To clear the confusion, the Ministry of Labour and Employment has clarified that the new Labour Codes will not reduce the take-home pay in all cases.

Nidhi | Dec 11, 2025 |

Take-Home Pay Will Remain Same if PF Deduction is Based on Wage Ceiling: Labour Ministry Clarifies

The Government of India introduced four new Labour Codes, effective November 2025, by consolidating 29 previous labour laws. By introducing these new labour codes, the government aims to provide a fair working environment and protect the working rights of employees in all sectors.

Under the new codes, at least 50% of the employee’s CTC must be treated as “wages” consisting of basic pay, dearness allowance and the retaining allowance. However, if the basic pay increases, then the provident fund will also increase as it is linked to basic pay. This has created confusion among the taxpayers about whether this would reduce their monthly take-home pay.

To clear the confusion, the Ministry of Labour and Employment has clarified that the new Labour Codes will not reduce the take-home pay in all cases. The Ministry said that the PF calculations will remain unchanged at the existing statutory wage cap of Rs 15,000, unless the employee and employer mutually decide to contribute a higher amount. “The new Labour Codes do not reduce take-home pay if PF deduction is on the statutory wage ceiling,” the labour ministry said.

The new Labour Codes do not reduce take-home pay if PF deduction is on statutory wage ceiling.

PF deductions remain based on the wage ceiling of ₹15,000 and contributions beyond this limit are voluntary, not mandatory.#ShramevJayate pic.twitter.com/zHVVziszpy— Ministry of Labour & Employment, GoI (@LabourMinistry) December 10, 2025

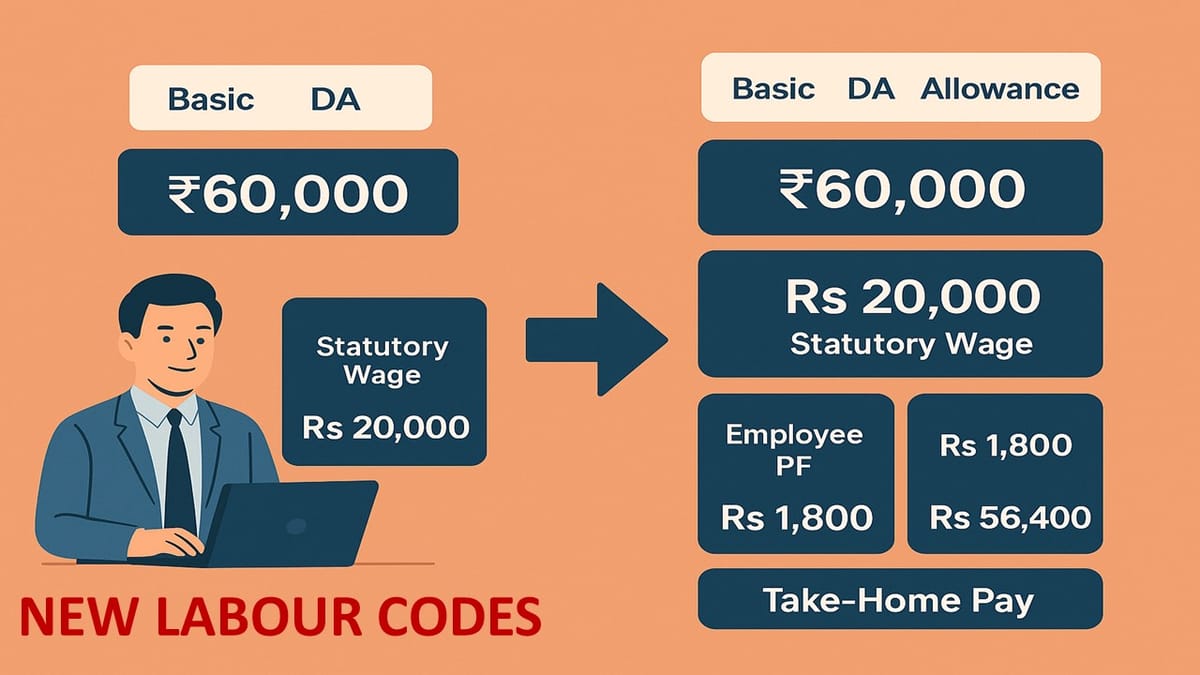

To understand this better, the Government gave an example.

Assume that an employee earns Rs 60,000 per month. The Basic and Dearness Allowance Amount to Rs 20,000, and the allowances are Rs 40,000.

Earlier, before the New Labour Codes, only Rs 20,000 was treated as a statutory wage, but the PF calculation was restricted to Rs 15,000. So, the employer’s PF contribution at 12% on the wage ceiling would be Rs 1,800, and the Employee’s PF contribution at 12% would be Rs 1,800. The take-home pay amount would be Rs 56,400.

Now with the New Labour Codes, the allowances cannot be more than 50% of the salary. Here, the excess amount above 50% is added back to the wages. However, the PF is still calculated on Rs 15,000. This means the employer and employee both pay 12% towards PF contributions, which is Rs 1,800 each. Accordingly, the Take-Home salary stays the same at Rs 56,400 because PF contributions are based on the Rs 15,000 wage ceiling limit. Therefore, the take-home pay does not decrease if the PF is calculated on this ceiling.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"