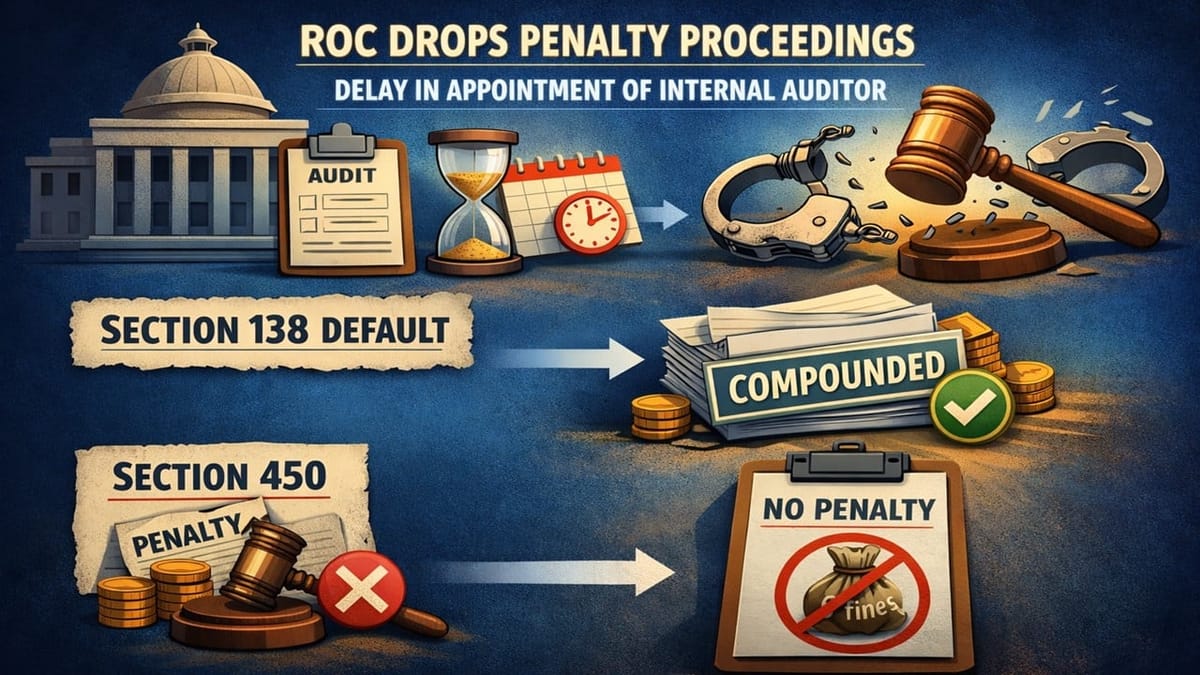

Section 138 default is treated as compounded; no penalty is levied under Section 450.

Meetu Kumari | Feb 16, 2026 |

ROC Drops Penalty Proceedings for Delay in Appointment of Internal Auditor

The Registrar of Companies initiated adjudication proceedings against Maharashtra Oil Extractions Limited and its Managing Director, Manoj Basantlal Agrawal, for failure to appoint an Internal Auditor under Section 138(1) of the Companies Act, 2013.

Since the Company’s turnover for FY 2013-14 exceeded Rs. 200 crore, appointment of an Internal Auditor was mandatory under Rule 13 of the Companies (Accounts) Rules, 2014. However, no Internal Auditor was appointed for FY 2021-22, leading to suo-motu proceedings under Section 454.

Main Issue: Whether penalty under Section 450 should be levied for the delay in appointing an internal auditor when the default has been compounded and rectified.

Registrar’s Decision: The Registrar noted that the offence under Section 138 had already been compounded by the Regional Director (Western Region) and the compounding fees were duly paid. The company had also rectified the default by appointing an Internal Auditor.

It was observed that Section 138 does not prescribe a fixed tenure or recurring annual approval requirement, and therefore the lapse could not be treated as a continuing default. Therefore, no cause of action survived for imposing penalty under Section 450. Thus, no penalty was levied.

To Read Full Judgment, Download PDF Given Below

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"