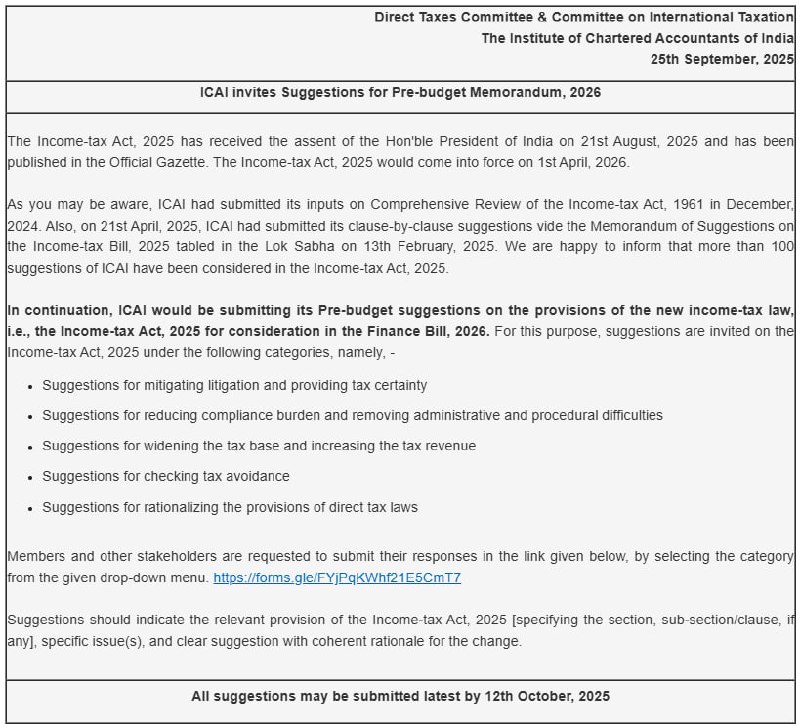

ICAI Invites Suggestions for Pre-Budget Memorandum, 2026

The Institute of Chartered Accountants of India (ICAI) has announced an important opportunity for chartered accountants and stakeholders to share their opinions and suggestions for the pre-budget memorandum, 2026. The last date for submission is 12th October, 2025.

The Income-tax Act, 2025, which will be replaced by the current Income-tax Act, 1961, officially received the president’s assent on August 21, 2025. The new act is set to take effect from April 1, 2026. The new act comes after taking several suggestions from tax professionals, shareholders, and chartered accountants, including the ICAI. It had submitted its clause-by-clause suggestions in the Memorandum of Suggestions on the Income Tax Bill, 2025, on April 21, 2025.

ICAI shared that over 100 suggestions given by the institute were taken into consideration in the Income-tax Act, 2025. Now, ICAI is preparing to submit its pre-budget suggestions on the provisions of the new Income-tax Act, 2025, which will be considered in the Finance Bill, 2026. It is giving the members and stakeholders an opportunity to be a part of this suggestion. Suggestions are invited on the following categories:

The ICAI has asked the members and stakeholders to clearly mention the specific section or clause of the Income-tax Act, 2025, the issue involved, and the proposed solution with a brief explanation in the suggestion.

You can submit your suggestions through the following Google Form:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"