The Securities and Exchange Board of India (SEBI) has suggested reducing the Total Expense Ratio (TER), aiming to boost investor returns while slightly impacting AMC profitability.

Saloni Kumari | Oct 30, 2025 |

Good News for Investors! SEBI Moves to Reduce Mutual Fund Expense Ratio

The Securities and Exchange Board of India (SEBI) has suggested reducing the Total Expense Ratio (TER), which is the fee that mutual funds charge investors for managing their money.

The reduction in TER, meaning mutual funds will now charge slightly lower fees in comparison to earlier, can reduce the revenues and profits of Asset Management Companies (AMCs). Therefore, AMC stocks may react slightly negatively in the stock market.

What is TER?

TER (Total Expense Ratio) is the annual percentage of your investment that a mutual fund takes to cover its costs, like fund management fees, administrative expenses, marketing, etc. For instance, if you make an investment of Rs. 1 lakh in mutual funds and the 2% TER is applied to it, meaning Rs. 2,000 per year will go to the fund house as expenses.

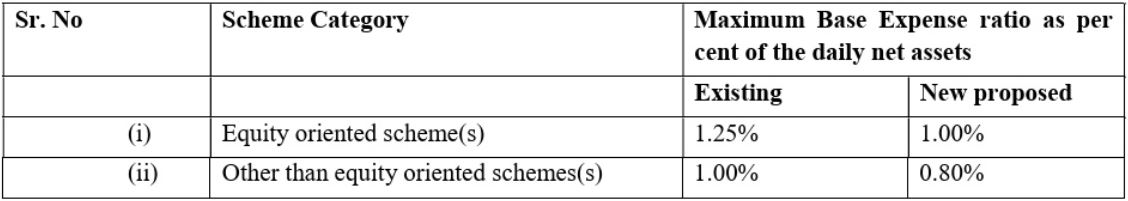

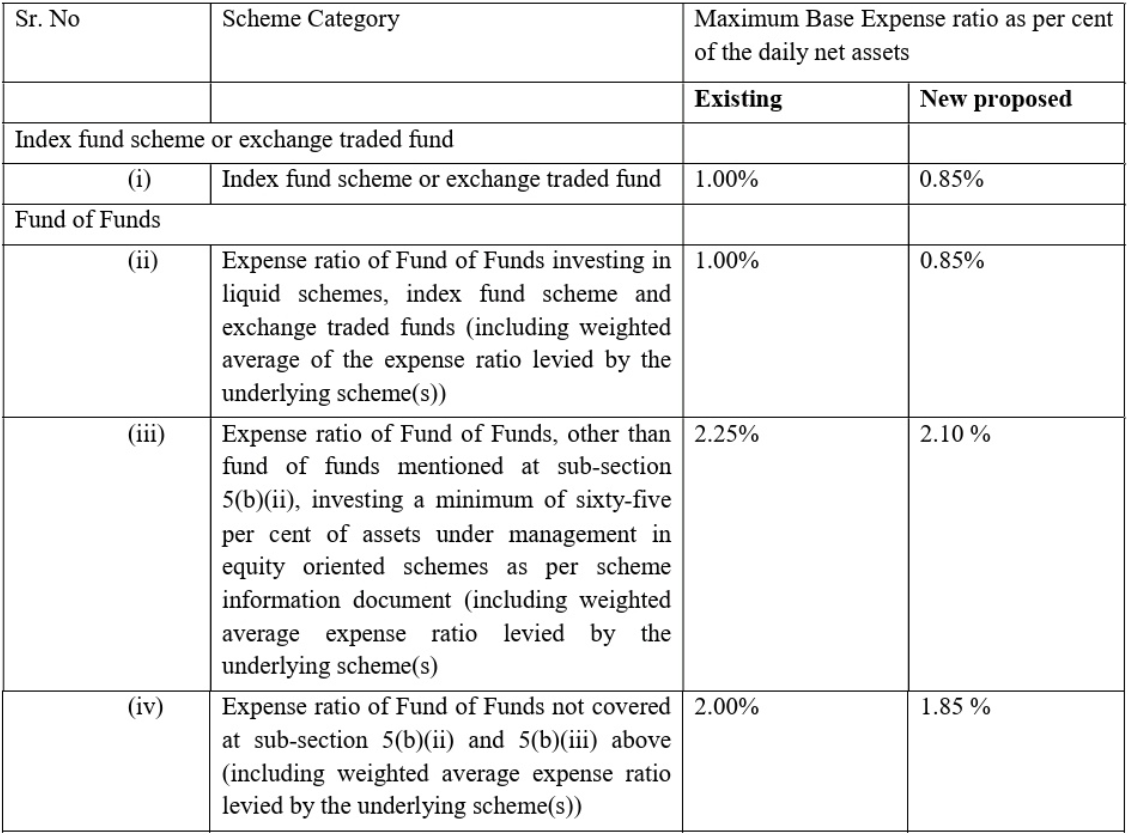

What SEBI is Suggesting

SEBI is proposing a reduction in TER limits charged by fund houses. This applies to both open-ended and close-ended mutual fund schemes. SEBI has proposed upto 0.15% TER cut for open-ended mutual funds and a 0.25% TER cut for closed-ended mutual funds.

Let’s look at each category one by one.

For Open-Ended Mutual Funds

(Open-ended means investors can buy or sell units anytime.)

| Assets Under Management (AUM) Slab (In Rs. Crore) | Existing TER | Proposed TER | Change |

| First Rs. 500 crore | 2.25% | 2.10% | -0.15% |

| Next Rs. 250 crore | 2.00% | 1.90% | -0.10% |

| Next Rs. 1,250 crore | 1.75% | 1.60% | -0.15% |

| Next Rs. 3,000 crore | 1.60% | 1.45% | -0.15% |

| Next Rs. 5,000 crore | 1.50% | 1.35% | -0.15% |

| On the next Rs. 40,000 crores of the daily net assets | Expense ratio reduction of 0.05% for every increase of Rs. 5,000 crores of daily net assets or part thereof. | ||

| On balance of the assets | 1.05% | 0.90% | -0.95% |

This means that as the fund size (AUM) grows, the fund must charge lower fees.

| Assets Under Management (AUM) Slab (In Rs. Crore) | Existing TER | Proposed TER | Change |

| First Rs. 500 crore | 2.00% | 1.85% | -0.15% |

| Next Rs. 250 crore | 1.75% | 1.65% | -0.10% |

| Next Rs. 1,250 crore | 1.50% | 1.35% | -0.15% |

| Next Rs. 3,000 crore | 1.35% | 1.25% | -0.10% |

| Next Rs. 5,000 crore | 1.25% | 1.15% | -0.10% |

| On the next Rs. 40,000 crores of the daily net assets | 0.80% | 0.70% | -0.10% |

Also, for every Rs. 5,000 crore increase in daily AUM beyond Rs. 50,000 crore, TER will further reduce by 0.05%.

This ensures that larger funds charge lower fees since their cost per investor is lower.

(Closed-ended means investors can only buy units during a specific period, and units are locked in for a fixed time.)

So, closed-ended funds will also become cheaper for investors.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"