The Tribunal cited the case of Arvind Kumar Agarwal vs. ITO (supra), which also clarified that the condition requiring the timely submission of a return for claiming a deduction under section 10AA was applicable from 1.04.2024.

Nidhi | Jan 7, 2026 |

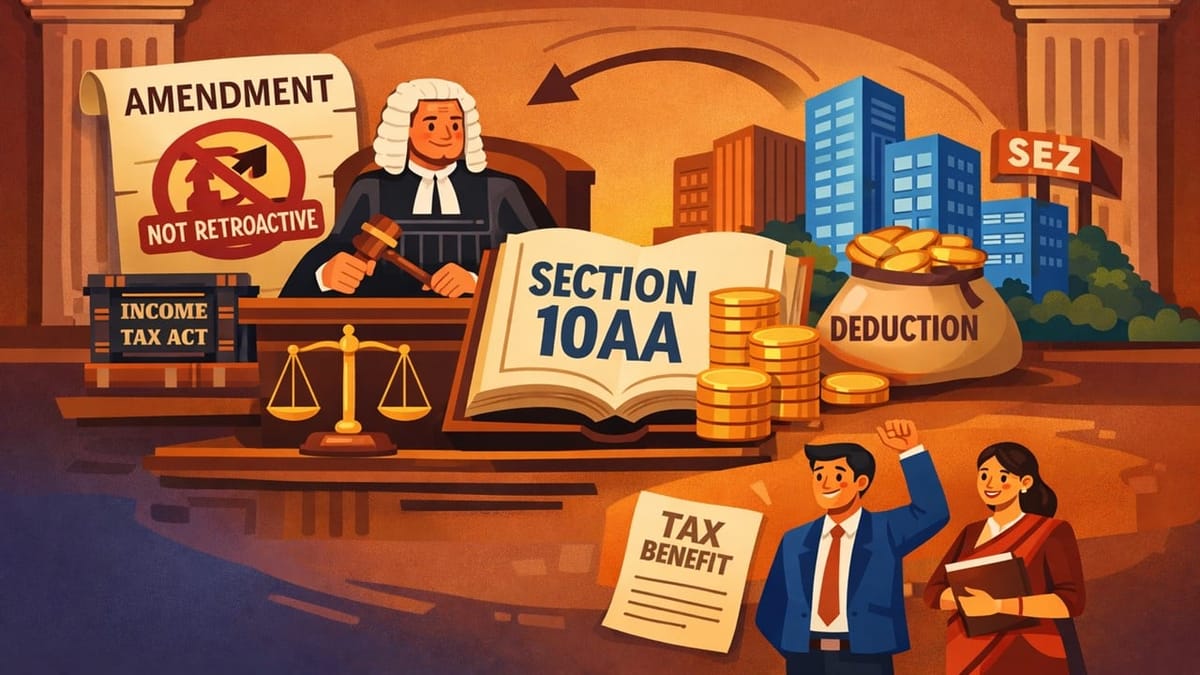

ITAT: Section 10AA Deduction Can’t Be Denied for AY 2023-24 for Belated Return or Form 56F Filed Within Extended Time

The assessee, MD Equipment Pvt Ltd, filed its income tax return late under section 139(4) and claimed a deduction under section 10AA of the Income Tax Act. Due to a technical error, Form 56F was not released till the due date, and CBDT had extended the due date for submitting Form 56F to 31.12.2023. The assessee company filed the Form 56F on 27.11.2023, which was within the extended time given by CBDT.

However, the CPC wrongly rejected the claim in the intimation issued to the company under section 143(1), saying that Form 56F was filed and the Return was also filed late. The CIT(A) allowed the claim to the assessee. However, the revenue aggrieved by CIT(A)’s order filed an appeal before the Income Tax Appellate Tribunal (ITAT), Delhi.

The company argued that the disallowance was not justified, as the CBDT had extended the due date for filing Form 56F, and the company had filed it within the extended timelines. The company also submitted that the proviso mandating the timely submission of income tax returns under section 139 was added from the assessment year 2024-25, while the CPC has applied it retrospectively to the assessment year 2023-24.

The ITAT agreed with the contentions of the assessee company and held that the CPC wrongly treated Form 56F as late, even though the CBDT had extended the submissions up to 31.12.2023. The Tribunal cited the case of Arvind Kumar Agarwal vs. ITO (supra), which also clarified that the condition requiring the timely submission of a return for claiming a deduction under section 10AA was applicable from 1.04.2024. Therefore, the amendment cannot be applied retrospectively to the assessment year 2023-24.

The Tribunal upheld the CIT(A)’s order and refused to interfere with it. Accordingly, the appeal filed by Revenue was dismissed.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"