Meetu Kumari | Feb 16, 2026 |

ICAI Reprimands CA for Certifying Revised AOC-4 Without NCLT Approval

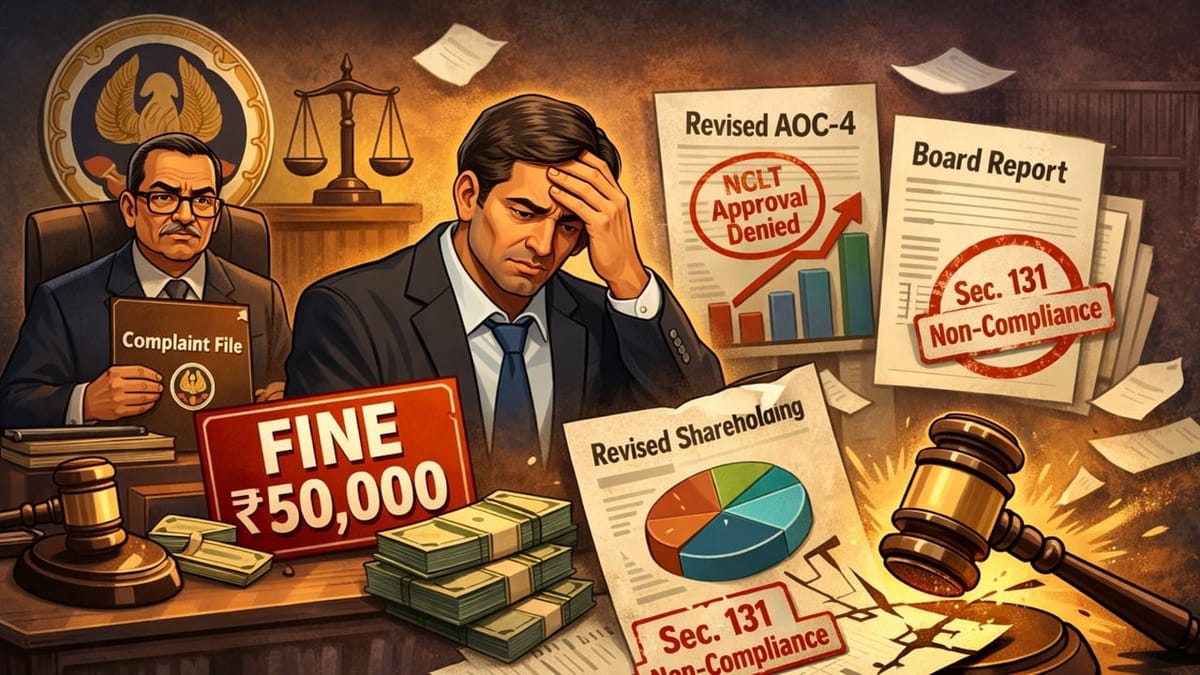

The Disciplinary Committee of the Institute of Chartered Accountants of India examined a complaint filed by Shri Manoj Laljibhai Baldha against CA Hasmukh Bhagwanji Kalaria. The complainant had acquired 10% shareholding in M/s Akshar Spintex Private Limited in 2016 and was reflected as such in the audited financial statements for FY 2016-17 and in the original Form AOC-4 XBRL filed on 07.11.2017. A revised Form AOC-4 XBRL was later filed on 23.01.2018, certified by the Respondent, removing the complainant’s name from the shareholding pattern and making other changes, including alterations in shareholding percentages and Board meeting dates.

It was undisputed that no prior approval was obtained from the National Company Law Tribunal under Section 131 of the Companies Act, 2013 before filing the revised form. The Director (Discipline) formed a prima facie view of lack of due diligence, and proceedings were initiated under Item (7) of Part I of the Second Schedule to the Chartered Accountants Act, 1949.

Main Issue: Whether certifying a revised Form AOC-4 involving substantive changes in shareholding and Board’s Report without prior NCLT approval under Section 131 amounts to professional misconduct.

Committee Held: The Committee held that Notes to Accounts are important to financial statements and that changes in shareholding disclosures constitute revision of financial statements and the Board’s Report. Section 131 mandates prior Tribunal approval for such voluntary revision once the statements are adopted and filed. The revised filing was not a mere clerical correction.

The Committee held that certifying the revised filing without ensuring statutory compliance amounted to gross negligence and lack of due diligence. He was found guilty under Item (7) of Part I of the Second Schedule and was reprimanded, with a fine of Rs. 50,000, payable within 60 days.

To Read Full Judgment, Download PDF Given Below

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"