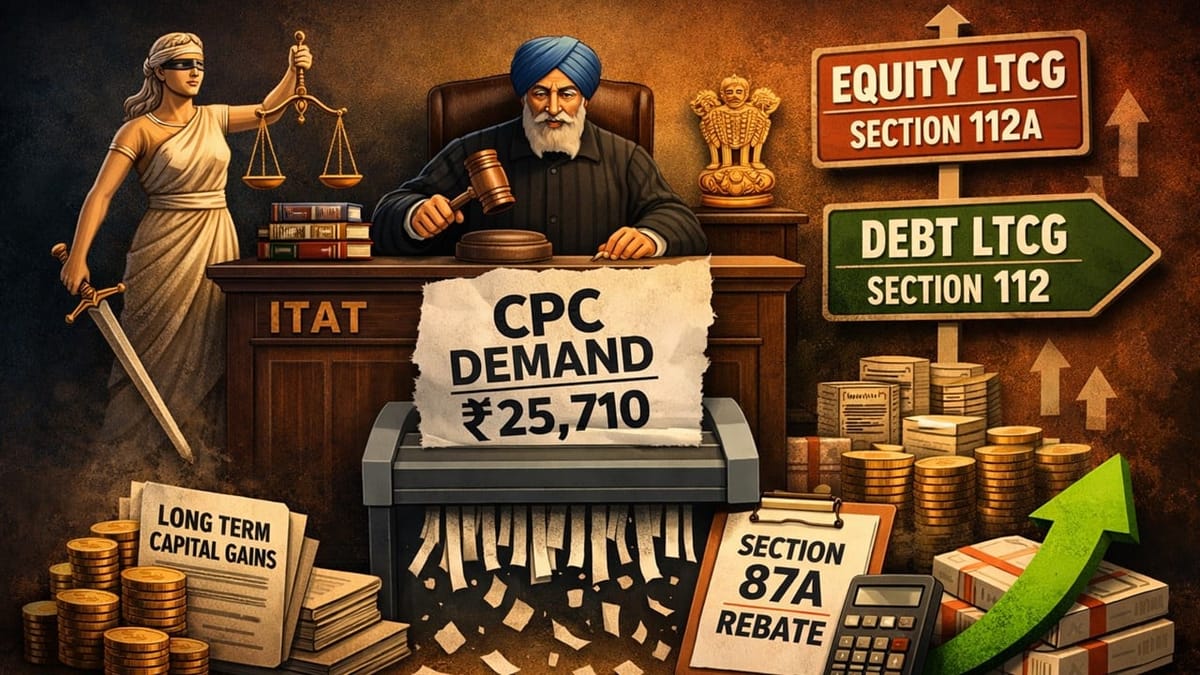

ITAT deletes the entire CPC demand of Rs. 25,710, holding that the Section 87A rebate is fully allowable on LTGCs from debt, as the restriction under Section 112A applies only to equity LTCG.

Saloni Kumari | Jan 7, 2026 |

Income Tax Rebate Restriction Applies Only to Equity LTCG u/s Section 112A, Not LTCG from debt investments: Rules ITAT

ITAT Chandigarh held Section 87A rebate cannot be denied for LTCG on debt. Section 112A restriction applies only to equity LTCG. Hence, the taxpayer is fully entitled to claim the Rs. 25,000 rebate. Deleted entire CPC demand of Rs. 25,710.

The present appeal has been filed by a taxpayer named Sh. Gurminder Singh in the ITAT Chandigarh, challenging an order dated December 10, 2025, challenging an order dated May 27, 2025, passed by the CIT(A), Nagpur. The impugned order had disallowed the rebate on tax computed on long-term capital gains and confirmed the tax demand of Rs. 25,710 imposed on the taxpayer by the CPC.

The taxpayer had filed his income tax return (ITR) for the assessment year 2024-25, disclosing the total agricultural income amounting to Rs. 847,263. Against the computed tax of Rs. 27,586, the taxpayer had availed a rebate of Rs. 25,000 under 87A and disclosed the total taxable income at Rs. 2,586. When the case was taken before the CPC, it restricted the rebate under Section 87A to the extent of Rs. 3,119; this increased the total taxable amount to Rs. 24,467. As a result, it imposed a total demand of Rs. 25,710 on the taxpayer.

The aggrieved assessee filed an appeal before ITAT Chandigarh, challenging the same demand of Rs. 25,710 raised by CPC. When the tribunal analysed the case, it noted that sub-section (6) of s.112A prohibits rebates u/s 87A on capital gains as referred to in sub-section (1) of s.112A.

Section 112A(1)(ii) applies only to long-term capital gains from equity investments, such as equity shares, equity-oriented mutual funds, or units of a business trust. It does not apply to long-term capital gains from debt investments. Long-term capital gains on debt are governed by Section 112, and there is no restriction under this section on claiming a rebate under Section 87A.

In this case, the taxpayer had earned long-term capital gains from debt of Rs. 119,020, on which tax was correctly calculated at 20%, amounting to Rs. 23,804. The tax on the assessee’s other normal income (excluding equity LTCG) was calculated at Rs. 3,456. When both these taxes are considered together, the total tax exceeds the rebate limit of Rs. 25,000 prescribed under Section 87A. Therefore ruled that the taxpayer is completely entitled to claim the rebate of Rs. 25,000.

Accordingly, the appeal of the taxpayer was allowed and directed the CPC to recalculate the tax payable by allowing the full rebate under Section 87A.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"